- Home

- »

- Renewable Chemicals

- »

-

Brazil Palm Oil Market Size, Share & Trends Report, 2025GVR Report cover

![Brazil Palm Oil Market Size, Share & Trends Report]()

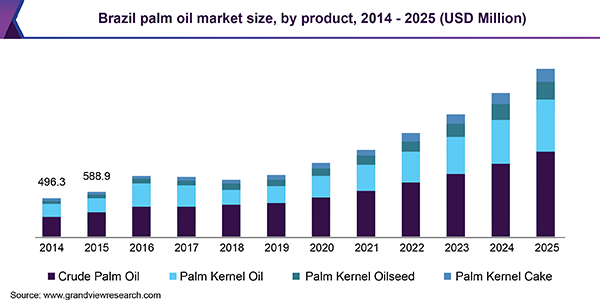

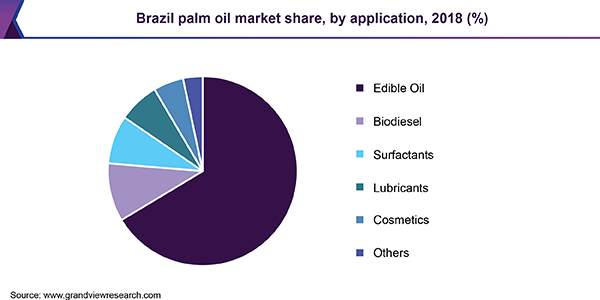

Brazil Palm Oil Market Size, Share & Trends Analysis Report By Product (Crude Palm Oil, Palm Kernel Oil), By Application (Edible Oil, Cosmetics, Bio-diesel, Surfactants), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-314-0

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Specialty & Chemicals

Report Overview

The Brazil palm oil market size was estimated at USD 738.2 million in 2018 and is projected to register a CAGR of 13.6 % from 2019 to 2025. A significant rise in consumption owing to its cheaper prices coupled with rising awareness regarding its health benefits is anticipated to drive the market growth.

CPO is witnessing a high demand in the industry owing to its rising use as an edible oil in food applications majorly for consumer diets and for the production of lubricants and greases. PKO emerged as the second-largest segment on account of its rising use in cosmetics, confectionery fats, and detergents.

Reserved palm tree plantation coupled with decreasing deforestation rate owing to government regulations for sustainable cultivation is expected to hamper the production in Brazil. However, with recovering conditions, higher yields are expected to foster market growth in the projected period.

Sustainable Palm Oil Production Program (SPOPP) was launched in Brazil in 2010 to control deforestation. This was also intended to prevent primary as well as secondary forest clearing in Legal Amazonia. According to the Brazilian Association of Palm Oil Producers, the manufacturers have to comply with regulatory norm NR-31, which disposes of health and work security.

The adoption of advanced satellite technology in Brazil for monitoring deforestation is expected to create new opportunities for development and boost sustainable cultivation in the country. Manufacturers are focusing on installing water recycling technology in their refineries for sustainable development.

Product Insights

CPO emerged as a dominant segment in 2018 accounting for 56.4% of the total revenue share followed by PKO. Increasing consumption in oleochemicals production of agrochemicals and cleaning products is expected to boost the market growth over the forecast period.

PKO is the second largest segment in 2018 accounting for 26.2% of the revenue share. The segment is expected to gain momentum owing to the product properties such as 80% saturated fat content and high medium-chain fatty acids such as capric, lauric acids, and caprylic. It is exclusively used as feedstock for animal feed and biomass.

The oilseed is considered to be one of the prominent agricultural commodities in the country. Edible oil and meal are the major products obtained from the crushing of oilseeds. The residue extracted from oilseeds is used as an animal feed, whereas, the extract is used in various food products for human consumption.

Application Insights

The edible oil segment accounted for the largest revenue share of 64.4% in 2018 and is expected to continue its dominance over the forecast period. It is considered an economical alternative to other edible oils such as the ones sourced from soybean and sunflower and has high acceptance among food processors, this is expected to boost the segment growth.

Biodiesel has gained tremendous popularity among consumers as an effective substitute for diesel in the past years. In terms of feedstock, palm oil is emphasized as the traditional feedstock for biodiesel production and is considered to be an economical alternative to soybean. However, the production in the country is not able to meet the demand from biodiesel manufacturers, which is expected to hamper the market growth.

The government of Brazil is focused on sustainable production, which can be used for biodiesel production. For instance, the Ministry of Mines and Energy (MME) launched a RenovaBio Program that regulates the biofuel production units to foster sustainable production of palm oil diesel over the projected period.

Surfactant was the fastest-growing segment, occupying a majority of the market share in terms of revenue in 2018. High penetration of petroleum-based surfactants and growing environmental concerns are projected to prompt manufacturers to use palm oil in surfactant production. However, high domestic consumption in food applications is expected to restrain its use in surfactants.

Key Companies & Market Share Insights

Some of the prominent producers operating in the value chain include AgroPalma, BIOPALMA, and Marborges Agroindústria SA among others. Most of the companies acquire their own land to harvest oil kernels for easy availability of raw materials. But few companies outsource the product. For instance, Archer Daniels Midland sources 70% of the product from Willmar art refiners and 30% from Sabha from Malaysia.

Manufacturers have established partnerships with farmers to grow palm groves for production as well as provide training and support to produce excellent quality products. Manufacturers are focusing on creating advanced product portfolios by making heavy investments in R&D activities.

Numerous corporations are constantly investing in research activities to improve their product portfolio by supplying a broader end-use application base and sustaining the competition. Technological inventiveness along with extensive foreign funds are predicted to generate sufficient opportunities for the market players.

Brazil Palm Oil Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 798.2 million

Revenue forecast in 2025

USD 2000.2 million

Growth Rate

CAGR of 13.6% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Country scope

Brazil

Key companies profiled

Archer Daniels Midland Company, BELEM BIOENERGIA BRASIL S.A., AgroPalma, BIOPALMA, Denpasa, and Marborges Agroindústria SA,

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the Brazil palm oil market report on the basis of product and application:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)

-

Crude Palm Oil

-

Palm Kernel Oil

-

Palm Kernel Cake

-

Palm Kernel Oilseed

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)

-

Edible Oil

-

Cosmetics

-

Biodiesel

-

Lubricants

-

Surfactants

-

Others

-

Frequently Asked Questions About This Report

b. The Brazil palm oil market size was estimated at USD 798.2 million in 2019 and is expected to reach USD 951.6 million in 2020.

b. The Brazil palm oil market is expected to grow at a compound annual growth rate of 13.6% from 2019 to 2025 to reach USD 2.2 billion by 2025.

b. CPO dominated the Brazil palm oil market with a share of 56.5% in 2019. This is attributable to the rising demand from food & beverage, personal care & cosmetics, detergent, and biodiesel. Also, Refined, bleached, deodorized (RBD) palm oil is extensively used in domestic cooking.

b. Some key players operating in the Brazil palm oil market include Archer Daniels Midland Company, BELEM BIOENERGIA BRASIL S.A., AgroPalma, BIOPALMA, Denpasa, and Marborges Agroindústria SA,

b. Key factors that are driving the market growth include a significant rise in consumption owing to its cheaper prices coupled with rising awareness regarding its health benefits.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."