- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Ballistic Composites Market Size Report, 2030GVR Report cover

![Ballistic Composites Market Size, Share & Trends Report]()

Ballistic Composites Market Size, Share & Trends Analysis Report By Raw Material (Polymer Matrix Composite, Metal Matrix Composite), By Application (Vehicle Armor, Body Armor), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-506-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Report Overview

The global ballistic composites market size was valued at USD 1.74 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2024 to 2030. Rising armed conflicts, terrorism, and security risks have pushed law enforcement to use advanced ballistic materials, such as ballistic composites. There is an increased demand for ballistic equipment such as helmets, body armor, and vehicle protection. This equipment aids in the protection of military and law enforcement officers in times of armed conflict. Hence, these factors are responsible for the growth of the ballistic components market.

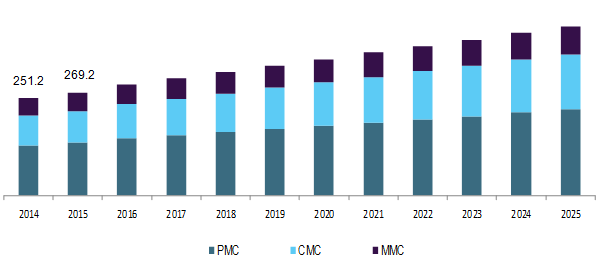

U.S. ballistic composites market revenue, by product, 2014 - 2025 (USD Million)

The rise in terror activities and inter-border conflicts has increased the utilization of ballistic composites. Governments are spending heavily to improve the safety of their military and police professionals during armed conflicts. The rising crime rate and the need for protection against armed criminals have led to increased adoption of ballistic composites. Military and defense professionals prefer ballistic composites as they offer properties such as high strength and low weight. Furthermore, the rise in personal safety awareness has increased the demand for ballistic composites. They safeguard the user without increasing its weight, helping in swift movements and target positioning. Hence, the rise in demand for equipment such as helmets, body armor, and vehicle armor triggers market growth.

The rise in the popularity of outdoor activities such as target shooting, hunting, and other sporting activities encourages market growth. Many activity centers offer proper equipment to provide real-life experience of target shooting and hunting. Furthermore, increased disposable income has led the population to opt for ballistic composites to improve vehicle safety and protection. There is an increased adoption of ballistic components by security personnel of high-profile populations such as celebrities, politicians, athletes, businesspeople, and others. Hence, these factors are responsible for the growing demand in the ballistic composites market.

Raw Material Insights

The polymer matrix composite segment dominated the market in 2023 with a share of 49.5% owing to properties offered by polymer matrix such as low-weight features, and robust performance. Polymer composites offer lower weight than traditional materials such as ceramic or steel. This helps in reduced physical strain and enhanced mobility of the personnel wearing the protective gear. Polymer matrix also protects against bullets. Hence, there is an increase in the use of polymer matrix for manufacturing components such as helmets, body armor, and more.

The polymer-ceramic matrix composite segment is expected to grow at a CAGR of 8.3% over the forecast period. The combination of polymer and ceramic offers enhanced protection against penetration and impacts. Many companies are investing in research and development to explore new ways to enhance the performance of polymer-ceramic matrix components. Furthermore, increasing demand for ballistic components in industries such as military and defense helps in the segment growth.

Application Insights

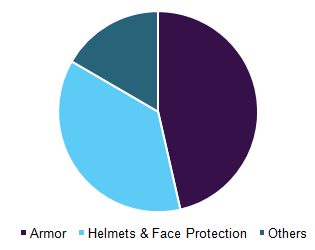

Vehicle armor dominated the market in 2023 with a share of 40.6%. The rising usage of ballistic composites for vehicle protection and the increased prevalence of terrorism, armed conflicts, and security threats have led to the segment growth. The increasing adoption of vehicle armor by high-profile and government personnel has also increased their significance. The lightweight and enhanced protection properties of ballistic composites have led to an increased number of armored vehicle manufacturing.

Global ballistic composites market revenue share by application, 2016 (%)

The body armor segment is expected to grow at a CAGR of 8.7% during the forecast period. The market growth is due to increased demand for body armor for military and police personnel due to rising civil unrest and terrorism. Governments emphasize improving the protection of frontline personnel during conflicts. Therefore, many companies are developing weapons and equipment solutions that offer maximum protection. The rise in defense budgets by governments of major countries has led to increased demand for body armor.

Regional Insights

North America dominated with a market share of 39.0% in 2023 pertaining to a high number of military and police personnel and high budgets for defense spending. Governments in the region are spending heavily to improve the protection of their military professionals. Furthermore, the presence of major defense equipment manufacturing companies also aids in the regional market growth.

U.S. Ballistic Composites Market Trends

The U.S. held a substantial market share of in North America in 2023. The U.S. has one of the largest budgets for defense operations. The presence of military and law enforcement personnel in high numbers has led to a substantial demand for ballistic composites such as helmets, body armor, and vehicle armor. Furthermore, major companies and research institutes invest heavily in the research and development of ballistic components. Hence, these factors encourage the growth of the ballistic composites market in the U.S.

Asia Pacific Ballistic Composites Market Trends

Asia Pacific ballistic composites market was identified as a lucrative region in this industry. The market growth results from rising demand for ballistic composites, as there is a rise in civil unrest and cross-border conflicts in the region. Population growth has led to an increase in the number of military and police personnel. Furthermore, economic growth in the region's developing countries has led to a rise in the military budgets. Hence, these factors are responsible for the market growth in this region.

The China ballistic composites market is expected to grow rapidly due to the rapid economic growth and infrastructure development in the country. The government has increased defense spending to improve the country's security infrastructure. This has resulted in an increased demand for ballistic protection equipment. Furthermore, the presence of a manufacturing sector encourages the production of high-quality ballistic equipment in the country.

Europe Ballistic Composites Market Trends

Europe ballistic composites market had a market share of 28.4% in 2023, owing to the rise in civil unrest, organized crime, and terrorist attacks in the region. This has led to governments adopting increased usage of ballistic equipment to improve the protection of their military and law enforcement personnel. Furthermore, the presence of technologically advanced manufacturing companies aids in producing high-quality military and ballistic equipment. Hence, these factors help the region's market growth of ballistic composites.

Germany ballistic composites market is expected to grow rapidly due to the rising defense budget, which improves the country's security against increasing terrorist attacks and crimes. Major companies focus on domestic production of ballistic composites to reduce their dependency on imported equipment. Furthermore, the rise in military personnel has led to increased demand for ballistic equipment in the country.

Key Company Share & Insights

Some major companies in the ballistic composites market are Honeywell International Inc.; TEIJIN LIMITED.; BAE Systems.; DuPont, and more. Companies are focusing on improving their end-user portfolio with the help of technological advancements, mergers, acquisitions, and investing in research and development.

-

Honeywell International Inc. offers advanced technology products and services. The product portfolio of Honeywell includes aerospace and automotive products, control systems, specialty chemicals and plastics, engineered materials, electronics, and more.

-

TEIJIN LIMITED is a company that offers services to industries such as chemical, information technology, pharmaceutical, and more. The company also provides materials such as aramid, composites, carbon fibers, resins, film sheets, and more.

Key Ballistic Composites Companies:

The following are the leading companies in the ballistic composites market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- TEIJIN LIMITED

- BAE Systems

- DuPont

- Avient Corporation

- Morgan Advanced Materials

- 3M

- Saint-Gobain Performance Plastics Corporation

- TenCate Fabrics

- Gurit Services AG

Recent Developments

-

In March 2024, Avient Corporation announced the launch of Polystrand thermoplastic composite materials. These materials offer properties such as enhanced strength, low weight, and corrosion resistance. The polystrand portfolio included products such as Thermoballistic panels, Polystrand tapes, Hammerhead marine composite panels, and more.

-

In April 2023, DuPont announced the launch of its new product, Kevlar EXO. It is an aramid fiber offering flexibility, and low-weight properties. The material is used in manufacturing soft body armor used by law enforcement officers and military personnel. It offers ballistic protection without reducing mobility.

Ballistic Composites Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.91 billion

Revenue forecast in 2030

USD 3.10 billion

Growth Rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Argentina; Brazil; Saudi Arabia; South Africa.

Key companies profiled

Honeywell International Inc.; TEIJIN LIMITED.; BAE Systems.; DuPont; Avient Corporation; Morgan Advanced Materials; 3M; Saint-Gobain Performance Plastics Corporation; TenCate Fabrics; Gurit Services AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ballistic composites market report based on raw material, application, and region.

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymer Matrix Composite

-

Polymer-Ceramic Matrix Composite

-

Metal Matrix Composite

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vehicle Armor

-

Body Armor

-

Helmets & Face Protection

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."