- Home

- »

- Biotechnology

- »

-

Clinical Microbiology Market Size And Share Report, 2030GVR Report cover

![Clinical Microbiology Market Size, Share & Trends Report]()

Clinical Microbiology Market Size, Share & Trends Analysis Report By Product (Laboratory Instruments, Reagents), By Disease (STDs, Respiratory Diseases), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-142-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Clinical Microbiology Market Size & Trends

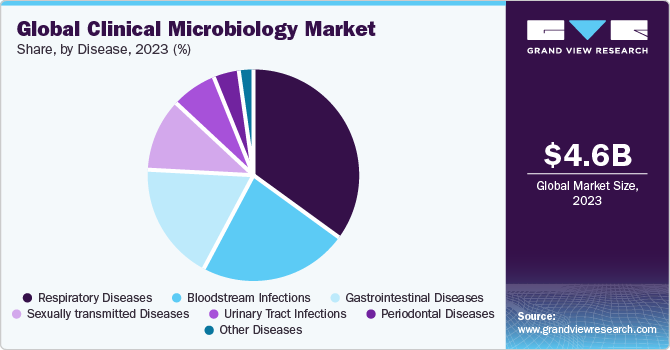

The global clinical microbiology market size was estimated at USD 4.57 billion in 2023 and is expected to grow at a CAGR of 5.35% from 2024 to 2030. The growth can be attributed to the increasing demand for laboratory services to detect pathogen-based diseases and growing need for control measures for infectious disease spread. In addition, rising geriatric population and constantly widening targeted disease conditions are expected to boost market growth. According to a fact sheet published by the WHO in April 2023, approximately 10.6 million people were diagnosed with tuberculosis worldwide in 2021, whereas 1.6 million lost their lives.

The need for rapid and accurate testing during the pandemic accelerated the development of testing technologies, such as Reverse Transcription-Polymerase Chain Reaction (RT-PCR), Loop-mediated isothermal Amplification (LAMP), and Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)-based essays, were prominent. Rapid antigen tests, such as Abbott BinaxNOW and Quidel Sofia SARS antigen tests, obtained Emergency Use Authorization (EUA) from regulatory agencies. They were widely used to screen the virus, propelling market growth. In addition, technological improvements that enable quicker, more precise, and more reliable diagnosis of infectious disorders are key drivers of consumer demand for clinical microbiology testing.

Advanced automated microbial identification and susceptibility testing techniques provide faster and more accurate results than previous manual approaches. These systems identify microbes and estimate their antibiotic susceptibility using modern technologies, such as mass spectrometry & molecular diagnostics. For instance, bioMérieux's VITEK MS system is an automated mass spectrometry-based device that can identify diverse bacteria in minutes. Similarly, the BD Phoenix Automated Microbiology System can fully automate microbe identification and susceptibility testing, offering fast & precise findings.

As the prevalence of healthcare-associated Infections (HAIs) rises, infection management is becoming increasingly crucial in healthcare settings. HAIs can have major repercussions, such as higher mortality & morbidity rates, longer hospital stays, and greater healthcare expenses. The CDC estimates that in the U.S., HAIs cause 1.7 million infections and 99,000 deaths each year. Moreover, the increased awareness of the significance of infection control drives consumer interest in clinical microbiology testing, aiding identification, prevention of infectious agents and minimization of HAI occurrence. As technology advances and novel products are developed, the demand for clinical microbiology grows and further boosts market growth.

Market Concentration & Characteristics

The market has seen significant innovation in recent years. Advancements in technology have led to the development of faster and more accurate diagnostic tests, allowing for more targeted and effective treatments. Some of the significant innovations in this field include the use of molecular diagnostic techniques, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), which enable the detection of a wide range of pathogens with high sensitivity and specificity.

Over the past few years, the market has seen a significant increase in mergers and acquisitions (M&A) activity. This can be attributed to various factors, such as the growing prevalence of infectious diseases, increasing need for rapid diagnostic tests, and the emergence of new technologies. Some notable M&A activities in the market include the acquisition of Specific Diagnostics by bioMérieux, acquisition of Inscopix, Inc. by Bruker, and acquisition of GenMark Diagnostics by Roche. These acquisitions have helped the acquiring companies expand their product portfolio and tap into new markets.

Regulatory bodies, such as the FDA, the European Medicines Agency (EMA), and other regional regulatory bodies impose strict guidelines on the development, manufacturing, and marketing of clinical microbiology products. The regulatory environment in the clinical microbiology market is constantly evolving, with new guidelines and policies being introduced. This create challenges for companies operating in the market, as they need to stay up-to-date with the changes to remain compliant. However, the regulations also provide opportunities for companies that can develop innovative products that meet the regulatory requirements. These products can gain a competitive advantage in the market and become the standard of care for diagnosing and treating infectious diseases.

The field of clinical microbiology has traditionally relied on laboratory-based testing methods to diagnose infectious diseases. However, with the rise of alternative solutions, such as point-of-care testing (POCT) and self-testing kits, customers now have access to a wide range of service substitutes in the market.

The dominance of a few key players in the market can lead to limited choices for end-users, reducing the diversity of available technologies and services. This can result in a lack of flexibility in adapting to specific institutional needs and emerging challenges.

Product Insights

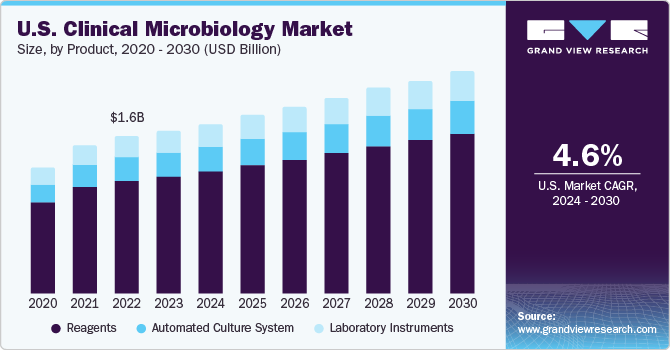

The reagents segment dominated the market with a share of 72.20% in 2023. This can be attributed to the increasing development and commercialization of novel reagents for clinical microbiology purposes. The prevalence of chronic illnesses like cancer, diabetes, and cardiovascular problems has increased across the globe. Reagents are essential for precisely detecting and tracking these illnesses by detecting biomarkers, particular molecules, or genetic variations linked to these diseases through various diagnostic procedures, such as imaging, blood tests, and genetic testing.

In addition, easy availability of advanced reagents that offer improved solutions for making testing simple, accurate, and quick is expected to accelerate market growth. The laboratory instruments segment is expected to register the fastest CAGR from 2024 to 2030 due to the high demand for products worldwide. Laboratory instruments play an important role in clinical microbiology. These instruments include incubators, gram stainers, bacterial colony counters, autoclave sterilizers, and petri dish fillers. This lab equipment is widely used in several industries, such as drug development, microbiology labs, biotechnology, and research institutes, to conduct experiments and analyze samples.

Disease Insights

In 2023, the respiratory diseases segment dominated the market. The prevalence of infectious diseases, such as tuberculosis, drives the need for respiratory disease testing. According to WHO’s Global Tuberculosis Report 2022, the number of people infected by tuberculosis globally stands at 10.6 million, of which only 6.4 million were diagnosed. Hence, the surge in respiratory diseases is increasing the significance of clinical microbiology by enabling precise diagnosis and tailored treatments. Furthermore, increasing air pollution, which results in the discharge of dangerous gases that cause lung diseases, such as Chronic Obstructive Pulmonary Disease (COPD), is propelling segment growth. The bloodstream infection (BSI) segment is expected to register a significant CAGR from 2024 to 2030.

A rise in BSI cases globally is a concern that has significant implications for public health. Various factors contribute to the rise in BSI cases, including increasing prevalence of antibiotic-resistant bacteria, invasive medical procedures, growing geriatric population, and high incidence of chronic diseases. In addition, the COVID-19 pandemic had a significant impact on the market for BSI testing. A retrospective observational study was conducted at a tertiary care center in Jaipur, India, to assess the prevalence & spectrum of BSIs in COVID-19 patients. During the 5-month study period, approximately 158 blood cultures were obtained from the 1,578 COVID-19-positive patients, and 15 patients (9.4%) showed positive results.

Regional Insights

North America dominated the market and accounted for a revenue share of 39.28% in 2023. The U.S. market is witnessing robust growth, driven by several factors shaping the healthcare landscape. An increasing prevalence of infectious diseases and ongoing challenges posed by emerging pathogens highlight the critical role of clinical microbiology in disease diagnosis, surveillance, and management. The market is characterized by a shift toward molecular diagnostics, with a focus on rapid and accurate testing methods.Companies, such as bioMérieux, B.D., and Danaher Corporation, continue to invest in research & development to introduce innovative technologies that improve sensitivity, increase specificity, and reduce turnaround time in microbiological testing.

U.S. Clinical Microbiology Market Trends

The clinical microbiology market in the U.S. is expected to grow over the forecast period due to several factors, which include the increasing prevalence of infectious diseases. Moreover, the ongoing challenges posed by emerging pathogens, highlights the critical role of clinical microbiology in disease diagnosis, surveillance, and management.

Europe Clinical Microbiology Market Trends

Europe clinical microbiology market was identified as a lucrative region in this industry. This can be attributed to the growing need for advanced diagnostic solutions. Furthermore, the presence of favorable government initiatives and the development of independent diagnostic centers are further expected to boost market growth over the forecast period.

The clinical microbiology market in the UK held a significant share in 2023. The increasing prevalence of infectious diseases and a growing emphasis on diagnostic accuracy, is projected to boost the demand for clinical microbiology products and services.

France clinical microbiology market is expected to grow in the near future. The advancing healthcare technologies is evident in the adoption of innovative diagnostic methods, including molecular diagnostics & automation, which contribute to market growth.

The clinical microbiology market in Germany is anticipated to grow significantly over the forecast period. In May 2022, the government of Germany provided a grant of USD 2.60 to researchers from the JMU Würzburg. The organization intended to use this grant for developing novel diagnostic and therapeutic approaches for UTIs.

Asia Pacific Clinical Microbiology Market Trends

The Asia Pacific clinical microbiology market held the highest CAGR of over the forecast period. This upsurge is attributed to the rapidly advancing healthcare sector and a strong focus on innovative medical technologies. Furthermore, the strategic initiatives undertaken by local key players for enhancing product capabilities are expected to contribute to market growth.

The clinical microbiology market in China is expected to grow significantly over the forecast period. This is driven by factors such as increasing awareness of infectious diseases, rising healthcare expenditure, and advancements in diagnostic technologies.

Japan clinical microbiology market is witnessing rapid growth due to the growing demand for diagnostic technologies and services, driven by factors such as an aging population, increasing prevalence of infectious diseases, & a focus on advanced healthcare infrastructure

MEA Clinical Microbiology Market Trends

The MEA clinical microbiology marketis expected to grow exponentially over the forecast period due to growing initiatives, such as organizing programs and conferences, are contributing to the growth of the market. In November 2023, the Emirates Society of Clinical Microbiology organized a third annual conference emphasizing the trends and patterns of Antimicrobial Resistance (AMR) surveillance in the UAE

Saudi Arabia clinical microbiology market is expected to grow over the forecast period. The market growth is driven by significant investments in R&D and the presence of leading institutions focused on science & technology.

The clinical microbiology market in Kuwait is anticipated to grow at a moderate rate over the forecast period. The increasing number of deaths due to infectious diseases in Saudi Arabia is expected to propel the market.

Key Clinical Microbiology Company Insights

Product launches, approvals, strategic acquisitions, and innovations are some of the important business strategies market participants have adopted to strengthen and maintain their global reach. Technological innovations, such as the introduction of automated systems with innovative designs, are expected to intensify the competition among industry players by changing its dynamics over the forecast period.

Key Clinical Microbiology Companies:

The following are the leading companies in the clinical microbiology market. These companies collectively hold the largest market share and dictate industry trends.

- bioMerieux SA

- Abbott

- BD

- Danaher (Cepheid, Inc.)

- Hologic, Inc.

- F. Hoffmann-La Roche Ltd.

- Bruker

- Bio-Rad Laboratories, Inc.

Recent Developments

-

In May 2023, HiMedia Laboratories Pvt. Ltd. and Advanced Instruments LLC collaborated to introduce their newest innovation in microbiology research-the Anoxomat III Anaerobic Culture System

-

In March 2023, bioMérieux SA in collaboration with its partner Interscience, introduced the 3P STATION, an automated system tailored to meet the specific requirements of pharmaceutical industry stakeholders. This automated system optimizes and ensures reliable reading performances and was created specially to satisfy the environmental monitoring requirements of the pharmaceutical industry

-

In February 2023,bioMérieux SA launched MAESTRIA, a cutting-edge middleware designed for microbiology laboratories. With the help of this new-generation middleware, all routine activities in the microbiology lab will be managed through a single software tool

-

In January 2023, Bruker acquired ACQUIFER Imaging GmbH, a provider of bioimaging and high-content microscopy solutions. This strategic move to strengthen Bruker’s capabilities in microscopy

Clinical Microbiology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.83 billion

Revenue forecast in 2030

USD 6.60 billion

Growth rate

CAGR of 5.35% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, disease, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

bioMérieux SA; BD; Abbott; Danaher Corp. (Cepheid, Inc.); Abbott (Alere, Inc.); Hologic, Inc.; F. Hoffmann-La Roche Ltd; Bruker; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Microbiology Market Report Segmentation

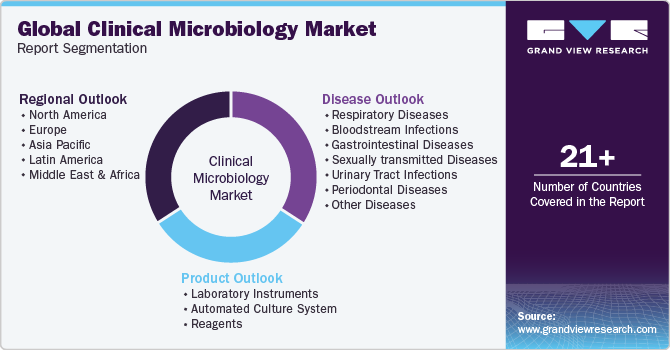

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical microbiology market report based on product, disease, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Laboratory Instruments

-

Incubators

-

Gram Stainers

-

Bacterial Colony Counters

-

Autoclave Sterilizers

-

Petri Dish Fillers

-

-

Automated Culture System

-

Microbiology Analyzers

-

Molecular Diagnostic Instruments

-

Microscopes

-

Mass Spectrometers

-

-

Reagents

-

-

Disease Outlook (Revenue, USD Billion, 2018 - 2030)

-

Respiratory Diseases

-

Bloodstream Infections

-

Gastrointestinal Diseases

-

Sexually transmitted Diseases

-

Urinary Tract Infections

-

Periodontal Diseases

-

Other Diseases

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Kuwait

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global clinical microbiology market size was estimated at USD 4.57 billion in 2023 and is expected to reach USD 4.83 billion in 2024.

b. The global clinical microbiology market is expected to grow at a compound annual growth rate of 5.35% from 2024 to 2030 to reach USD 6.60 billion by 2030.

b. North America dominated the clinical microbiology market with a share of 39.28% in 2023. This is attributable to highly developed industrial and healthcare sectors in the U.S. that are fueling the adoption of advanced clinical diagnostic techniques.

b. Some key players operating in the clinical microbiology market include bioMérieux SA; BD; Abbott; Danaher Corporation (Cepheid, Inc.); Abbott (Alere, Inc.); Hologic, Inc.; F. Hoffmann-La Roche Ltd; Bruker; Bio-Rad Laboratories, Inc.

b. Key factors that are driving the market growth include rising healthcare expenditure in developing countries, the growing demand for rapid diagnostic tests, and the rising adoption of advanced molecular diagnostic techniques.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."