- Home

- »

- Plastics, Polymers & Resins

- »

-

Conductive Silicone Rubber Market Size, Share Report, 2030GVR Report cover

![Conductive Silicone Rubber Market Size, Share & Trends Report]()

Conductive Silicone Rubber Market Size, Share & Trends Analysis Report By Product (Thermally Conductive, Electrically Conductive, Others), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-548-9

- Number of Report Pages: 172

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The global conductive silicone rubber market size was valued at USD 6.65 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. Electronic industry growth, particularly in the Asia Pacific, is expected to fuel the demand for lighting as well as wire applications. In addition, the rising importance of anti-static packaging for dust control during electric charge is expected to augment industry growth over the forecast period. The rising demand for lightweight automobile parts owing to improved fuel efficiency and lower emissions is expected to drive the demand for conductive silicone rubber. The product is used in manufacturing plastic and rubber modifiers in interior car parts on account of exhibiting superior anti-wear and anti-blocking properties.

The industrial and infrastructural growth in emerging economies, including China, India, Brazil, and North African countries, is expected to positively impact market growth. In addition, favorable regulatory policies such as the FDI and the free trade agreement are likely to propel the demand for this compound over the forecast period. The growing use of conductive silicone polymers in manufacturing rings, seals, gaskets, and coupling materials in packaging and oil & gas industries is expected to augment industry growth.

On the other hand, rising consumer awareness regarding the benefits of bio-based chemicals as compared to their synthetic counterparts is expected to hamper growth over the forecast period. Furthermore, the steadily growing application scope of silicone in manufacturing lubrication oil and greases is expected to pose a major threat to raw material availability, which, in turn, is expected to increase the overall product cost over the forecast period.

Market players, including Dow, Momentive, Wacker, and Shin-Etsu are integrated across the entire value chain, right from raw material suppliers, to manufacturing and distributing conductive silicone rubber. The rising application of silicone in the manufacturing of lubricants and greases is expected to reduce the availability of raw materials for the production of conductive silicone rubber, restraining market expansion.

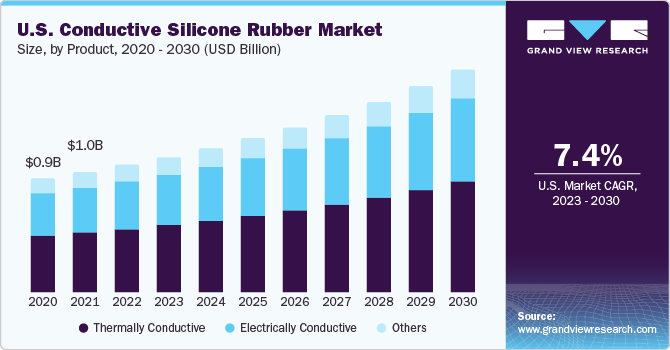

Product Insights

The thermally conductive segment accounted for the largest revenue share of 48.5% in 2022. The product finds applications in manufacturing various components used in automotive vehicles, personal computers, and home appliances, on account of exhibiting superior heat dissipation properties. The increasing use of thermally conductive silicone rubber materials in electronic components such as sensors, and printed and electric circuit boards on account of exhibiting good flow and processing as well as high thermal stability is likely to be a favorable factor.

The electrically conductive segment is projected to advance at the fastest CAGR of 8.2% over the forecast period. The rising miniaturization of electronic products has led to the need to protect these parts from Electromagnetic Interference (EMI) and Electrostatic Dissipation (ESD). The increasing use of conductive silicone rubber for ESD and EMI protection is expected to have a positive impact over the forecast period.

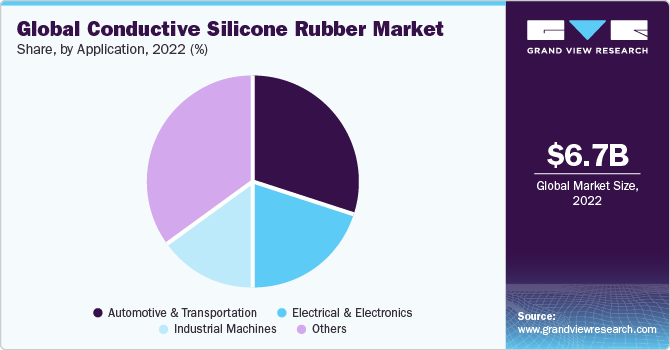

Application Insights

The automotive & transportation segment held a significant revenue share of 30.5% in 2022. The increasing use of conductive silicone rubber for automobile interiors, owing to its flame and weather resistance properties, is expected to have a favorable impact on product demand. It is used to manufacture a number of automotive parts, including engine bay components, wiring harnesses, sealants, gaskets, connectors, and spark plugs, on account of exhibiting excellent electrical insulation, weather ability, heat and chemical resistance, tear strength, and adhesive properties.

These products provide reliable protection against moisture, dirt, and water spray, thus finding applications in spark plugs. Lightweight materials are increasingly being used in order to reduce automobile weight, which results in decreasing the total fuel consumption of the vehicle. Over the past few years, the automotive industry has started using lighter materials to manufacture vehicles, in accordance with numerous regulations included in the Euro 6 and 7.

The electrical & electronics segment is expected to advance at the highest CAGR of 9.0% over the forecast period. Conductive silicone rubber finds applications in adhesives, sealants, and coatings of wires & cables, along with acting as an anti-static packaging agent for electronic components. Other properties such as resistance to weathering, ozone, moisture, and UV radiation that are offered by conductive silicon rubber are expected to increase its applications for manufacturing internal and external components of consumer electronic goods, and power distribution & transmission devices.

In the construction sector, the compound is used in coating agents for waterproofing mortar, metal surfaces, and concrete. These rubbers maintain elasticity over a wide range of temperatures and exhibit UV and ozone resistance properties. The increasing use of these rubber compounds for waterproofing, flame-resistant, and airtight gaskets in the construction industry is expected to have a positive impact on market growth during the projection period.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 51.7% in 2022. The robust electronics industry in Taiwan, Japan, China, Korea, and India is likely to be a favorable factor in the coming years. Supportive government regulations in India are likely to drive the demand for conductive silicone rubber-based products.

For instance, in May 2023, the Minister of Chemicals and Fertilizers in India announced a plan to introduce a Production Linked Incentive (PLI) scheme specifically tailored for basic chemicals. This initiative aims to enhance self-sufficiency within the country while ensuring affordability in crucial sectors such as petrochemicals, agrochemicals, and active pharmaceutical ingredient (API) manufacturing.

The North American conductive silicone rubber market is anticipated to expand at a CAGR of 7.5% over the forecast period. The easy availability of silver resources in Mexico and a strong manufacturing base in the U.S. and Canada are likely to push the market growth for conductive silicone rubbers in the region. In addition, the streamlined value chain of these three aforementioned countries is expected to play a crucial role in positively influencing market growth over the coming years.

Key Companies & Market Share Insights

Major manufacturers are expected to opt for forward integration in light of the rising application scope of conductive silicone rubber. The steadily growing demand for silicone in lubricants and greases is expected to induce price hikes for market players in the future. Industry participants have formed strategic partnerships with compounders and contract manufacturers that convert the conductive silicone rubber into sheets, films, and numerous compounds.

In addition, some distributors and market players sell their products through established web portals such as Alibaba. Buyers present in the automotive, electronics, industrial, food & beverage, and healthcare sectors are using conductive silicone rubber to manufacture different products. Following are some of the major participants in the global conductive silicone rubber market:

-

Dow

-

Saint-Gobain

-

Wacker Chemie AG

-

Western Rubbers

-

Western Polyrub India Pvt. Ltd.

-

Momentive

-

Shin-Etsu Chemical Co., Ltd.

-

Specialty Silicone Products, Inc.

-

KCC CORPORATION

-

China Bluestar International Chemical Co., Ltd.

-

REISS MANUFACTURING, INC.

-

MESGO SpA

-

Jan Huei K.H. Industry Co., Ltd.

Recent Developments

-

In December 2022, LegenDay announced the development of conductive silicone components specifically tailored for the healthcare and medical sectors. These parts are crafted from premium-grade silicone infused with electrically conductive and inert particles, with the option for electromagnetic interference (EMI) shielding. LegenDay has utilized low volatility and ion content conductive silicone, which is particularly suitable for highly sensitive medical electronic systems. This advanced composition ensures that LegenDay's conductive silicone parts are well-suited for use in hermetically sealed, vacuum, or high-temperature environments, meeting the stringent requirements of the healthcare and medical industries

-

In March 2022, Minnesota Rubber and Plastics completed the acquisition of Primasil Silicones, a custom silicone rubber compounder and manufacturer based in Weobley, U.K. Primasil has established itself as a specialist serving the medical, HVAC, and specialty industrial sectors. This strategic acquisition aligns seamlessly with Minnesota Rubber and Plastic's distinguished materials science and molding capabilities, allowing for a synergistic integration of knowledge and resources. Together, the combined expertise of both entities will enable the provision of comprehensive solutions to meet the evolving needs of customers in various industries

-

In January 2021, Novation Solutions, LLC, a company focused on silicone dispersions, announced the development of the PURmix high-consistency rubber (HCR) healthcare compounds. These compounds have been designed to enhance the properties related to the electrical performance of silicone rubber by combining a proprietary single-wall carbon nanotube from Zeon Corporation. This innovative silicone technology finds practical application in different medical devices. The incorporation of NovationSi's advanced compounds, which possess superior electrical properties, presents exciting opportunities for enhancing the performance and efficacy of medical devices

Conductive Silicone Rubber Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.09 billion

Revenue forecast in 2030

USD 12.14 billion

Growth Rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Thailand; Malaysia; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Dow; Saint-Gobain; Wacker Chemie AG; Western Rubbers; Western Polyrub India Pvt. Ltd.; Momentive; Shin-Etsu Chemical Co., Ltd.; Specialty Silicone Products, Inc.; KCC CORPORATION; China Bluestar International Chemical Co., Ltd.; REISS MANUFACTURING, INC.; MESGO SpA; Jan Huei K.H. Industry Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Conductive Silicone Rubber Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global conductive silicone rubber market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Thermally Conductive

-

Electrically Conductive

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Industrial Machines

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global conductive silicone rubber market size was estimated at USD 6.65 billion in 2022 and is expected to reach USD 7.09 billion in 2023.

b. The global conductive silicone rubber market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 12.14 billion by 2030.

b. The Asia Pacific dominated the conductive silicone rubber market with a share of 51.7% in 2022. This is attributable to the growth of electronic, electrical, and automotive industries owing to the rising economy coupled with increased purchasing capacity in countries such as China, India, and South Korea.

b. Some key players operating in the conductive silicone rubber market include Wacker, Shin Etsu, Momentive, Dow Corning, Saint-Gobain, China National BlueStar (Group) Co., Ltd., Western Rubber & Supply, KCC Corporation, and Reiss Manufacturing, Inc.

b. Key factors that are driving the conductive silicone rubber market growth include increasing demand for lighting as well as wire applications and rising demand for lightweight automobile parts.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."