- Home

- »

- Consumer F&B

- »

-

Cookies Market Size Report, 2030GVR Report cover

![Cookies Market Size, Share & Trends Report]()

Cookies Market Size, Share & Trends Analysis Report By Type (Bar, Molded, Rolled, Drop, Others), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-836-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Report Overview

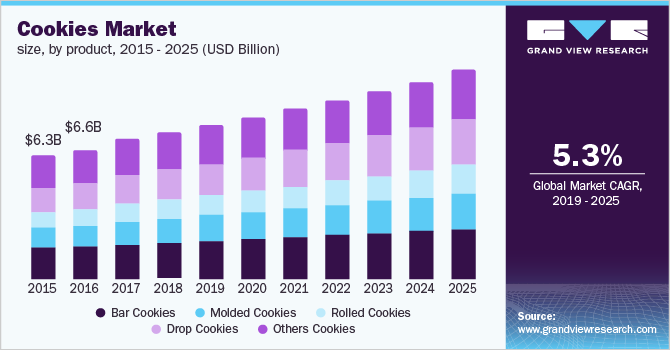

The global cookies market size was valued at USD 39.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030. Cookies are considered one of the most sought-after snacks in the world. Their taste varies from sweet to salty and multiple ingredients are incorporated to produce different types of products. With an increasing focus on catering to the rapidly emerging health-conscious generation, manufacturers are introducing oatmeal, whole-grain, peanut, walnut, almond, and many other types of healthy cookies in market. Apart from such ingredients, the demand for gluten-free & vegan cookies is rising steadily. Increasing disposable income in developing countries and rising demand from the younger demographics are additional growth drivers for the cookies market.

The cookies industry is constantly evolving with innovations in ingredients, such as healthy alternatives for almonds, raisins, apricots, walnuts, and omega-3-rich seeds. These cookies are offered at premium prices, targeting the high net-worth and health-conscious populations. Oats as well as other digestive ingredients are majorly used in cookies. Some cookies are marketed as being gluten-free and being high in energy. Nowadays, new kinds of flavors with exotic additions are being rapidly introduced according to changing consumer requirements. Cookies prepared through a shortened baking procedure are usually fat-free and a cohesive protein product. The gym-going population prefers cookies rich in protein and showcases flexibility in terms of product prices.

Cookies are an integral part of the culture across many economies, particularly the Western Hemisphere. For instance, families bake cookies on festive occasions, birthdays, and anniversaries. Cookies are extensively purchased and gifted to families and friends, which makes cookies a part of daily life in many cultures. Globalization has further caused cultural fusion, leading to the rapid adoption of international food habits across cultures, which provides a significant opportunity for manufacturers to promote their products in untapped regions. Leading players in the cookie market are expanding their operations in newer areas, leading to significant market growth.

Distribution Channel Insights

The offline segment dominated the market with 81.4% of the revenue share in 2023 owing to to the presence of a widespread network of offline stores, bakeries, and supermarkets across all regions that specialize in cookie production and sales. These stores offer high visibility for cookie brands, making them readily accessible to a large customer base. Consumers prefer freshly prepared cookies over stored ones and the ability to see, touch, and even smell cookies in a physical store allows consumers to make informed choices based on packaging design, texture cues, and enticing aromas. A lack of such a sensory experience in the online environment drives segment appeal.

The online channels are expected to witness a fastest CAGR of 5.2% over the forecast period. Cookies have a shorter shelf life compared to other products. The efficient logistics and distribution networks of established online channels ensure faster product turnover and fresher cookies for consumers. In the coming years, developments in e-commerce and strengthening of the supply chain are expected to aid the progress of this segment.

Type Insights

Bar cookies accounted for the highest market share of 33.5% in 2023 owing to the convenience in production and versatility offered by bar cookies. For instance, these cookies do not require specific molds, as they are cut into bar shapes in the latter stages of manufacturing. Moreover, the rectangular shape offers ease of storage and transport; these cookies also have a long shelf life. Popular varieties of bar cookies include chocolate chip cookies and oatmeal raisin cookies. Bar cookies offer high convenience on automated production lines, leading to their cost-effective manufacturing and higher profit margins for cookie companies.

Drop cookies accounted for a promising share of the global market in 2023 and the segment is expected to provide the second-largest revenue contribution by 2030. This is attributed to their simple manufacturing process, as their batter requires minimal shaping, allowing for high-volume manufacturing with lower labor and specialized equipment requirements. This translates to cost savings for producers and ultimately, competitive pricing for consumers. Furthermore, drop cookies are visually appealing due to the incorporation of various mix-ins and attractive toppings. This is a crucial factor, especially when targeting younger consumers who are more susceptible to impulse purchases.

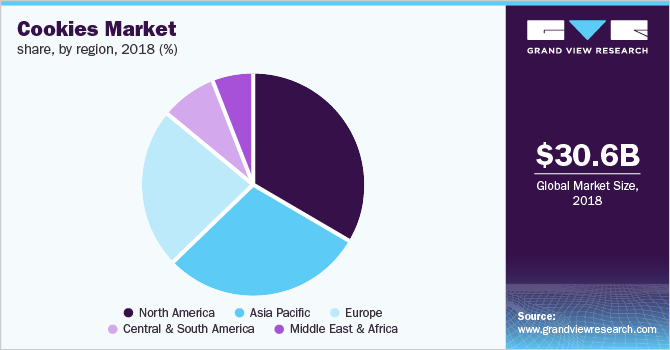

Regional Insights

North America held the highest revenue share of 33.7% in 2023 owing to cultural preferences in the region that have steadily driven the demand for cookies. For instance, North American consumers have a well-established cultural affinity for baked goods, with cookies ranking among the most popular snack choices. This ingrained preference translates to a consistently high demand for cookies across the region. Additionally, North America has a well-developed network of distribution channels for bakery items. This includes supermarkets, hypermarkets, convenience stores, and specialty stores, ensuring easy access and product visibility for consumers.

U.S. Cookies Market Trends

The U.S. accounted for a significant market share in 2023. Many big players in the cookies industry have their manufacturing facilities based in this country. Additionally, well-established supermarket channels such as Walmart ensure availability of cookies in a variety of flavors and preferences. The working class population in the economy prefers sandwich biscuits while the youth prefers chocolate chip cookies, which drives sales in different segments. With increasing focus on healthy diets, the market for nutrition-rich and fortified cookies is expected to witness steady expansion in the coming years.

Asia Pacific Cookies Market Trends

The Asia Pacific region has been identified as a lucrative market for cookies. Rapid urbanization and increasing disposable income are major drivers of regional market growth. As the number of working women is increasing, the ready-to-eat snacks segment presents promising growth prospects, offering convenience and affordability in terms of consumption. The region has an extensive presence of small- and medium-sized bakeries preparing a variety of fresh bakery products. Furthermore, the entry of global players in the region has led to the entry of new cookie variants in this market, propelling product demand.

India Cookies Market Trends

The Indian population is slowly integrating cookies in their daily diets and lifestyle. A significant consumer base in the country requires snacks with their morning tea and coffee. Cookies offer convenience and a variety of tastes as per their preferences and have emerged as a go-to option for snacking needs during morning and evening tea time. Additionally, growing concern over the extensive use of white sugar in cookies has led to the development of sugar-free, hand-made, and unprocessed cookies market. Manufacturers are offering healthy options in terms of ingredients used, catering to the changing needs of this population.

Europe Cookies Market Trends

The European population is a major consumer of cookies. The bakery culture in Europe has been established for a long time. European consumers are increasingly becoming health-conscious, driving the demand for options such as whole grain, gluten-free, vegan, and organic cookies. The presence of a rich café culture, small bakeries offering hand-made items, and cross-cultural fusion of tastes offers diverse choices for consumers. With a high disposable income, consumers prefer premium-priced and high-quality cookies in their diet.

UK Cookies Market Trends

The UK has been identified as a promising market for cookies. The country has a well-developed retail infrastructure with a strong network of supermarkets and convenience stores. This robust distribution channel allows for efficient product placement and widespread brand exposure. The new health-conscious generation demands nutrient-rich organic cookies. This well-established snacking culture drives market expansion in the UK.

Key Companies & Market Share Insights

Some key companies involved in the cookies market include Mondelez International, Inc.; Kellogg's; and Campbell Soup Company.

-

Mondelez International, Inc. specializes in the development of confectionery, food, and beverages, and holds a large portfolio of popular snack brands. Some of their well-known brands include Oreo cookies, Cadbury chocolate, belVita cookies, and Trident gum. The company has manufacturing facilities across the Americas, Asia, the Middle East, Africa, and Europe.

-

Kellogg's is an American multinational company involved in the production and marketing of convenience and snack foods, such as crackers, toaster pastries, and cereal, and market their products via well-established brands including Kellogg's, Rice Krispies Treats, Pringles, Eggo, and Cheez-It. The company has presence in over 180 countries globally.

Key Cookies Companies:

The following are the leading companies in the cookies market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé S.A.

- Mondelez International, Inc.

- United Biscuits (UK) Limited Co.

- Grupo Bimbo

- Kellogg's

- Campbell Soup Company

- Britannia Industries Limited

- Ferrero Group

- ITC Limited

- General Mills, Inc.

Recent Developments

-

In May 2024, Grupo Bimbo announced its partnership with Oobli, a notable sweet protein brand, to incorporate sweet proteins into their baked goods. The partnership is expected to help Grupo Bimbo address the demand from health-conscious consumers that is increasingly seeking healthy bakery options.

-

In October 2023, Kellogg’s separated its business into two separate entities - W K Kellogg Co and Kellanova. This planned development is expected to allow Kellanova to focus on its operations and allocate resources effectively for improved profitability.

Cookies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.8 billion

Revenue Forecast in 2030

USD 54.9 billion

Growth Rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Mondelez International, Inc.; Kellogg's; Campbell Soup Company; Nestlé S.A.; United Biscuits (UK) Limited Co.; Grupo Bimbo; Britannia Industries Limited; Ferrero Group; ITC Limited; General Mills, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cookies market report based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bar

-

Molded

-

Rolled

-

Drop

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."