- Home

- »

- Renewable Chemicals

- »

-

1,4-Butanediol, Polytetramethylene Ether Glycol and spandex Market Size, Share Report, 2019-2025GVR Report cover

![1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) & Spandex Market Size, Share & Trends Report]()

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) & Spandex Market Size, Share & Trends Analysis Report By Application (THF, PBT, Urethanes, Textiles), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: 978-1-68038-683-7

- Number of Report Pages: 149

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Specialty & Chemicals

Report Overview

The global 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and spandex market size was estimated at USD 14.49 billion in 2018 and is anticipated to expand at a CAGR of 7.8% over the forecast period. Increasing demand for enhanced quality stretch fabric across various textile applications is estimated to drive the growth. A growing number of sports activities and awareness regarding fitness and healthy lifestyles is projected to further propel the growth. Rapidly expanding markets in the Asia Pacific owing to populace explosion, rising disposable income, and developing end-user industries are expected to further boost the market.

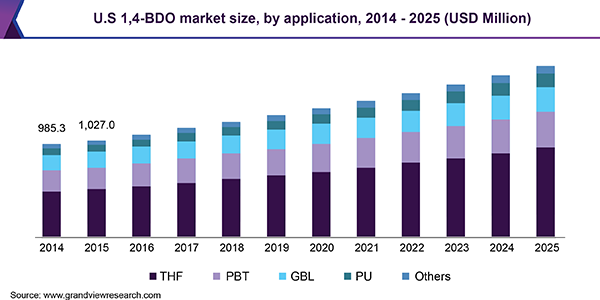

In the U.S., Tetrahydrofuran (THF) application sector accounted for the largest market share of 50.17% in terms of volume in 2018 and is estimated to continue its dominance over the forecast period. The reason being the availability of a highly-skilled workforce, advanced processing and application technologies, developed infrastructure, and an increasing number of R&D activities in the region. On the other hand, the PBT sector is estimated to grow at the fastest pace with a healthy CAGR in the upcoming period.

Furthermore, initiatives such as the Manufacturing Extension Partnership (MEP), a government initiative to assist U.S. firms, by offering individually tailored services to help industries to enhance their productivity, economic competitiveness, and technological capabilities, are anticipated to significantly contribute to the growth of the 1,4-butanediol market.

However, fluctuating raw material price is estimated to hamper overall growth during the projected period. Production of bio-based raw materials such as bio-succinic acid is a factor creating new growth opportunities. For instance, a rising focus on green chemistry has encouraged key players like Myriant, BioAmber, and Genomatica to develop substitutes for bio-based routes to derive BDO from sugars or cellulosic feedstock, which is estimated to positively impact the growth.

Also, the production of BDO from coal is likely to change market dynamics in the forthcoming years. Development of novel spandex products such as flat strain curve, fine denier, and 3D lycra for the hosiery market is a recent technological trend estimated to augment market growth. Furthermore, regulatory policies preventing hazardous and carcinogenic materials, such as 1,4 BDO and GBL, being used to obtain PTMEG and spandex are projected to challenge market growth over the forecast period.

BDO Application Insights

The 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG), and spandex market are segmented based on BDO applications such as Tetrahydrofuran (THF), Polybutylene Terephthalate (PBT), Gamma-butyrolactone (GBL), and Polyurethane (PU). Globally, THF accounted for the largest market share of 49.47% in 2018 and is estimated to continue its dominance over the forecast period.

THF industry has developed over the past few years owing to rising use for the production of PTMEG that is a polymer extensively utilized for manufacturing urethane elastomers and fibers. Moreover, it is a versatile solvent with several applications in areas like adhesives, vinyl films and cellophane, industrial resins, elastomers, coatings, and printing inks. It is exclusively used in the formulation of PVC types of cement and it also functions as a PVC-type cleaner before joint formation.

PBT was the second largest application sector with a market share of 22.26% in 2018, owing to growing demand from end-use industries such as an automotive and electrical appliance. It is estimated to grow at a CAGR of 6.2% over the forecast period.

Polyurethane (PU) application sector is also anticipated to witness modest CAGR owing to the strong industrial growth in emerging regions of the Asia Pacific and Latin America, which, in turn, has widened the application scope of the PU products.

PTMEG Application Insights

PTMEG applications include spandex, Copolyester-ether Elastomers (COPE), and urethanes. Spandex is the largest application sector for PTMEG, expanding at over 8.2% CAGR in terms of revenue owing to high demand for the production of flexible sports apparel and textiles.

These fibers are exclusively used owing to their exceptional inherent characteristics such as high elasticity and durability along with higher flexibility than rubber. Rising healthcare standards owing to innovative medical applications for spandex in wound dressing and protective apparel sector is expected to drive the demand for spandex over the forecast period.

Increasing awareness regarding the benefits of such high-performance engineering materials that bridge the gap between flexible elastomers and rigid plastics is estimated to boost industrial development across North America and Europe. Urethanes are estimated to expand at the fastest pace with a CAGR of 9.6% over the forecast period owing to technological advancements and a greater cost-to-benefit ratio.

Spandex Application Insights

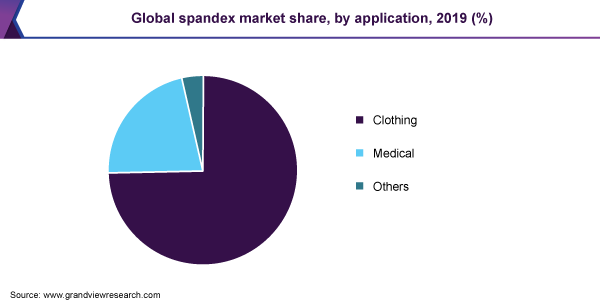

Spandex applications include textiles, medical and hygiene, and automotive interiors. The textile sector accounted for the largest market share in 2018 and is estimated to expand at 8.2% CAGR over the forecast period owing to product innovation and development of non-woven textiles.

The Asia Pacific is expected to remain the largest market for textiles owing to increasing exports to North American and European countries. Increasing capacity expansion, modernization, and diversification with the textile industry are projected to positively impact the growth of the spandex market over the forecast period.

The growing textile industry coupled with the high demand for spandex from the medical and hygiene industry is estimated to drive market growth in Germany. Medical and hygiene is the fastest growing sector and is projected to account for 20.70% of the total market share during the forecast period owing to growing demand from the healthcare sector.

Spandex is also gaining popularity in automotive interiors since it can be used in various automotive applications such as in the manufacturing of the door panel fabrics that stretch and adhere to the door. These synthetic fibers are also used in manufacturing solar control automotive window films. The automotive interiors application is estimated to account for 19.04% total market share over the projected period.

Regional Insights

The Asia Pacific accounted for the largest market value of 3.15 billion in 2018 and is estimated to continue its dominance in the forecast period, owing to the expanding end-use industries and availability of low-cost labor. China is estimated to be the major consumer of 1,4 BDO, PTMEG, and spandex market owing to increasing consumer disposable income.

North America and Europe, despite being relatively mature and saturated end-use markets, are expected to remain lucrative for an innovative manufacturer who taps bio-based resources to meet sustainable production standards. The regions accounted for 3.5% and 2.9% total market share in 2018 and are estimated to expand at a healthy CAGR over the forecast period.

Central and South America (CSA) is estimated to grow at a lucrative pace over the forecast period owing to developing infrastructure and rising use of advanced technology. Moreover, emerging economies in CSA present several untapped opportunities for market players, as consumers become increasingly aware of the benefits of spandex and similar elastic fabrics, for hosiery, sports apparel, and even medical textiles.

The market for spandex in the Middle East is estimated to expand at 7.6% CAGR over the forecast period, owing to increasing disposable income and rising participation in sports activities in the region. The textile industry in MEA economies including UAE is considered to be the largest trading sector after oil. The reason being developing online e-commerce shopping sites and the rising popularity of international brands.

Key Companies & Market Share Insights

Prominent market players are Mitsui Chemicals Inc.; BASF SE; Ashland Inc.; BioAmber Inc.; Genomatica; Asahi Kasei Corp.; DuPont; Toray Industries Inc.; The Dow Chemical Company; Sipchem; Lotte Chemical; Indorama Synthetics; LyondellBasell; Dairen Chemicals Corporation (DCC); Invista; and Nan Ya Plastics.

Dairen Chemicals Corporation (DCC) became the first local BDO producer to use its own patented technology in Taiwan. LyondellBasell was the next producer to develop its technology involving a propylene oxide-based process. The LyondellBasell Netherlands plant was the second to utilize the original ARCO propylene oxide (PO) to BDO technology.

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) & Spandex Market Report Scope

Report Attribute

Details

The market size value in 2019

USD 15.58 billion

The revenue forecast in 2025

USD 17.63 billion

Growth Rate

CAGR of 7.8% from 2019 to 2025

The base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Germany, U.K., France, Turkey, China, India, Japan, Brazil, Saudi Arabia

Key companies profiled

Mitsui Chemicals Inc.; BASF SE; Ashland Inc.; BioAmber Inc.; Genomatica; Asahi Kasei Corp.; DuPont; Toray Industries Inc.; The Dow Chemical Company; Sipchem; Lotte Chemical; Indorama Synthetics; LyondellBasell; Dairen Chemicals Corporation (DCC); Invista; and Nan Ya Plastics.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and spandex Market based on application and region:

-

1,4-BDO Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Tetrahydrofuran (THF)

-

Polybutylene Terephthalate (PBT)

-

Gamma-Butyrolactone (GBT)

-

Polyurethane (PU)

-

Others

-

-

PTMEG Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Spandex

-

Co-polyester-Ether Elastomers (COPE)

-

Urethanes

-

Others

-

-

Spandex Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Textiles

-

Medical & Hygiene

-

Automotive Interiors

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) & Spandex market size was estimated at USD 15.58 billion in 2019 and is expected to reach USD 15.89 billion in 2020.

b. The global 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) & Spandex market is expected to grow at a compound annual growth rate of 7.8% from 2019 to 2025 to reach USD 17.63 billion by 2025.

b. Asia Pacific dominated the 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) & Spandex market with a share of 32.2% in 2019. This is attributable to the expanding end-use industries and availability of low cost labor.

b. Some key players operating in the 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) & Spandex market include Mitsui Chemicals Inc.; BASF SE; Ashland Inc.; BioAmber Inc.; Genomatica; Asahi Kasei Corp.; DuPont; Toray Industries Inc.; The Dow Chemical Company; Sipchem; Lotte Chemical; Indorama Synthetics; LyondellBasell; Dairen Chemicals Corporation (DCC); Invista; and Nan Ya Plastics.

b. Key factors that are driving the market growth include increasing demand for sustainable & bio-based feedstock and growth of textile & apparel industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."