- Home

- »

- Smart Textiles

- »

-

Ballistic Protective Equipment Market Size Report, 2030GVR Report cover

![Ballistic Protective Equipment Market Size, Share & Trends Report]()

Ballistic Protective Equipment Market Size, Share & Trends Analysis Report By Material (Aramid, Composites, UHMWPE, Steel), By Product, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-242-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Ballistic Protective Equipment Market Trends

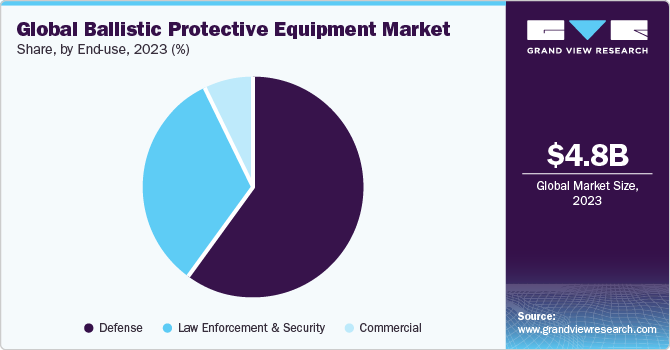

The global ballistic protective equipment market size was estimated at USD 4.80 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030. Increasing concerns about improving army survival are expected to benefit market growth. Additionally, rising defense spending as a result of expanding regional economies, as well as increased competition among governments to demonstrate their power, are expected to fuel market growth. The increased demand for newer gadgets and devices as a result of continued technological innovation is anticipated to bode well for this growth.

Growing concerns about enhancing army survivability are predicted to have a favorable impact on market growth. Furthermore, rising defense spending as a result of expanding regional economies, as well as increased rivalry among governments to demonstrate their strength, are likely to fuel market expansion. It is anticipated that over the forecast period, the market growth will continue to be driven by the growing need for newer gadgets and devices as a result of ongoing technological innovation.

North America remained a dominant consumer of armor and protective wear globally, with the United States being the frontrunner over the past decade. Active involvement of the U.S. military in the Middle Eastern conflicts coupled with threats of fatal attacks from various terrorist organizations over the past few years has fuelled the North America ballistic wear market’s growth. Increasing pressure on the U.S. federal government to sustain itself as a military superpower is also projected to drive the regional industry.

The increasing need for innovative devices and gadgets on account of technological advancements is also anticipated to increase product demand over the forecast period. The high cost associated with protective equipment is projected to hamper the industry’s growth.

The growing awareness of commercial security in the U.S. is driving the demand for body armor. As threats become more prevalent, worries about security in commercial areas such as retail security, healthcare security, and transportation security are growing rapidly. As a result, demand for this product is expected to rise over the forecast period.

The heavy material weight is affecting the personnel mobility adversely which is also expected to negatively impact the industry growth. Increasing usage of better raw materials to decrease ballistic product weight along with innovation of breathable armor wear is anticipated to create new opportunities for the industry participants for further investments.

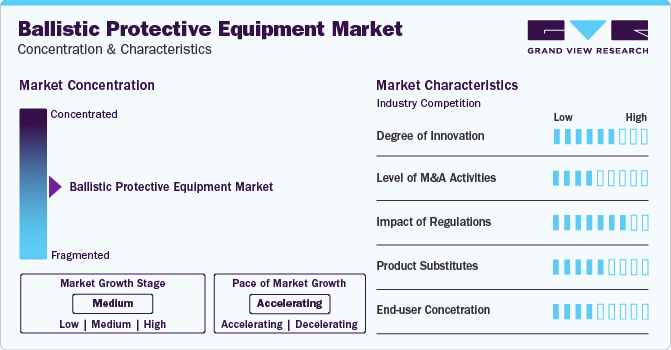

Market Concentration & Characteristics

Market growth stage is medium, and the pace of growth is accelerating. The ballistic protective equipment market is characterized by a high degree of innovation owing to rapid technological advancements. The companies are further adopting various organic and inorganic growth strategies, such as geographical expansions, product launches, and mergers & acquisitions to strengthen their position in the global market.

The market is also influenced by stringent regulatory standards and certifications, such as those set by the National Institute of Justice (NIJ) in the U.S. and the European Norm (EN) standards in Europe, which govern the performance and quality requirements of ballistic protective equipment. Compliance with these standards is crucial for market players to ensure the effectiveness and reliability of their products and to gain the trust of end-users, including military forces, law enforcement agencies, and civilian users.

Continuous investment in research and development is essential for maintaining competitiveness and driving innovation in the ballistic protective equipment industry. Companies allocate resources to develop advanced materials, lightweight designs, and integrated technologies that enhance ballistic resistance, comfort, and usability while meeting evolving customer needs and market trends.

End-users increasingly seek customized and personalized ballistic protective solutions tailored to their specific requirements, operational needs, and body shapes. Manufacturers offer modular designs, adjustable features, and customization options to accommodate individual preferences and optimize user comfort and fit.

Raw Material Insights

The aramid fiber segment led the market and accounted for more than 33% of the total revenue in 2023. This dominance can be attributed to the unique properties of aramids like Kevlar, Twaron, and Nomex. These fibers offer a combination of exceptional lightweight construction, superior strength-to-weight ratio, and flexibility. The ability of the aramid fiber and relative blends to be easily molded for manufacturing ballistic helmets and body armor is the key factor responsible for high market penetration.

The ultra-high molecular weight polyethylene (UHMWPE) is anticipated to emerge as the fastest-growing material segment. The finished products are majorly used across the defense industry for personnel protection and tactical armor wear, owing to their very high impact strength and excellent stab resistance. Excellent mechanical properties that tend to decrease time spent in material molding and cutting, thus enhancing faster manufacturing in short delivery time are the major factors expected to drive the segment growth over the forecast period.

Product Insights

The soft armor segment led the market in 2023. Soft armor is commonly used in the production of concealable body armor vests, allowing wearers to maintain a low profile while still enjoying reliable protection against handgun threats and fragmentation. The technology behind soft armor focuses on optimizing material composition and layering techniques to achieve the desired balance between ballistic resistance, flexibility, and comfort for the wearer. Innovations in developing integrated undersuit systems, exoskeletons, and soft ballistic protection plates are anticipated to drive soft armor demand and provide better speed with improved flexibility suited for a broad range of missions.

Hard armor is projected to account for the highest proportion of expenditure over the forecast period, especially due to the rising demand for body armor and personal protection. Hard armor refers to ballistic protective equipment constructed from rigid materials such as ceramics, steel, or composite materials. These materials offer exceptional resistance against high-velocity projectiles, rifle rounds, and armor-piercing threats. Hard armor solutions include ballistic plates, inserts, and shields designed to be worn externally or integrated into tactical vests. Hard armor provides robust protection for military personnel, law enforcement officers, and tactical operators operating in high-threat environments.

End-use Insights

The defense end-use segment dominated the market in 2023. This dominance is driven by the high demand for helmets and hard body armor, spurred by counter-terrorism initiatives implemented globally. Within the defense sector, the focus lies on enhancing soldier survivability and mobility to address evolving battlefield threats. Manufacturers are creating lightweight, modular protection solutions that protect against various ballistic and explosive hazards. These solutions include body armor, helmets, vehicle armor, and mission-specific protective gear. Moreover, the integration of sensors, communication systems, and smart materials is becoming increasingly important to bolster situational awareness and boost soldier efficiency on the battlefield.

Law enforcement and security prioritize equipping their personnel with effective protection against ballistic threats faced in their daily duties. A crucial trend in this sector is the growing adoption of concealable and lightweight body armor, offering discreet protection without sacrificing comfort or mobility. Manufacturers are developing specialized gear, like tactical helmets, and vests, specifically tailored to address the diverse operational needs and threat scenarios encountered by law enforcement and security professionals. Additionally, there's a growing demand for integrated solutions that combine ballistic protection with functionalities like communication systems, body-worn cameras, and non-lethal weapons, ultimately enhancing both officer safety and their effectiveness in challenging environments.

Regional Insights

The ballistic protective equipment market in North America is the largest, accounting for 38.6% of the total in 2023. North America's ballistic protective equipment market is poised for continued growth, driven by technological advancements, stringent regulatory standards, and increasing demand from military, law enforcement, and commercial sectors. With a focus on innovation, collaboration, and market diversification, manufacturers in the region are well-positioned to capitalize on emerging opportunities and maintain their leadership in the global ballistic protection industry.

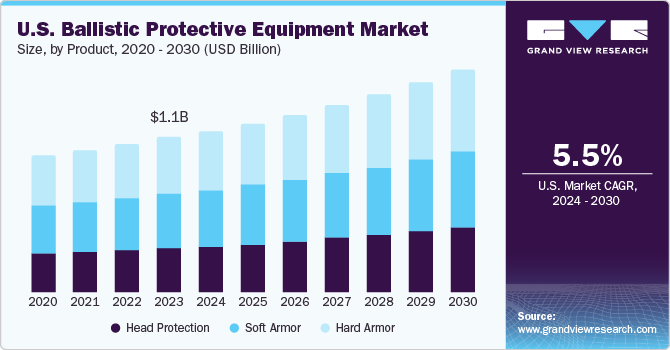

U.S. Ballistic Protective Equipment Market Trends

The ballistic protective equipment market in the U.S. is projected to grow at a CAGR of 5.5% over the forecast period, due to the region’s significant defense budget and large-scale procurement programs for military and law enforcement equipment.

Europe Ballistic Protective Equipment Market Trends

The growth of the ballistic protective equipment market in Europe is driven by the region's diverse security landscape, stringent regulatory standards, and increasing threats from terrorism and asymmetric warfare. European countries maintain well-equipped military forces and law enforcement agencies, necessitating continuous investment in advanced protective gear for personnel engaged in various missions, including combat operations, counter-terrorism, and peacekeeping missions.

The Germany ballistic protective equipment market is projected to grow at a CAGR of 4.3% from 2024 to 2030. The market is characterized by its advanced technological capabilities, strong industrial base, and stringent regulatory standards.

The ballistic protective equipment market in Russia is experiencing considerable growth due to increasing demand for advanced body armor, helmets, and other protective gear driven by both internal security needs and Russia's involvement in regional conflicts.

Asia Pacific Ballistic Protective Equipment Market Trends

Asia Pacific is witnessing significant growth in the ballistic protective equipment market, driven by escalating geopolitical tensions and security threats, particularly in areas like the Korean Peninsula, the South China Sea, and the India-Pakistan border. This has led to heightened demand for advanced protective gear among military personnel, law enforcement agencies, and security forces, driving investments in ballistic protection solutions.

The ballistic protective equipment market in China is witnessing significant growth propelled by the country's rapid military modernization efforts, expanding law enforcement capabilities, and increasing security concerns.

The India ballistic protective equipment market is projected to account for more than 14% revenue share within Asia Pacific, driven by the government's emphasis on domestic defense manufacturing under the "Make in India" initiative.

Middle East & Africa Ballistic Protective Equipment Market Trends

The Middle East & Africa (MEA) ballistic protective equipment market is witnessing significant growth driven by geopolitical tensions, persistent security threats, and increasing military and law enforcement modernization efforts across the region.

The ballistic protective equipment market in Israel accounted for a revenue share of more than 23% in 2023 within Middle East & Africa, characterized by its strong focus on defense innovation, advanced technology, and security expertise, driven by the country's unique security challenges and geopolitical dynamics.

Central & South America Ballistic Protective Equipment Market Trends

The Central and South America ballistic protective equipment market is witnessing steady growth driven by various factors, including rising security concerns, increasing military and law enforcement expenditures, and growing awareness of the need for personal protection. In Central and South America, countries face diverse security challenges, including organized crime, drug trafficking, and political instability, which necessitate the procurement of advanced protective gear to ensure the safety and effectiveness of defense and security personnel.

The Brazil ballistic protective equipment market is projected to grow at a CAGR of 5.4% over the forecast period. Brazil faces diverse security challenges, including organized crime, drug trafficking, and urban violence, necessitating the procurement of advanced protective gear to ensure the safety and effectiveness of defense and security personnel.

Key Ballistic Protective Equipment Company Insights

In the competitive landscape of the ballistic protective equipment industry, several key players vie for dominance by leveraging their technological prowess, product innovation, and market reach. Industry giants like Seyntex N.V., Honeywell International, and BAE Systems stand out with their comprehensive portfolios of high-performance materials and advanced protective solutions. Alongside these established players, specialized firms such as ArmorSource and Point-Blank Enterprises carve out niches with their expertise in specific product categories, such as ballistic helmets and body armor systems. The competitive landscape is further shaped by strategic partnerships, mergers, and acquisitions aimed at expanding market presence, enhancing technological capabilities, and gaining access to new customer segments.

Key Ballistic Protective Equipment Companies:

The following are the leading companies in the ballistic protective equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Seyntex N.V.

- BAE Systems, Plc

- Rheinmetall AG

- Honeywell International, Inc.

- Point Blank Enterprise, Inc.

- Morgan Advanced Materials

- ArmorSource LLC

- Craig International Ballistics

- Survitec Group Ltd

- Safe Life Defense

- Tactical Assault Gear (TAG)

- Hellweg International Pty. Ltd

- MKU Limited

- Mehler Vario System

Recent Developments

-

In November 2023, MKU Limited unveiled its innovative Kavro Doma 360 ballistic helmet. MKU claims this helmet offers protection against 7.62×39 mm mild steel core (MSC) bullets from AK-47 rifles, along with 7.62×51 mm and 5.56×45 mm NATO rounds. It can also be customized with various accessories like night vision devices, communication equipment, and masks, enhancing its functionality for diverse operational needs.

-

In May 2023, GPC Investments, acquired Body Armor Outlet (BAO). BAO is a leading supplier of protective gear for law enforcement, military, and civilians. While financial details weren't disclosed, the acquisition aims to help BAO expand its product offerings and enter new defense equipment markets.

Ballistic Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.99 billion

Revenue forecast in 2030

USD 6.70 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Material, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Japan; China; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; Israel

Key companies profiled

Seyntex N.V.; Honeywell International, Inc.; Tencate; Rheinmetall AG; BAE Systems, Plc Point Blank Enterprise, Inc.; Morgan Advanced Materials; ArmorSource LLC; Craig International Ballistics; Survitec Group Ltd; Verseidag-Indutex GmbH; Safe Life Defense; Tactical Assault Gear (TAG); Hellweg International Pty. Ltd; MKU Limited; Mehler Vario System; Mars Armor

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ballistic Protective Equipment Market Report Segmentation

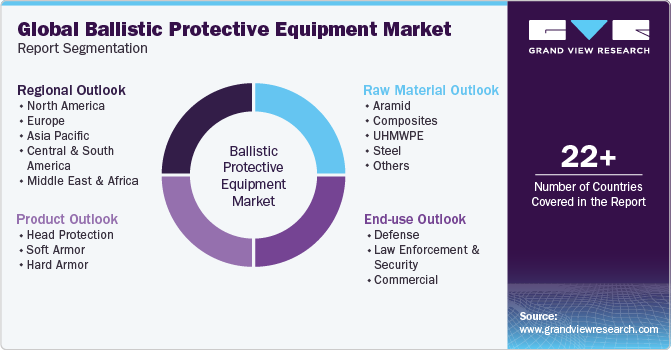

This report forecasts revenue growth at global, regional & country levels, and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ballistic protective equipment market report based on raw material, product, end-use, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Aramid

-

Composites

-

UHMWPE

-

Steel

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Head Protection

-

Soft Armor

-

Hard Armor

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Defense

-

Law Enforcement & Security

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Russia

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global ballistic protective equipment market size was estimated at USD 4.80 billion in 2023 and is expected to reach USD 4.99 billion in 2024.

b. The global ballistic protective equipment market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 6.70 billion by 2030.

b. The ballistic protective equipment market in North America is the largest market accounting for 38.6% in 2023. North America ballistic protective equipment market is poised for continued growth, driven by technological advancements, stringent regulatory standards, and increasing demand from military, law enforcement, and commercial sectors.

b. Some of the key players operating in the ballistic protective equipment market includes Seyntex N.V.; Honeywell International, Inc.; Tencate; Rheinmetall AG; Point Blank Enterprise, Inc.; Morgan Advanced Materials; ArmorSource LLC; Craig International Ballistics; Survitec Group Ltd; Verseidag-Indutex GmbH; Safe Life Defense; Tactical Assault Gear (TAG); Hellweg International Pty. Ltd; MKU Limited; Mehler Vario System; Mars Armor; Paul Boyé Technologies; Vista Outdoor, Inc.; EnGarde; Safariland, LLC; CQC Ltd.; Armor Wear; BAE Systems, Plc.

b. Increasing concerns about improving army survival are expected to benefit market growth. Additionally, rising defense spending as a result of expanding regional economies, as well as increased competition among governments to demonstrate their power, are expected to fuel market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."