- Home

- »

- Clinical Diagnostics

- »

-

Clinical Laboratory Services Market Size, Share Report, 2030GVR Report cover

![Clinical Laboratory Services Market Size, Share & Trends Report]()

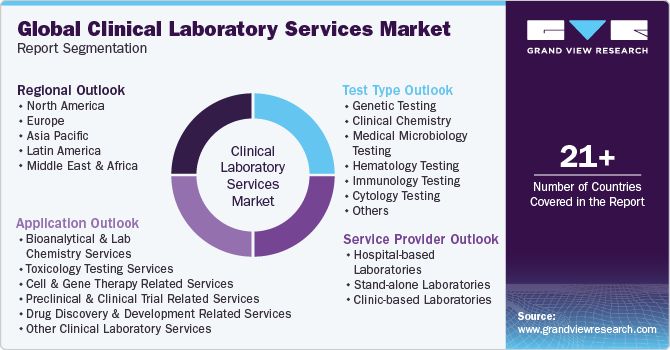

Clinical Laboratory Services Market Size, Share & Trends Analysis Report By Test Type (Human & Tumor Genetics, Clinical Chemistry), By Service Provider, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-250-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Clinical Laboratory Services Market Trends

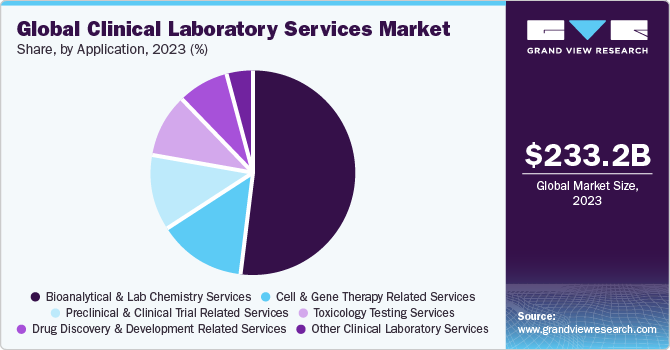

The global clinical laboratory services market size was estimated at USD 233.24 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2030. The market growth is due to the factors such as increasing burden of chronic diseases and growing demand for early diagnostic tests. Moreover, rapid advancements in data management and sample preparation due to growing volumes of testing samples are anticipated to boost market growth during the forecast period.

Clinical lab services are widely used for variety of applications, primarily for detecting and quantifying different biological substances. Variations in biomolecular concentrations can indicate various abnormal metabolic activities, infections, infectious and non-infectious diseases, and inflammatory conditions. To ensure optimal clinical results and overall public health, it's vital to rapidly and accurately diagnose severe illnesses and administer appropriate treatment.

Automation in clinical settings has significantly improved the data management process in laboratories. Growing adoption of laboratory automation systems is expected to boost the market during the forecast period. Furthermore, database management tools, patient test records, and integrated workflow management systems have received significant consideration in the healthcare industry. This can be attributed mainly to companies that are involved in processing nearly 100 to 150 billion samples per year. Hence, improvement & implementation of informatics and automated data management solutions to perform seamless operations are anticipated to drive the market.

An increase in disease prevalence and high demand for early disease diagnosis are expected to boost the market during the forecast period. These factors have prompted market players to introduce innovative services to address the growing demand. The introduction of accurate and technologically advanced products, such as companion diagnostics, biochips, & microarrays, has increased the demand for early disease detection. Products such as companion diagnostics also reduce the overall healthcare cost by helping physicians identify the most suitable treatment option based on the genetic makeup of a patient.Furthermore, growing prevalence of target diseases, such as cardiovascular diseases and diabetes, is a high-impact rendering driver of the market over the forecast period. Cardiovascular disease has become the most dominant cause of mortality and morbidity in the world in the past three decades. According to WHO, by 2030, cardiovascular diseases are estimated to cause approximately 23.6 million deaths, mainly due to heart disease and stroke. Moreover, the global prevalence of diabetes is constantly increasing, creating a large patient pool for the global market.

Market Concentration & Characteristics

Market growth stage is moderate, and pace of the market growth is accelerating. The market is characterized by a moderate degree of innovation. This can be attributed to the advanced technologies and methodologies for transforming diagnostic practices. From novel testing approaches to automation, the sector continually evolves, enhancing accuracy and efficiency in healthcare diagnostics. For instance, in January 2023, QIAGEN released EZ2 Connect MDx, an in-vitro diagnostics platform for automated sample processing for diagnostic laboratories. The device allows labs to purify RNA and DNA samples in 30 minutes.

The market witnesses a notable M&A activities by the leading players. Leading players are strategically joining forces toexpand and enhance their services, gain access to new technologies, consolidate in the rapidly growing market, and address the increasing strategic importance of clinical laboratory services. In February 2022, Laboratory Corporation of America Holdings acquired Personal Genome Diagnostics Inc. to expand its portfolio of oncology-based NGS services.

The clinical laboratory services market is also subject to increasing regulatory scrutiny. The regulations ensure ensure safety standards, quality control, and fair competition. Countries have designated regulatory bodies that regulate the clinical laboratory services.In the United States, the application and safety aspects of laboratory tests and services are regulated and reviewed by the federal government through the Clinical Laboratory Improvement Amendments (CLIA). In addition to CLIA, the U.S. FDA is also involved in the regulations for the market.

There are limited direct substitutes for clinical laboratory services, such as at-home diagnostics kits and direct-to-consumer lab testing. However, these substitutes often lack the same level of performance and flexibility, emphasizing the unique value proposition of advanced clinical laboratory services.

The market is witnessing a growing number of geographical expansion strategies, with key players such as Quest Diagnostics, and LabCorp, employing this approach to broaden their service reach. This strategy enhances service availability across diverse geographic areas, ensuring a more extensive market presence.

Test Type Insights

Based on test type, the clinical chemistry segment led the market with the largest revenue share of 56.6% in 2023. The dominance of the segment is attributed to the presence of numerous clinical chemistry tests involved in pathology analysis of body fluids, including analysis of urine, plasma, serum, and other body fluids. Clinical chemistry tests or biochemistry tests form an integral part of basic level diagnosis and laboratory testing. Some of the common tests for clinical chemistry include glucose, creatinine, urea, total protein, globulins, albumin, bilirubin, alanine transaminase (ALT), aspartate transaminase (AST), alkaline phosphatase (ALP), andgamma-glutamyl transpeptidase (GGT) among others. Techniques such as spectrophotometry, immunoassay, and electrophoresis are used to measure the concentration of different types of molecules present in the collected sample. Increasing automation to enhance customer experience is gaining traction in the segment.

The genetics testing segment is anticipated to witness the lucrative CAGR during the forecast period. This can be attributed to an increase in intensive research activities on genetic and proteomic studies, in context to hereditary & gene-mutation-related disorders. Moreover, there is an increasing demand for personalized care with accurate and early diagnosis in oncology is expected to fuel segment growth. Rising need for efficient tests in early diagnosis of major infections and cancer is anticipated to boost the segment growth.

Service Provider Insights

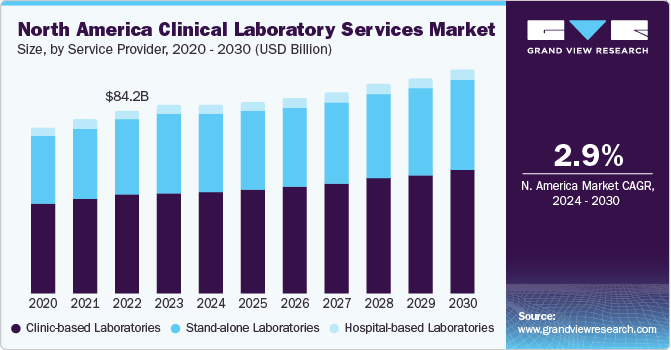

Based on the service provider, The hospital-based laboratories segment led the market in 2023 with a largest revenue share of 53.7%. This dominance is attributed to the high turnaround number of patients’ tests majorly for complex and severe disease conditions that are comparatively more cost-intensive. It is expected to maintain its dominance owing to the increasing number of hospitals integrating laboratories into their premises. The expansion of outreach programs initiated by hospitals, along with the quick turnaround of patients grappling with severe and major diseases, is projected to propel the segment growth. For instance, in February 2023, Tenaris along with San Jose Municipal Hospital in Campana, launched a new laboratory in Argentina to improve the capability of testing in the country.

The stand-alone laboratories segment is anticiapated to witness a lucrative CAGR over the forecast period. The market growth is owing to efforts to improve patient outcomes by providing diagnostic facilities at the retail level. Moreover, the ability of standalone labs to handle large volumes of diagnostic tests at an expedited rate and provide better results at comparatively lower prices is anticipated to offer economies of scale to service providers. There has been an increasing growth of standalone market since the outbreak of COVID-19 pandemic. In addition, emerging players providing standalone clinical lab testing services are expected to make a significant contribution to the segment’s rapid growth.

Application Insights

Based on application, the bioanalytical & lab chemistry services segment held the largest market revenue share of 52.1% in 2023. Bioanalytical & lab chemistry laboratories use a wide range of techniques and technology platforms to fulfill diagnostic needs. ELISA, chromatography, immunochemistry, mass spectroscopy, and molecular biology, are the most commonly used technologies in bioanalytical & lab chemistry applications. Bioanalytical services are an essential tool in drug discovery and development for determining the concentration of drugs and their metabolites. For instance, in November 2021, Labcorp launched a bioanalytical laboratory in Singapore expanding its bioanalytical presence in the Asia Pacific.

The toxicology testing services segment is expected to register a lucrative CAGR during the forecast period. Toxicology testing services include the identification of chemicals, drugs, and other toxic elements that affect patients and help clinicians in predicting future toxic effects, confirming a different diagnosis, or guiding a therapy. Moreover, market players are adopting various strategies, including mergers and acquisitions, contributing to segment growth. For instance, in January 2023, Aegis Sciences Corporation acquired HealthTrackRx's Toxicology business unit, strengthening Aegis's toxicology portfolio. This allows Aegis to provide comprehensive clinical toxicology testing, while HealthTrackRx concentrates on expanding its capabilities in PCR infectious disease testing. Similarly, in August 2022, LifeNet Health LifeSciences launched a human-relevant cell-based assay service by the acquisition of IONTOX, aiding in cytotoxic screening, biocompatibility assay, and a next-generation multi-organ platform. The main services in toxicity testing include urine testing, hair testing, blood testing, and saliva testing.

Regional Insights

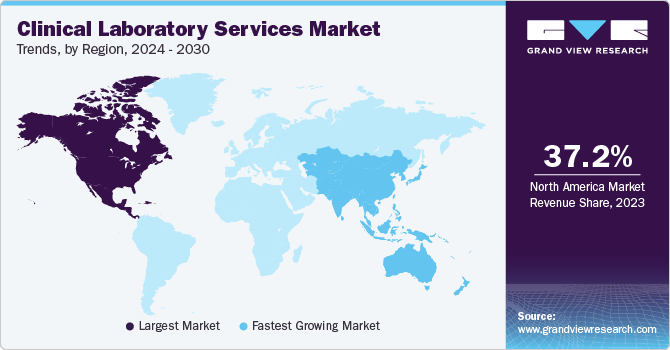

North America dominated the market with a revenue share of 37.24% in 2023. Major factors contributing to the largest share include high prevalence of chronic diseases, well established healthcare infrastructure, and rising geriatric population. The region shows presence of well established healthcare system and reimbursement framework for clinical laboratory services. Moreover, new players are entering the market owing to the lucrative nature of the business in the country. For instance, in February 2023, Dutch biotech company Detact Diagnostics announced setting up a new laboratory in the Keene State College (U.S.) with a 2-year rental contract. Moreover, leading clinical laboratories that offer patients and healthcare professionals with crucial diagnostic information are represented by the American Clinical Laboratory, a national trade group.

Asia Pacific. is anticipated to witness the fastest CAGR over the forecast period. The growth of the region is largely due to escalating scientific research, unmet medical needs, economic growth, and improvements in healthcare infrastructure and regulations. Increasing public awareness, and the availability of advanced medical treatments are anticipated to bolster the region's growth. Clinical laboratories serivces have gained significant importance during the COVID-19 pandemic due to heightened demand for testing. Major players are focusing on partnerships to introduce new lab testing services.

Key Clinical Laboratory Services Company Insights

Some of the key players operating in the market are Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, QIAGEN NV, Eurofins Scientific SE, Siemens Medical Solutions USA, Inc., and NeoGenomics Laboratories. These key players adopt various strategies to compete with their peers and drive growth. Companies are involved in expanding their market presence by entering into partnerships, collaborations, and agreements with other players to expand their product portfolio and geographic reach.

OPKO Health, Inc., ARUP Laboratories,and Sonic Healthcare are some of the emerging market participants in the global market. Emerging companies are employing various strategies to expand their footprint and grow at a fast pace. Customer acquisition strategies are being adopted by partnering with hospitals and clinics.

Key Clinical Laboratory Services Companies:

The following are the leading companies in the clinical laboratory services market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these clinical laboratory services companies are analyzed to map the supply network.

- Laboratory Corporation of America Holdings (LabCorp)

- QIAGEN NV

- Eurofins Scientific SE

- Quest Diagnostics Incorporated

- OPKO Health, Inc.

- Siemens Medical Solutions USA, Inc.

- NeoGenomics Laboratories

- Fresenius Medical Care

- ARUP Laboratories

- Sonic Healthcare

- Charles River Laboratories International, Inc.

- SYNLAB International GmbH

- Mayo Clinic Laboratories

- Unilabs

Recent Developments

- In August 2023, Laboratory Corporation of America Holdings entered into an agreement with Tufts Medicine. Under the agreement, Labcorp will acquire Tufts Medicine Outreach Laboratory Business to expand its diagnostic testing and laboratory services

- In July 2023, DiaCarta, Ltd. partnered with Hopkins MedTech Lab Services and Hopkins MedTech Compliance to support development and validation of laboratory developed tests in the U.S.

- In February 2023, Dutch biotech company Detact Diagnostics announced setting up a new laboratory in the Keene State College (U.S.) with a 2-year rental contract

Clinical Laboratory Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 233.63 billion

Revenue forecast in 2030

USD 286.77 billion

Growth rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, application, service provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; South Korea; Brazil; Mexico; Colombia, Peru, Argentina; South Africa; Saudi Arabia; UAE;

Key companies profiled

Laboratory Corporation of America Holdings (LabCorp); QIAGEN NV; Eurofins Scientific SE; Quest Diagnostics Incorporated; OPKO Health, Inc; Siemens Medical Solutions USA, Inc.; NeoGenomics Laboratories; Fresenius Medical Care; ARUP Laboratories; Sonic Healthcare; Charles River Laboratories International, Inc; SYNLAB International GmbH; Mayo Clinic Laboratories; Unilabs

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase option

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Laboratory Services Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the clinical laboratory services market on thetest type,application, service provider, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Genetic Testing

-

Clinical Chemistry

-

Routine Chemistry Testing

-

Therapeutic Drug Monitoring Testing

-

Endocrinology Chemistry Testing

-

Specialized Chemistry Testing

-

Other Clinical Chemistry Testing

-

-

Medical Microbiology Testing

-

Infectious Disease Testing

-

Transplant Diagnostic Testing

-

Other Microbiology Testing

-

-

Hematology Testing

-

Immunology Testing

-

Cytology Testing

-

Drug of Abuse Testing

-

Other Esoteric Tests

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-based Laboratories

-

Stand-alone Laboratories

-

Clinic-based Laboratories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioanalytical & Lab Chemistry Services

-

Toxicology Testing Services

-

Cell & Gene Therapy Related Services

-

Preclinical & Clinical Trial Related Services

-

Drug Discovery & Development Related Services

-

Other Clinical Laboratory Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Colombia

-

Peru

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical laboratory service market size was estimated at USD 233.24 billion in 2023 and is expected to reach USD 233.63 billion in 2024.

b. The global clinical laboratory service market is expected to grow at a compound annual growth rate of 3.47% from 2024 to 2030 to reach USD 286.77 billion by 2030.

b. Clinical chemistry dominated the clinical laboratory service market with a share of 56.60% in 2023 owing to the wide usage of tests related to urine, plasma, serum, and other body fluids for disease screening.

b. Some of the key service providers in the market include QIAGEN, ARUP Laboratories., Quest Diagnostics Incorporated, OPKO Health, Inc., Abbott, Siemens Medical Solutions USA, Inc., NeoGenomics Laboratories., Fresenius Medical Care., Sonic Healthcare., Laboratory Corporation of America Holdings (LabCorp).

b. Key factors that are driving the clinical laboratory service market growth include the increasing burden of chronic disease prevalence coupled with consequent demand for the early diagnostic tests and rapid advances in data management & sample preparation due to growing volumes of testing samples.

b. North America led the clinical laboratory service market for clinical laboratory services and accounted for the largest revenue share of 37.24% in 2023, owing to the high burden of chronic diseases in the region.

Table of Contents

Chapter 1 Clinical Laboratory Services Market: Methodology And Scope

1.1 Market Segmentation

1.1.1 Segment Scope

1.1.2 Regional Scope

1.1.3 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Gvr’s Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.1.2 Approach 2: Country Wise Market Estimation Using Bottom Up Approach

1.6.1.3 Approach 2: Country Wise Market Estimation Using Top Down Approach

1.7 Global Market: Cagr Calculation

1.8 Global Market: Cagr Calculation

1.9 List Of Secondary Sources

1.10 Objectives

1.10.1 Objective 1:

1.10.2 Objective 2:

1.11 List Of Abbreviations

Chapter 2 Clinical Laboratory Services Market: Executive Summary

2.1 Clinical Laboratory Services Market: Market Outlook

2.1.1 Market Summary

Chapter 3 Clinical Laboratory Services Market: Industry Outlook

3.1 Market Lineage Outlook

3.1.1 Parent Market Lineage Outlook

3.1.2 Related/Ancillary Market Outlook

3.2 Penetration & Growth Prospect Mapping

3.3 Market Dynamics

3.3.1 Market Drivers

3.3.1.1 Technological Advancements In The Filed Of Clinical Testing

3.3.1.2 Growing Prevalence Of Target Diseases Coupled With Rising Demand For Early Disease Diagnostic Tests

3.3.1.3 Introduction Of Novel Solutions

3.3.1.4 Introduction Of Home Health Tests

3.3.1.5 Outbreak Of Coivd-19 Technologies

3.3.2 Market Restraint Analysis

3.3.2.1 Presence Of Stringent Regulatory Framework

3.4 Swot Analysis, By Factor (Political & Legal, Economic And Technological)

3.5 Industry Analysis - Porter’s

3.6 Reimbursement & Regulatory Scenario

3.7 Major Deals & Strategic Alliances

3.7.1 New Product Launch

3.7.2 Acquisition

3.7.3 Expansion

3.7.4 Partnerships

3.7.5 Marketing & Promotions

Chapter 4. Clinical Laboratory Services Market: Test Type Estimates & Trend Analysis

4.1. Test Type Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Clinical Laboratory Services Market by Test Type Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Genetic Testing

4.4.1.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2. Clinical Chemistry

4.4.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2.2. Routine Chemistry Testing Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2.3. Therapeutic Drug Monitoring Testing Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2.4. Endocrinology Chemistry Testing Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2.5. Specialized Chemistry Testing Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2.6. Other Clinical Chemistry Testing Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.3. Medical Microbiology Testing

4.4.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.3.2. Infectious Disease Testing Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.3.3. Transplant Diagnostic Testing Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.3.4. Other Microbiology Testing Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.4. Hematology Testing

4.4.5. Immunology Testing

4.4.6. Cytology Testing

4.4.7. Drug of Abuse Testing

4.4.8. Other Esoteric Tests

4.4.8.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 5. Clinical Laboratory Services Market: Service Provider Estimates & Trend Analysis

5.1. Service Provider Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Clinical Laboratory Services Market by Service Provider Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Hospital-Based Laboratories

5.4.1.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

5.4.2. Stand-Alone Laboratories

5.4.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

5.4.3. Clinic-Based Laboratories

5.4.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 6. Clinical Laboratory Services Market: Application Estimates & Trend Analysis

6.1. Application Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Global Clinical Laboratory Services Market by Application Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4.1. Bioanalytical & Lab Chemistry Services

6.4.1.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

6.4.2. Toxicology Testing Services

6.4.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

6.4.3. Cell & Gene Therapy Related Services

6.4.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

6.4.4. Preclinical & Clinical Trial Related Services

6.4.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

6.4.5. Drug Discovery & Development Related Services

6.4.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

6.4.6. Others

6.4.6.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 7. Clinical Laboratory Services Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Global Regional Market Snapshot

7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030

7.5. North America

7.5.1. U.S.

7.5.1.1. Key country dynamics

7.5.1.2. Regulatory framework/ reimbursement structure

7.5.1.3. Competitive scenario

7.5.1.4. U.S. market estimates and forecasts, 2018 to 2030 (USD Million)

7.5.2. Canada

7.5.2.1. Key country dynamics

7.5.2.2. Regulatory framework/ reimbursement structure

7.5.2.3. Competitive scenario

7.5.2.4. Canada market estimates and forecasts, 2018 to 2030 (USD Million)

7.6. Europe

7.6.1. UK

7.6.1.1. Key country dynamics

7.6.1.2. Regulatory framework/ reimbursement structure

7.6.1.3. Competitive scenario

7.6.1.4. UK market estimates and forecasts, 2018 to 2030 (USD Million)

7.6.2. Germany

7.6.2.1. Key country dynamics

7.6.2.2. Regulatory framework/ reimbursement structure

7.6.2.3. Competitive scenario

7.6.2.4. Germany market estimates and forecasts, 2018 to 2030 (USD Million)

7.6.3. France

7.6.3.1. Key country dynamics

7.6.3.2. Regulatory framework/ reimbursement structure

7.6.3.3. Competitive scenario

7.6.3.4. France market estimates and forecasts, 2018 to 2030 (USD Million)

7.6.4. Italy

7.6.4.1. Key country dynamics

7.6.4.2. Regulatory framework/ reimbursement structure

7.6.4.3. Competitive scenario

7.6.4.4. Italy market estimates and forecasts, 2018 to 2030 (USD Million)

7.6.5. Spain

7.6.5.1. Key country dynamics

7.6.5.2. Regulatory framework/ reimbursement structure

7.6.5.3. Competitive scenario

7.6.5.4. Spain market estimates and forecasts, 2018 to 2030 (USD Million)

7.6.6. Norway

7.6.6.1. Key country dynamics

7.6.6.2. Regulatory framework/ reimbursement structure

7.6.6.3. Competitive scenario

7.6.6.4. Norway market estimates and forecasts, 2018 to 2030 (USD Million)

7.6.7. Sweden

7.6.7.1. Key country dynamics

7.6.7.2. Regulatory framework/ reimbursement structure

7.6.7.3. Competitive scenario

7.6.7.4. Sweden market estimates and forecasts, 2018 to 2030 (USD Million)

7.6.8. Denmark

7.6.8.1. Key country dynamics

7.6.8.2. Regulatory framework/ reimbursement structure

7.6.8.3. Competitive scenario

7.6.8.4. Denmark market estimates and forecasts, 2018 to 2030 (USD Million)

7.7. Asia Pacific

7.7.1. Japan

7.7.1.1. Key country dynamics

7.7.1.2. Regulatory framework/ reimbursement structure

7.7.1.3. Competitive scenario

7.7.1.4. Japan market estimates and forecasts, 2018 to 2030 (USD Million)

7.7.2. China

7.7.2.1. Key country dynamics

7.7.2.2. Regulatory framework/ reimbursement structure

7.7.2.3. Competitive scenario

7.7.2.4. China market estimates and forecasts, 2018 to 2030 (USD Million)

7.7.3. India

7.7.3.1. Key country dynamics

7.7.3.2. Regulatory framework/ reimbursement structure

7.7.3.3. Competitive scenario

7.7.3.4. India market estimates and forecasts, 2018 to 2030 (USD Million)

7.7.4. Australia

7.7.4.1. Key country dynamics

7.7.4.2. Regulatory framework/ reimbursement structure

7.7.4.3. Competitive scenario

7.7.4.4. Australia market estimates and forecasts, 2018 to 2030 (USD Million)

7.7.5. South Korea

7.7.5.1. Key country dynamics

7.7.5.2. Regulatory framework/ reimbursement structure

7.7.5.3. Competitive scenario

7.7.5.4. South Korea market estimates and forecasts, 2018 to 2030 (USD Million)

7.7.6. Thailand

7.7.6.1. Key country dynamics

7.7.6.2. Regulatory framework/ reimbursement structure

7.7.6.3. Competitive scenario

7.7.6.4. Thailand market estimates and forecasts, 2018 to 2030 (USD Million)

7.8. Latin America

7.8.1. Brazil

7.8.1.1. Key country dynamics

7.8.1.2. Regulatory framework/ reimbursement structure

7.8.1.3. Competitive scenario

7.8.1.4. Brazil market estimates and forecasts, 2018 to 2030 (USD Million)

7.8.2. Mexico

7.8.2.1. Key country dynamics

7.8.2.2. Regulatory framework/ reimbursement structure

7.8.2.3. Competitive scenario

7.8.2.4. Mexico market estimates and forecasts, 2018 to 2030 (USD Million)

7.8.3. Argentina

7.8.3.1. Key country dynamics

7.8.3.2. Regulatory framework/ reimbursement structure

7.8.3.3. Competitive scenario

7.8.3.4. Argentina market estimates and forecasts, 2018 to 2030 (USD Million)

7.8.4. Colombia

7.8.4.1. Key country dynamics

7.8.4.2. Regulatory framework/ reimbursement structure

7.8.4.3. Competitive scenario

7.8.4.4. Colombia market estimates and forecasts, 2018 to 2030 (USD Million)

7.8.5. Peru

7.8.5.1. Key country dynamics

7.8.5.2. Regulatory framework/ reimbursement structure

7.8.5.3. Competitive scenario

7.8.5.4. Peru market estimates and forecasts, 2018 to 2030 (USD Million)

7.9. MEA

7.9.1. South Africa

7.9.1.1. Key country dynamics

7.9.1.2. Regulatory framework/ reimbursement structure

7.9.1.3. Competitive scenario

7.9.1.4. South Africa market estimates and forecasts, 2018 to 2030 (USD Million)

7.9.2. Saudi Arabia

7.9.2.1. Key country dynamics

7.9.2.2. Regulatory framework/ reimbursement structure

7.9.2.3. Competitive scenario

7.9.2.4. Saudi Arabia market estimates and forecasts, 2018 to 2030 (USD Million)

7.9.3. UAE

7.9.3.1. Key country dynamics

7.9.3.2. Regulatory framework/ reimbursement structure

7.9.3.3. Competitive scenario

7.9.3.4. UAE market estimates and forecasts, 2018 to 2030 (USD Million)

7.9.4. Kuwait

7.9.4.1. Key country dynamics

7.9.4.2. Regulatory framework/ reimbursement structure

7.9.4.3. Competitive scenario

7.9.4.4. Kuwait market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.3.3. Key company market share analysis, 2023

8.3.4. LABORATORY CORPORATION OF AMERICA HOLDINGS (LABCORP)

8.3.4.1. Company overview

8.3.4.2. Financial performance

8.3.4.3. Product benchmarking

8.3.4.4. Strategic initiatives

8.3.5. QIAGEN NV

8.3.5.1. Company overview

8.3.5.2. Financial performance

8.3.5.3. Product benchmarking

8.3.5.4. Strategic initiatives

8.3.6. QUEST DIAGNOSTICS INCORPORATED

8.3.6.1. Company overview

8.3.6.2. Financial performance

8.3.6.3. Product benchmarking

8.3.6.4. Strategic initiatives

8.3.7. OPKO HEALTH, INC

8.3.7.1. Company overview

8.3.7.2. Financial performance

8.3.7.3. Product benchmarking

8.3.7.4. Strategic initiatives

8.3.8. CHARLES RIVER LABORATORIES

8.3.8.1. Company overview

8.3.8.2. Financial performance

8.3.8.3. Product benchmarking

8.3.8.4. Strategic initiatives

8.3.9. ARUP LABORATORIES (ASSOCIATED REGIONAL AND UNIVERSITY PATHOLOGISTS, INC.)

8.3.9.1. Company overview

8.3.9.2. Financial performance

8.3.9.3. Product benchmarking

8.3.9.4. Strategic initiatives

8.3.10. SONIC HEALTHCARE

8.3.10.1. Company overview

8.3.10.2. Financial performance

8.3.10.3. Product benchmarking

8.3.10.4. Strategic initiatives

8.3.11. NEOGENOMICS LABORATORIES, INC.

8.3.11.1. Company overview

8.3.11.2. Financial performance

8.3.11.3. Product benchmarking

8.3.11.4. Strategic initiatives

8.3.12. FRESENIUS MEDICAL CARE AG & CO. KGAA

8.3.12.1. Company overview

8.3.12.2. Financial performance

8.3.12.3. Product benchmarking

8.3.12.4. Strategic initiatives

8.3.13. SIEMENS HEALTHCARE LIMITED

8.3.13.1. Company overview

8.3.13.2. Financial performance

8.3.13.3. Product benchmarking

8.3.13.4. Strategic initiatives

8.3.14. SYNLAB International GmbH

8.3.14.1. Company overview

8.3.14.2. Financial performance

8.3.14.3. Product benchmarking

8.3.14.4. Strategic initiatives

8.3.15. Mayo Clinic Laboratories

8.3.15.1. Company overview

8.3.15.2. Financial performance

8.3.15.3. Product benchmarking

8.3.15.4. Strategic initiatives

8.3.16. Unilabs

8.3.16.1. Company overview

8.3.16.2. Financial performance

8.3.16.3. Product benchmarking

8.3.16.4. Strategic initiatives

8.3.17. Eurofins Scientific SE

8.3.17.1. Company overview

8.3.17.2. Financial performance

8.3.17.3. Product benchmarking

8.3.17.4. Strategic initiatives

List of Tables

Table 1 List of Abbreviation

Table 2 North America clinical laboratory services market, by region, 2018 - 2030 (USD Million)

Table 3 North America clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 4 North America clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 5 North America clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 6 U.S. clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 7 U.S. clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 8 U.S. clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 9 Canada clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 10 Canada clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 11 Canada clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 12 Europe clinical laboratory services market, by region, 2018 - 2030 (USD Million)

Table 13 Europe clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 14 Europe clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 15 Europe clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 16 Germany clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 17 Germany clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 18 Germany clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 19 UK clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 20 UK clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 21 UK clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 22 France clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 23 France clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 24 France clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 25 Italy clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 26 Italy clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 27 Italy clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 28 Spain clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 29 Spain clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 30 Spain clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 31 Denmark clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 32 Denmark clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 33 Denmark clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 34 Sweden clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 35 Sweden clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 36 Sweden clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 37 Norway clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 38 Norway clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 39 Norway clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 40 Asia Pacific clinical laboratory services market, by region, 2018 - 2030 (USD Million)

Table 41 Asia Pacific clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 42 Asia Pacific clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 43 Asia Pacific clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 44 China clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 45 China clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 46 China clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 47 Japan clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 48 Japan clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 49 Japan clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 50 India clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 51 India clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 52 India clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 53 South Korea clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 54 South Korea clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 55 South Korea clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 56 Australia clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 57 Australia clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 58 Australia clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 59 Thailand clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 60 Thailand clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 61 Thailand clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 62 Latin America clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 63 Latin America clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 64 Latin America clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 65 Brazil clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 66 Brazil clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 67 Brazil clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 68 Mexico clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 69 Mexico clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 70 Mexico clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 71 Argentina clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 72 Argentina clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 73 Argentina clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 74 Colombia clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 75 Colombia clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 76 Colombia clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 77 Peru clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 78 Peru clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 79 Peru clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 80 MEA clinical laboratory services market, by region, 2018 - 2030 (USD Million)

Table 81 MEA clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 82 MEA clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 83 MEA clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 84 South Africa clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 85 South Africa clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 86 South Africa clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 87 Saudi Arabia clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 89 Saudi Arabia clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 90 UAE clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 91 UAE clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 92 UAE clinical laboratory services market, by application, 2018 - 2030 (USD Million)

Table 93 Kuwait clinical laboratory services market, by test type, 2018 - 2030 (USD Million)

Table 94 Kuwait clinical laboratory services market, by service provider, 2018 - 2030 (USD Million)

Table 95 Kuwait clinical laboratory services market, by application, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Clinical laboratory services market: market outlook

Fig. 14 Clinical laboratory services competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Clinical laboratory services market driver impact

Fig. 20 Clinical laboratory services market restraint impact

Fig. 21 Clinical laboratory services market strategic initiatives analysis

Fig. 22 Clinical laboratory services market: Test Type movement analysis

Fig. 23 Clinical laboratory services market: Test Type outlook and key takeaways

Fig. 24 Genetic Testing market estimates and forecast, 2018 - 2030

Fig. 25 Clinical chemistry market estimates and forecast, 2018 - 2030

Fig. 26 Routine chemistry testing market estimates and forecast, 2018 - 2030

Fig. 27 Therapeutic drug monitoring testing market estimates and forecast, 2018 - 2030

Fig. 28 Endocrinology chemistry testing market estimates and forecast, 2018 - 2030

Fig. 29 Specialized chemistry testing market estimates and forecast, 2018 - 2030

Fig. 30 Other clinical chemistry testing market estimates and forecast, 2018 - 2030

Fig. 31 Medical microbiology testing market estimates and forecast, 2018 - 2030

Fig. 32 Infectious disease testing market estimates and forecast, 2018 - 2030

Fig. 33 Transplant diagnostic testing market estimates and forecast, 2018 - 2030

Fig. 34 Other microbiology testing market estimates and forecast, 2018 - 2030

Fig. 35 Hematology testing market estimates and forecast, 2018 - 2030

Fig. 36 Immunology testing market estimates and forecast, 2018 - 2030

Fig. 37 Cytology testing market estimates and forecast, 2018 - 2030

Fig. 38 Drug of abuse testing market estimates and forecast, 2018 - 2030

Fig. 39 Other esoteric tests market estimates and forecast, 2018 - 2030

Fig. 40 Clinical laboratory services market: Service Provider movement Analysis

Fig. 41 Clinical laboratory services market: Service Provider outlook and key takeaways

Fig. 42 Hospital-based laboratories market estimates and forecasts, 2018 - 2030

Fig. 43 Stand-alone laboratories market estimates and forecasts,2018 - 2030

Fig. 44 Clinic-based laboratories market estimates and forecasts,2018 - 2030

Fig. 45 Clinical laboratory services market: application movement analysis

Fig. 46 Fig. .46 Clinical laboratory services market: application outlook and key takeaways

Fig. 47 Bioanalytical & lab chemistry services market estimates and forecasts, 2018 - 2030

Fig. 48 Toxicology testing services market estimates and forecasts,2018 - 2030

Fig. 49 Cell & gene therapy related services market estimates and forecasts, 2018 - 2030

Fig. 50 Preclinical & clinical trial related services market estimates and forecasts,2018 - 2030

Fig. 51 Drug discovery & development related services market estimates and forecasts, 2018 - 2030

Fig. 52 Other clinical laboratory services market estimates and forecasts,2018 - 2030

Fig. 53 Global clinical laboratory services market: Regional movement analysis

Fig. 54 Global clinical laboratory services market: Regional outlook and key takeaways

Fig. 55 Global clinical laboratory services market share and leading players

Fig. 56 North America market share and leading players

Fig. 57 Europe market share and leading players

Fig. 58 Asia Pacific market share and leading players

Fig. 59 Latin America market share and leading players

Fig. 60 Middle East & Africa market share and leading players

Fig. 61 North America: SWOT

Fig. 62 Europe SWOT

Fig. 63 Asia Pacific SWOT

Fig. 64 Latin America SWOT

Fig. 65 MEA SWOT

Fig. 66 North America

Fig. 67 North America market estimates and forecasts, 2018 - 2030

Fig. 68 U.S.

Fig. 69 U.S. market estimates and forecasts, 2018 - 2030

Fig. 70 Canada

Fig. 71 Canada market estimates and forecasts, 2018 - 2030

Fig. 72 Europe

Fig. 73 Europe market estimates and forecasts, 2018 - 2030

Fig. 74 UK

Fig. 75 UK market estimates and forecasts, 2018 - 2030

Fig. 76 Germany

Fig. 77 Germany market estimates and forecasts, 2018 - 2030

Fig. 78 France

Fig. 79 France market estimates and forecasts, 2018 - 2030

Fig. 80 Italy

Fig. 81 Italy market estimates and forecasts, 2018 - 2030

Fig. 82 Spain

Fig. 83 Spain market estimates and forecasts, 2018 - 2030

Fig. 84 Denmark

Fig. 85 Denmark market estimates and forecasts, 2018 - 2030

Fig. 86 Sweden

Fig. 87 Sweden market estimates and forecasts, 2018 - 2030

Fig. 88 Norway

Fig. 89 Norway market estimates and forecasts, 2018 - 2030

Fig. 90 Asia Pacific

Fig. 91 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 92 China

Fig. 93 China market estimates and forecasts, 2018 - 2030

Fig. 94 Japan

Fig. 95 Japan market estimates and forecasts, 2018 - 2030

Fig. 96 India

Fig. 97 India market estimates and forecasts, 2018 - 2030

Fig. 98 Thailand

Fig. 99 Thailand market estimates and forecasts, 2018 - 2030

Fig. 100 South Korea

Fig. 101 South Korea market estimates and forecasts, 2018 - 2030

Fig. 102 Australia

Fig. 103 Australia market estimates and forecasts, 2018 - 2030

Fig. 104 Latin America

Fig. 105 Latin America market estimates and forecasts, 2018 - 2030

Fig. 106 Brazil

Fig. 107 Brazil market estimates and forecasts, 2018 - 2030

Fig. 108 Mexico

Fig. 109 Mexico market estimates and forecasts, 2018 - 2030

Fig. 110 Colombia

Fig. 111 Colombia market estimates and forecasts, 2018 - 2030

Fig. 112 Peru

Fig. 113 Peru market estimates and forecasts, 2018 - 2030

Fig. 114 Argentina

Fig. 115 Argentina market estimates and forecasts, 2018 - 2030

Fig. 116 Middle East and Africa

Fig. 117 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 118 South Africa

Fig. 119 South Africa market estimates and forecasts, 2018 - 2030

Fig. 120. Saudi Arabia

Fig. 121 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 122UAE

Fig. 123 UAE market estimates and forecasts, 2018 - 2030

Fig. 124 Kuwait

Fig. 125 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 126 Market share of key market players - Clinical laboratory services marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Clinical Laboratory Services Test Type Outlook (Revenue, USD Million, 2018 - 2030)

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Clinical Laboratory Services Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Clinical Laboratory Services Application Outlook (Revenue, USD Million, 2018 - 2030)

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Clinical Laboratory ServicesRegional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- North America Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- North America Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- U.S.

- U.S. Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- U.S. Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- U.S. Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- U.S. Clinical Laboratory Services, By Test Type

- Canada

- Canada Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Canada Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Canada Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Canada Clinical Laboratory Services, By Test Type

- North America Clinical Laboratory Services, By Test Type

- Europe

- Europe Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Europe Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Europe Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- UK

- UK Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- UK Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- UK Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- UK Clinical Laboratory Services, By Test Type

- Germany

- Germany Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Germany Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Germanya Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Germany Clinical Laboratory Services, By Test Type

- France

- France Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- France Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- France Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- France Clinical Laboratory Services, By Test Type

- Italy

- Italy Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Italy Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Italy Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Italy Clinical Laboratory Services, By Test Type

- Spain

- Spain Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Spain Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Spain Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Spain Clinical Laboratory Services, By Test Type

- Denmark

- Denmark Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Denmark Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Denmark Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Denmark Clinical Laboratory Services, By Test Type

- Sweden

- Sweden Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Sweden Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Sweden Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Sweden Clinical Laboratory Services, By Test Type

- Norway

- Norway Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Norway Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Norway Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Norway Clinical Laboratory Services, By Test Type

- Europe Clinical Laboratory Services, By Test Type

- Asia Pacific

- Asia Pacific Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Asia Pacific Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Asia Pacific Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Japan

- Japan Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Japan Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Japan Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Japan Clinical Laboratory Services, By Test Type

- China

- China Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- China Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- China Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- China Clinical Laboratory Services, By Test Type

- India

- India Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- India Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- India Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- India Clinical Laboratory Services, By Test Type

- Australia

- Australia Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Australia Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Australia Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Australia Clinical Laboratory Services, By Test Type

- South Korea

- South Korea Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- South Korea Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- South Korea Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- South Korea Clinical Laboratory Services, By Test Type

- Thailand

- Thailand Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Thailand Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Thailand Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Thailand Clinical Laboratory Services, By Test Type

- Asia Pacific Clinical Laboratory Services, By Test Type

- Latin America

- Latin America Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Latin America Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Latin America Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Brazil

- Brazil Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Brazila Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Brazil Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Brazil Clinical Laboratory Services, By Test Type

- Mexico

- Mexico Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

- Mexico Clinical Laboratory Services, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- Mexico Clinical Laboratory Services, By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

- Mexico Clinical Laboratory Services, By Test Type

- Colombia

- Colombia Clinical Laboratory Services, By Test Type

- Genetic Testing

- Clinical Chemistry