- Home

- »

- Renewable Chemicals

- »

-

Dimer Acid Market Size, Share, Trends, Growth Report, 2029GVR Report cover

![Dimer Acid Market Size, Share & Trends Report]()

Dimer Acid Market Size, Share & Trends Analysis Report By Application (Nonreactive Polyamide Resins, Reactive Polyamide Resins, Oilfield Chemicals), By Region, And Segment Forecasts, 2022 - 2029

- Report ID: 978-1-68038-352-2

- Number of Report Pages: 71

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2029

- Industry: Specialty & Chemicals

Report Overview

The global dimer acid market size was USD 2.2 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2022 to 2029. Rising demand for polyamide resins in coatings and adhesives industries is expected to be a key driving factor for industry growth over the forecast period.

Developing regions in Asia Pacific & Central & South America are expected to witness considerable growth over the forecast period collectively accounting for over 45% of the overall market by 2024. Rapid urbanization in China, India, Russia, Brazil, South Africa, and Mexico has facilitated the need for better residential as well as public infrastructure.

These regions are also characterized by expanding manufacturing facilities further facilitating construction activities. Increasing construction spending, particularly by the government, in these countries is expected to boost demand for polyamide resins in adhesives & construction materials, thereby fostering dimer acid market growth.

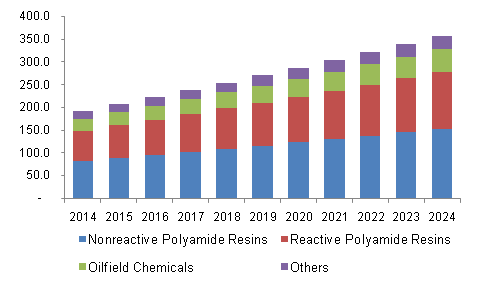

U.S. dimer acid market revenue by application, 2014 - 2024, (USD Million)

Oilfield chemicals find wide application scope in oil and gas extraction and processing activities along with other applications such as well drilling, refining, and hydraulic fracturing. Key oilfield chemicals that utilize dimer acid as a raw material include corrosion & scale inhibitors, wetting agents, surfactants, and demulsifiers.

The shift in trend from energy imports to domestic generation, to become self-sufficient &cater to the growing energy demand in emerging economies is also likely to encourage dimer acid applications.

The increasing number of drilling activities across the globe to meet excess energy demand is expected to positively impact oilfield chemicals and positively impact dimer acid demand. Growing crude oil production & consumption in countries such as the U.S., Canada, and China along with other Middle Eastern countries is also expected to boost oilfield chemicals demand. These factors are a crucial determinant of dimer acid market growth.

Expanding water transport and shipping industry is poised to drive marine coatings demand. Marine coatings are increasingly utilizing dimer acid in the form of acid based polyamide resins for enhanced coatings performance. This trend is expected to fuel dimer acid demand over the forecast period.

Vegetable oils such as soybean & corn are witnessing high demand from the food and biofuels industry, resulting in dwindling supplies for dimer acid production. Raw material price volatility owing to limited supply is expected to hinder growth. However, favorable regulations from agencies such as EPA and REACH are expected to provide immense opportunities to major participants over the forecast period

Application Insights

Reactive polyamide resins emerged as the largest application segment with a volume estimated at over 190kilo tons in 2015. Segment growth is driven by increasing demand for these resins in the construction industry, specifically in epoxies & floor coatings to enhance performance. It is also anticipated to emerge as the fastest growing application, growing at an estimated CAGR of 4.3% from 2016 to 2024.

Nonreactive polyamide resins segment is expected to exhibit considerable growth over the future, on account of growing applications in various industrial solvents, flexographic printing inks and paper coatings. The segment accounted for 40% of the overall market volume in 2015 and is expected to grow at an estimated CAGR of 4.0% from 2016 to 2024.

Regional Insights

Asia Pacific dimer acid market led the global industry and accounted for over one-third of the total volume in 2015. It is expected to maintain its dominance over the forecast period, growing at an estimated CAGR of 4.8% from 2016 to 2024. Growth in construction activities coupled with favorable regulations and government initiatives in the region promoting manufacturing is expected to drive dimer acid demand as well.

North America is anticipated to witness average growth owing increasing construction spending in Mexico along with the recovery of housing sector post-recession. It is also expected to benefit from increasing crude oil production and shale gas extraction in the U.S.

Competitive Insights

The industry is highly concentrated with top four companies accounting for over 45% of the overall volume. Some of the key players operating in global dimer acid market include Florachem Corp., BASF, Arizona Chemicals, Emery Oleochemicals, Aturex Group, Anqing Hongyu Chemical Co. Ltd., Oleon N.V., Novepha Co. Ltd., Harima Chemicals and Nissan Chemical America Corp.

-

Florachem Corp.

-

BASF

-

Arizona Chemicals

-

Emery Oleochemicals

-

Aturex Group

-

Anqing Hongyu Chemical Co. Ltd.

-

Oleon N.V., Novepha Co. Ltd.

-

Harima Chemicals

-

Nissan Chemical America Corp.

Recent Development

-

In December 2022, Oleon NV acquired a blending plant in Conroe, Texas. The company could provide warehousing and blending services for several markets with the help of this new manufacturing facility.

-

In May 2022, Florachem accelerated the growth plan under the new ownership of SK capital partners. The new partnership strengthened Florachem's investments and allowed the business to offer its customers a wider range of cutting-edge natural ingredients and product solutions.

Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.2 billion

Revenue forecast in 2029

USD 2.8 billion

Growth Rate

CAGR of 5.0% from 2022 to 2029

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2029

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2029

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment Scope

Application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; UK; Germany; Japan; China; India

Key companies profiled

Florachem Corp.; BASF; Arizona Chemicals; Emery Oleochemicals; Aturex Group; Anqing Hongyu Chemical Co. Ltd.; Oleon N.V., Novepha Co. Ltd.; Harima Chemicals; Nissan Chemical America Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2029. For the purpose of this study, Grand View Research has segmented the global dimer acid market on the basis of application and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2029)

-

Nonreactive Polyamide Resins

-

Reactive Polyamide Resins

-

Oilfield Chemicals

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2029)

-

North America

-

U.S

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Middle East and Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."