- Home

- »

- Advanced Interior Materials

- »

-

Bricks Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Bricks Market Size, Share & Trends Report]()

Bricks Market Size, Share & Trends Analysis Report By Brick Type (Clay, Concrete, Calcium Silicate, Fly Ash, Stone), By Size (Standard, Modular, Jumbo), By Application, By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR455961

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Data: ---

- Industry: Advanced Materials

Bricks Market Size & Trends

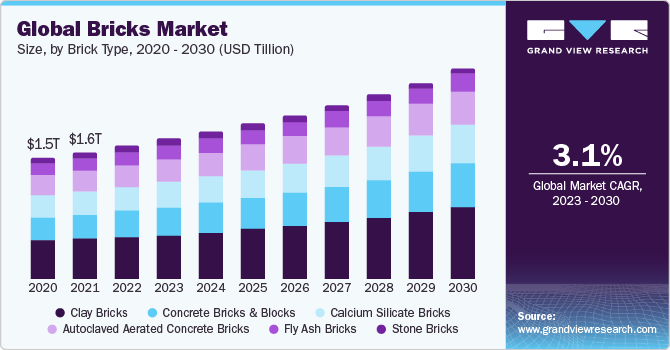

The global bricks market was valued at USD 1,642.15 billion in 2022 and is expected to grow at a CAGR of 3.1% from 2023 to 2030. The market is a vital component of the construction industry, serving as one of the oldest and most fundamental building materials.One of the key characteristics of the market is its versatility. Bricks come in a wide variety of sizes, colors, and textures, allowing architects and builders to create structures with diverse aesthetics and functionalities. Whether it's the classic red clay bricks for traditional buildings or modern, sleek bricks for contemporary designs, the market caters to a range of architectural styles.

The COVID-19 pandemic has considerably impacted the market, as it did on many industries worldwide. Several key factors came into play during this period, influencing both the demand for bricks and the production and supply chain dynamics. Many brick manufacturing facilities faced temporary shutdowns or reduced their production capacity due to lockdowns and safety measures. This led to delays in production and distribution, which affected construction projects relying on a steady supply of bricks. These disruptions often resulted in construction delays and increased costs.

Different regions around the world have their own brick manufacturing traditions, leading to unique brick types and production methods. For instance, traditional hand-made bricks in some parts of the world coexist with highly automated brick manufacturing facilities in others.

Market demand for bricks is closely tied to the overall health of the construction industry. During economic downturns, demand may decrease, while construction booms can lead to increased demand for bricks. The durability and fire resistance of bricks, along with their aesthetic appeal, make them a popular choice for both residential and commercial construction projects.

Brick Type Insights

Based on the product, the market is segmented into clay bricks, calcium silicate bricks, autoclaved aerated concrete bricks, fly ash bricks, and concrete blocks, and stone bricksClay is a natural, abundant resource, and the production process typically involves minimal energy consumption. This aligns with the increasing focus on eco-friendly building materials and sustainable construction practices, making clay bricks an attractive choice for environmentally conscious projects.

Value Of Construction Put In Place In The United States (USD Million)

Type of Construction

Aug

2023Jul

2023Jun

2023May

2023Apr

2023Aug

2022Residential

889,803

884,675

870,655

864,027

834,713

917,150

Nonresidential

1,093,668

1,089,019

1,085,571

1,082,705

1,073,124

930,135

Total Construction

1,983,470

1,973,693

1,956,226

1,946,733

1,907,837

1,847,285

Size Insights

On the basis of size-based segmentation, the market is categorized into modular, standard, and jumbo. Standard size is the largest size segmentation in 2022. The standard size bricks market is evolving to meet the demands of a changing construction landscape. Sustainability, architectural creativity, energy efficiency, digital tools, and regional variations are among the key drivers propelling the market's growth and adaptation to contemporary construction needs.

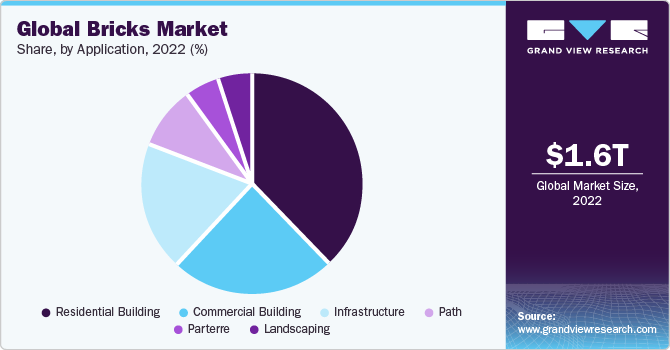

Application Insights

Based on application, the market is segmented into residential building, commercial building, infrastructure, path, parterre, and landscaping. Residential building segment dominated the application segmentation in 2022. The market within the residential building segment is characterized by its adaptability and the diverse applications of bricks, from enhancing exterior facades to creating appealing interior spaces and functional outdoor landscapes. These versatile building materials continue to be integral to the construction and design of residential properties.

Regional Insights

The Asia Pacific region is experiencing substantial population growth, urbanization, and infrastructure development. As a result, the demand for building materials, including bricks, has been consistently on the rise. The construction of residential buildings, commercial structures, and infrastructure projects has driven the growth of the market in countries like China, India, and Southeast Asian nations.

China, in particular, is a major player in the Asia Pacific bricks market. The country has a massive construction industry that relies heavily on brick usage. Traditional red clay bricks are widely used, but there is also a growing trend toward eco-friendly bricks that align with China's efforts to reduce environmental impact in construction.

Key Companies & Market Share Insights

The market is highly competitive, driven by a combination of established players, regional manufacturers, and innovative startups. Here are some competitive insights that shed light on the dynamics within this industry. The focus on sustainability and eco-friendly construction practices has spurred innovation in the market. Startups and smaller manufacturers have entered the market with a focus on producing environmentally responsible bricks. These companies are developing bricks made from recycled materials, low-energy manufacturing processes, and eco-friendly designs. Their ability to cater to the growing demand for green building materials makes them formidable competitors.

In December 2022, the joint venture Siam Cement BigBloc Construction Technologies, with a 52:48 partnership between BigBloc Construction Limited and SCG INTERNATIONAL INDIA PVT LTD, completed the acquisition of land in Gujarat, India. This acquisition aims to establish a manufacturing facility for AAC Blocks and Panels with an anticipated annual production capacity of 300,000 cubic meters, with operations slated to commence in 2023.

In October 2021, Wienerberger successfully finalized the purchase of Meridian Brick in the North American market, encompassing their operations in both the United States and Canada. Meridian Brick, known for its annual production of over 1.1 billion bricks, holds a prominent position as a primary brick supplier in regions such as Texas, the southeastern United States, Ontario, and Canada.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."