- Home

- »

- Automotive & Transportation

- »

-

Car Rental Market Size, Share And Growth Report, 2030GVR Report cover

![Car Rental Market Size, Share & Trends Report]()

Car Rental Market Size, Share & Trends Analysis Report By Vehicle Type (Luxury Cars, Executive Cars, Economy Cars, SUVs, MUVs), By Application (Local Usage, Airport Transport, Outstation, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-568-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2028

- Industry: Technology

Car Rental Market Size & Trends

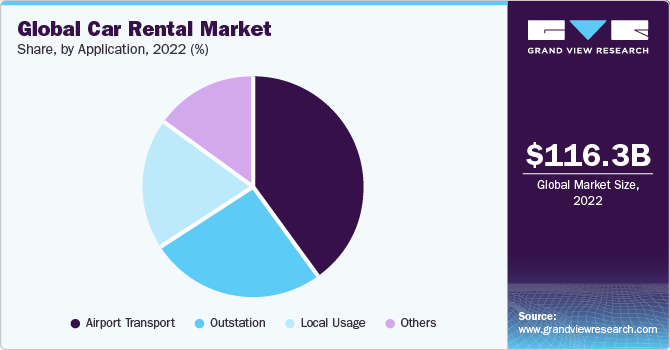

The global car rental market size was valued at USD 116.34 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.2% from 2023 to 2030. A significant rise in the number of people taking business and leisure trips across the globe is driving the demand for car rental services, thereby propelling the industry’s growth. Rising internet penetration across developing as well as developed countries has further helped companies in the market capture a larger customer base with the help of dedicated mobile apps for the convenience of customers. Technology is considered to be a crucial factor driving market growth.

The impact of technological advancements has revolutionized the industry in the recent past. Improved customer & corporate information management and hassle-free internet booking applications are the two prominent ways of assisting car rental service operators to offer enhanced services to their customers. The increasing reliance of users on smartphones for carrying out various tasks traditionally done by computers has transformed the car rental experience for customers.

There has been a significant increase in global travel across the world over the last decade. Global commuters are increasingly demanding familiar, reliable, and high-quality travel services. Some of the key car rental operators are attempting to leverage this trend by expanding their brand and distribution platforms on a global level. The implementation of an integrated global car rental system is anticipated to enable these operators to manage their geographically dispersed business operations.

An emerging trend in the travel and tourism industry is the evolution of ’bleisure’. This relatively new term describes a combination of leisure travel with a business trip and is gaining popularity across the globe. Bringing the family on corporate trips is becoming more acceptable since companies follow this trend to aid employee retention and alleviate some of the key road warriors’ stress. This incentive is increasingly appealing to recruits as younger employees are increasingly becoming business travelers. This concept is particularly advantageous for international trips where employees can get acquainted with locations, especially essential business details.

The rapid spread of COVID-19 had a significant impact on the overall tourism sector in 2020, which, in turn, affected the car rental market. Additionally, a decrease in air traffic across the globe has resulted in low demand for car rentals at airports. To ensure safety and avoid transmission of the virus, car rental operators are following hygiene and safety norms such as disinfecting their vehicles after each ride. Some car rental operators are providing free hand sanitizers and masks to their customers. Key competitors in the market, including Hertz and Avis, have disposed of their older cars at a higher volume during the pandemic than usual to make these transactions a source of revenue generation.

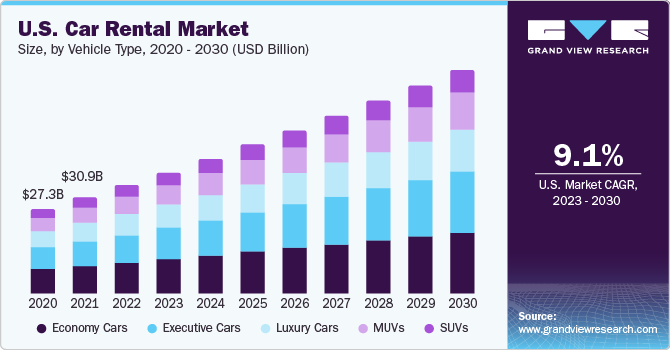

Vehicle Type Insights

The economy cars segment accounted for the largest revenue share of 33.1% in 2022. Some of the prime factors driving the growth of this segment are the compact nature and cost-effectiveness of these cars. As a result, economy cars are increasingly preferred for airport and intra-city travel.

The SUVs segment is expected to expand at the fastest CAGR of 11.5% during the forecast period. SUVs offer more spacious interiors and increased cargo capacity compared to traditional sedans, making them an attractive option for families and travelers with larger groups or luggage. Additionally, SUVs provide a sense of safety and stability, which can be especially appealing for customers seeking reliable and comfortable transportation during their travels. The popularity of road trips and outdoor adventures has also contributed to the rising demand for SUV rentals, as these vehicles are well-suited for various terrains and weather conditions.

Application Insights

The airport transport segment held the largest revenue share of 39.6% in 2022. A significant increase in air travelers globally in recent years is anticipated to boost the segment growth. Considering this trend, numerous car rental operators are expanding their fleet and promoting services across major airports. Leading market participants have their presence at airports, wherein customers can avail of round-the-clock car rental services, ultimately driving the segment growth.

The local usage segment is expected to expand at the fastest CAGR of 12.9% over the forecast period. Standard timings and lack of route flexibility of public transport have resulted in the shifting preferences of tourists toward car rental services for day-to-day navigation, driving the growth of the segment. In addition, several market participants offer customers the option of choosing the vehicle at their convenience.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 37.5% in 2022. The presence of some of the leading car rental operators in this region, such as Avis Budget Group and Enterprise Rent-a-Car, is anticipated to provide lucrative growth opportunities. The increasing number of business and leisure trips across the region is also a critical factor propelling regional growth. Additionally, the region includes numerous popular tourist destinations that attract a large number of travelers who require car rental services, ultimately boosting the market growth.

Asia Pacific is expected to expand at the fastest CAGR of 13.4% during the forecast period. Rising disposable incomes of consumers, steadily growing economies, and increasing expenditure on business travel are expected to impact the regional market growth favorably. The markets in China and India are expected to expand exponentially over the forecast period. Government bans on car purchases in certain parts of China, in an attempt to address the rising issues of pollution and traffic, are anticipated to encourage people to opt for car rental services.

Key Companies & Market Share Insights

The global market is moderately fragmented and is characterized by the presence of a large number of international and local players. Key car rental players are anticipated to focus on expansion strategies to gain regional market share, create brand awareness, and penetrate developing markets. The main focus of these players is on enhancing their services to maximize profitability and gain a larger customer base.

Strategic partnership is another critical strategy implemented by market participants to strengthen their hold on the market. For instance, in January 2023, Hertz and Uber Technologies Inc. disclosed their plans to offer up to 25,000 electric vehicles (EVs) for rental to Uber drivers in Europe by 2025. The rental deal will encompass models from renowned brands like Polestar and Tesla. The rollout began in January 2023 in London, with Hertz, which will add over 10,000 EVs by 2025, allowing Uber drivers to rent these vehicles for their ride-hailing services.

Key Car Rental Companies:

- AVR Qatar, Inc.

- Avis Budget Group, Inc.

- Carzonrent India Pvt. Ltd.

- Eco Rent A Car

- Enterprise Holdings, Inc.

- Europcar

- Localiza

- The Hertz Corporation

- SIXT

Recent Developments

-

In May 2023, Car Karlo Mobility Technologies LLP unveiled their self-driven car rental services in Pune, India. The company aims to tap into the rapidly expanding Indian market by introducing a user-friendly car rental booking website and mobile app.

-

In April 2022, SIXT, a leading global mobility provider, continued with its expansion throughout the U.S. The company revealed plans to open new branches in Charlotte and Baltimore, to provide customers with a broader selection of rental options along the East Coast.

-

In April 2021, GoAir joined forces with Eco Europcar to introduce car rental services in 100 cities throughout India, encompassing 25 airports. The partnership allows GoAir to provide chauffeur-driven cars, ranging from mid to luxury car segments, through Eco Europcar's platform.

-

In May 2021, Uber Technologies Inc. introduced a car rental service named Uber Rent in Washington DC. Additionally, the company revealed its plans to expand the Uber Reserve option for several major airports in the U.S.

Car Rental Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 132.48 billion

Revenue forecast in 2030

USD 278.03 billion

Growth rate

CAGR of 11.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

AVR Qatar, Inc.; Avis Budget Group, Inc.; Carzonrent India Pvt. Ltd.; Eco Rent A Car; Enterprise Holdings, Inc.; Europcar; Localiza; The Hertz Corporation; SIXT

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Car Rental Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global car rental market report based on vehicle type, application, and region:

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Luxury cars

-

Executive cars

-

Economy cars

-

SUVs

-

MUVs

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Local usage

-

Airport transport

-

Outstation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global car rental market size was estimated at USD 116.34 billion in 2022 and is expected to reach USD 132.48 billion in 2023.

b. The global car rental market is expected to grow at a compound annual growth rate of 11.2% from 2023 to 2030, to reach USD 278.03 billion by 2030.

b. North America dominated the car rental market with a share of 37.5% in 2022. This is attributable to the rising number of leisure and business trips across the region, both locally and internationally.

b. Some key players operating in the car rental market include Enterprise Rent-A-Car, The Hertz Corporation, Sixt SE, Europcar, and Avis Budget Group.

b. Key factors that are driving the car rental market growth include an upsurge in travel and tourism activities across the globe and improved road infrastructure, coupled with increased disposable incomes, especially in emerging economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."