- Home

- »

- Clinical Diagnostics

- »

-

Body Fluid Collection And Diagnostics Market Report, 2030GVR Report cover

![Body Fluid Collection And Diagnostics Market Size, Share & Trends Report]()

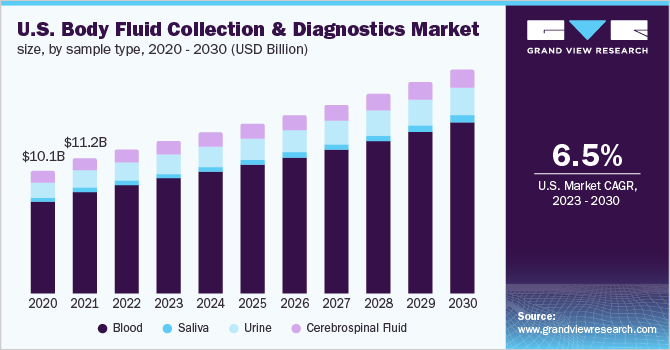

Body Fluid Collection And Diagnostics Market Size, Share & Trends Analysis Report By Sample Type (Blood, Saliva, Urine, Cerebrospinal Fluid), By Products, By Technology, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-019-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

The global body fluid collection and diagnostics market size was valued at USD 30.19 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. Rapid results, cost-effectiveness, and early prognosis of diseases are some of the factors contributing to the growth of the market. In May 2022, TECHKON GmbH announced of developing a novel method for body fluid analysis which could assess the medical parameters and diagnose diseases simultaneously.

The COVID-19 outbreak has positively impacted the body fluid collection and diagnostics market as it has boosted the demand for fluid diagnostic tests for the early detection of disease. Saliva, blood, urine, and semen are taken from the patients to examine viral RNA in the sample. Furthermore, several developments have been done globally which has also contributed to the market’s growth. For instance, in July 2021, Abbott announced of launching Panbio COVID-19 Antigen Self-Test in India to strengthen its rapid diagnostics product portfolio. It would support testing needs at work, at clinics, and at home.

Alzheimer's Disease (AD) is a severe neurodegenerative disease that requires the identification of precise biomarkers. The development and validation of early-stage biomarkers is a high research priority for existing diagnostics that can detect AD. Body-fluid biomarkers accurately reflect a synaptic failure in the brain and, as a result, could help improve diagnostic accuracy, track the course of the disease, and act as indicators for evaluating the effectiveness of early-onset disease-modifying therapies. In May 2022, the FDA authorized the marketing of a new test that could improve the diagnosis of AD. The Lumipulse test evaluates the ratio of -amyloid 1-40 and-amyloid 1-42 concentrations found in the human cerebral spinal fluid, which can help doctors in determining if a patient is expected to have amyloid plaques, a characteristic symptom of AD.

Body fluid samples contain a large number of naturally occurring biomarker proteins, which effectively show cancer progression. They are also utilized to find these biomarkers in order to validate the presence of cancer. For instance, in January 2022, scientists from the University of Illinois developed a tool that could detect cancer biomarkers in the body fluid samples. The quantification and detection of cancer-associated molecular biomarkers in such body fluids would help for minimally invasive cancer detection.

Sample Type Insights

The blood segment dominated the body fluid collection and diagnostics market in 2022, capturing a market share of 75.38%. Body fluid traces recovered at crime scenes are important evidence for forensic researchers. They contain useful DNA evidence which can identify a victim or suspect. Crime scene investigation is one of the main fields in forensics. The introduction of advanced techniques such as single-nucleotide polymorphism (SNP) analysis, short tandem repeat (STR) recognition, mitochondrial deoxyribonucleic acid (DNA) analysis, and microfluid system for genetic material analysis extracted from the blood sample assists scientists in forensic investigations. In May 2022, BD expanded its partnership with Babson Diagnostics to advance diagnostic blood collection. The new care setting would allow patients to collect blood samples at home.

The urine sample type is anticipated to witness considerable growth in the coming years. Medical tests are becoming an important tool for the diagnosis and treatment of diseases. Urine collection is used for the metabolic evaluation of proteinuria, urinary stone disease, renal function estimation, and others. The testing is performed in an outpatient setting. In November 2022, researchers from the University of Tokyo stated that they are deriving new tests which could help in the early diagnosis of chronic kidney disease. Continuous developments in this field would further drive the segment’s growth.

Product Insights

The kits and consumables segment dominated the market in 2022 by capturing a market share of 67.18%. The increasing demand for rapid and cost-effective kits coupled with easing government regulations for COVID-19 kits have contributed to the segment’s growth. For instance, in May 2021, COVID home test kits received approval from the Indian Council of Medical Research which issued detailed guidelines on how and who can use the kits. Mylab Discovery Solutions Ltd developed the CoviSelfTM COVID-19 OTC device whose process should be conducted according to the mobile app.

The instruments segment is anticipated to witness significant growth in the coming years. Laboratories have implemented analyzer-based body fluid analysis for cell counting to ensure the highest quality of insights and thereby replacing the manual cell counting procedure. Moreover, it will be useful the laboratories with daily large sample loads. In March 2022, Mindray announced of launching the BC-700 Series, an Integrated ESR & CBC Hematology Analyzer for Small-to-mid Sized Labs. However, the cost associated with the analyzer is relatively high therefore, laboratories choose to use routine hematology analyzers for fluid cell counts.

Technology Insights

The Polymerase Chain Reaction (PCR) segment dominated the market in 2022 by capturing a market share of 57.73%. Body fluid DNA sequencing is a noninvasive technique for infectious diseases and genetic defects diagnosis. T Oligo-Primed Polymerase Chain Reaction is a robust technique that can be used for the minute DNA fragments amplification in body fluids. In August 2022, the Ministry of Health of the Democratic Republic of the Congo announced the recent Ebola Virus Disease outbreak. This has boosted the demand for RT-PCR in laboratories for virus detection. The sample is taken from the oropharyngeal secretions.

The next-generation sequencing segment is anticipated to witness the fastest growth rate in the coming years. NGS has revolutionized every field of biological science. It has significantly reduced the sequencing costs Several developments have been happening in this segment which is contributing to the segment’s growth. In September 2021, Selux Diagnostics, Inc. received FDA authorization for its NGS “phenotyping” platform for sterile body fluid samples and positive blood cultures. It is a single-platform solution for rapid antimicrobial susceptibility testing (AST) for specific sample types

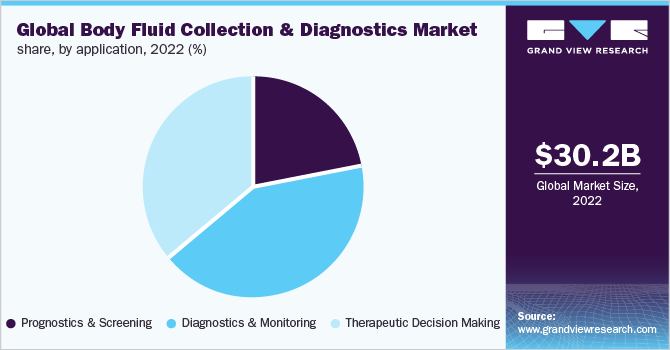

Application Insights

The diagnostics and monitoring segment dominated the market in 2022 with a market share of 41.69%. Clinical markers are considered to be ideally derived from human body fluid. Low cost, low invasiveness, and quick sample collection and processing are advantages of body fluid testing for disease diagnosis and monitoring. Additionally, molecular expression level profiles in body fluid can aid in identifying changes to cellular networks and physiological conditions in diseased tissues. Body fluid analysis is now considered to be one of the most suitable techniques for the early diagnosis, monitoring, management, and evaluation of the early response to chronic diseases, as well as for identifying the possible pathogenesis of such abnormalities.

Therapeutic decision-making is projected to witness lucrative growth during the forecast period. Incorporating the patient in therapeutic decision-making explains the benefits and risks of treatment. It assists physicians to decide whether or not to treat patients who may have a disease or may not have the disease.

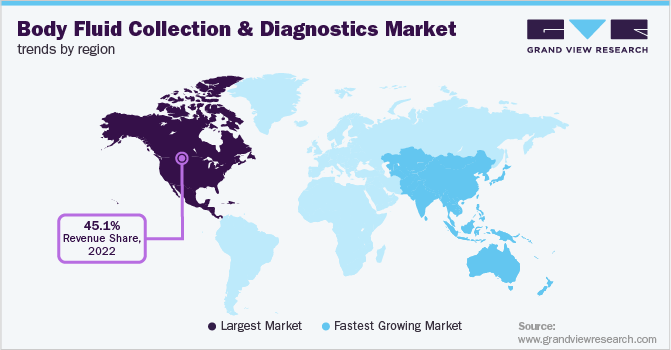

Regional Insights

North America region dominated the body fluid collection and diagnostics market. The region held a market share of 45.15% in 2022. Several developments such as product launches and strategic initiatives between companies have impacted the market positively. In May 2022, KDx Diagnostics Inc entered into a partnership agreement with UroGPO to offer a non-invasive urine test, URO17, for bladder cancer in the U.S. Similarly, in July 2021, Psomagen Inc. expanded its COVID-19 diagnostic services to expand its product portfolio by adding at-home saliva collection kits.

Asia Pacific region is anticipated to witness the fastest growth during the forecast period. The increasing prevalence of diseases such as cancer, cardiovascular diseases, and other rare diseases has boosted the demand for the body fluid diagnostics and collection market. In November 2022, Roche Diagnostics announced launching its first automated cerebrospinal fluid (CSF)-based test in India for Alzheimer's disease.

Key Companies & Market Share Insights

Key market players operating in this market are entering into several strategic collaborations and partnerships to expand their existing diagnostics and collection product portfolio. For instance, in August 2022, Mount Sinai entered into a partnership agreement with Exosome Diagnostics to accelerate research and development of real-time nucleic acid-based body-fluid diagnostics, in order to promote personalized medicine. Some of the prominent players operating in the market include:

-

Thermo Fisher Scientific Inc.

-

Bio-Rad Laboratories

-

Illumina, Inc

-

Guardant Health

-

QIAGEN

-

Johnson & Johnson

-

Laboratory Corporation of America Holdings

-

Biocept Inc

-

F. Hoffmann-La Roche Ltd.

-

MDxHealth SA.

Body Fluid Collection And Diagnostic Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 32.24 billion

Revenue forecast in 2030

USD 50.2 billion

Growth rate

CAGR of 7.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sample type, products, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand; South Korea, Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Bio-Rad Laboratories; Illumina, Inc.; Guardant Health; QIAGEN N.V.; Johnson & Johnson; Laboratory Corporation of America Holdings; Biocept Inc.; F. Hoffmann-La Roche Ltd.; MDxHealth SA.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Body Fluid Collection And Diagnostic Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global body fluid collection and diagnostics market report on the basis of sample type, products, technology, application, and region:

-

Sample Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blood

-

Saliva

-

Urine

-

Cerebrospinal Fluid

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tests/Services

-

Kits & Consumables

-

Instruments

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Next Generation Sequencing (NGS)

-

Polymerase Chain Reaction (PCR)

-

Fluorescence in situ hybridization (FISH)

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prognostics & screening

-

Diagnostics & monitoring

-

Therapeutic decision making

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global body fluid collection and diagnostics market size was estimated at USD 30.19 billion in 2022 and is expected to reach USD 32.24 billion in 2023.

b. The global body fluid collection and diagnostics market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 50.2 billion by 2030.

b. North America dominated the body fluid collection and diagnostics market with a share of 45.15% in 2022. This is attributable to increasing technological advancements in clinical diagnostics along with new product launches.

b. Some key players operating in the body fluid collection and diagnostics market include Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Illumina, Inc., Guardant Health, QIAGEN N.V., Johnson & Johnson, Laboratory Corporation of America Holdings, Biocept Inc., F. Hoffmann-La Roche Ltd., MDxHealth SA.

b. Key factors that are driving the market growth include increasing demand for the analysis of body fluids in various clinical and diagnostic applications is likely to enhance the demand for instruments used for the collection and analysis of such samples during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."