- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Adhesives Market Size & Share Report, 2025GVR Report cover

![Automotive Adhesives Market Size, Share & Trends Report]()

Automotive Adhesives Market Size, Share & Trends Analysis Report By Technology (Reactive, Water-Based), By Function (Bonding, NVH), By Vehicle, By Application, By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-270-9

- Number of Report Pages: 250

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Bulk Chemicals

Report Overview

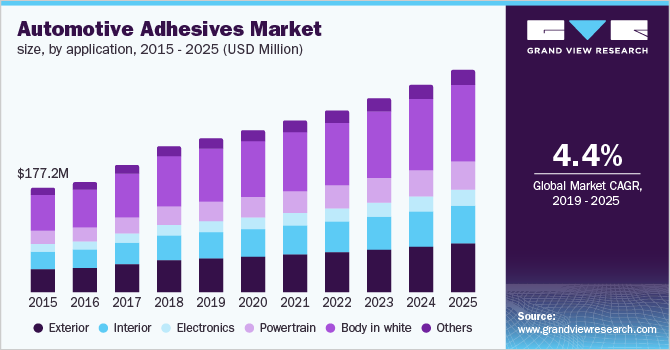

The global automotive adhesives market size to be valued at USD 6.5 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% during the forecast period. Government initiatives to increase the production of lightweight vehicles is a major driver for market growth. The ability of adhesives to reduce vehicle weight, increase fuel efficiency, and lower carbon emissions is likely to augment the market growth over the next seven years. This has resulted in increased product penetration in automotive sector and, thereby, in the replacement of welding & metal joints with adhesives.

An increase in harmful emissions has led to the establishment of stringent regulations to reduce environmental footprint of vehicles. For instance, in April 2019, the European Commission announced new carbon dioxide emission standards, which stated that CO2 emissions levels from new cars and vans will be reduced by 37.5% and 31.0%, respectively by 2030, as compared to 2021.

Lightweight vehicles are fuel-efficient and have low carbon dioxide emissions. According to Henkel, the utilization of modern adhesives can reduce the weight of an automobile by as much as 15.0%. The growing production of lightweight vehicles is anticipated to fuel the consumption of adhesives in automotive industry over the forecast period.

Although adhesives help reduce harmful vehicular emissions, they contribute to VOC emissions. As a result, several regulatory bodies such as the United States Environmental Protection Agency (EPA), California Air Resources Board (CARB), and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) have set certain guidelines & standards pertaining to their use to reduce environmental & health-related risks. Hence, manufacturers are switching to environment-friendly adhesives to abide by these regulations.

Automotive Adhesives Market Trends

The continued growth of adhesives in the automotive sector to restore multiple aspects is driving adhesive manufacturers to innovate. The automobile industry is a significant consumer of adhesives, and demand is expected to rise during the forecast period. This factor is propelling the automotive adhesive market forward. The shift in consumer behavior toward lightweight materials has led to significant consumption of light vehicles in the automotive industry. As a result, the automobile industry is increasingly using adhesives to seal rather than traditional welding.

The rising automobile manufacturing demand for adhesives is propelling the revenue generation stream of automobile adhesive manufacturers, aiding the market to grow. However, low-volume vehicle manufacturers are still hesitant to use adhesives and prefer using traditional processes, which has hampered the growth of the market over the years.

Moreover, adhesive interaction in the automobile sector results in an indispensable joining innovation for lightweight vehicle multi-material design. However, rising raw material prices and the influence of the downturn on finished industry sectors are expected to restrict the overall market growth.

Autonomous EVs are self-parking, driverless, or robotic electric vehicles. They process billions of data points per second from a network of sensors, cameras, and radar systems. Adhesives of various types are used in cameras, radars, and sensors in electric vehicles. With the development and commercialization of self-driving vehicles, the demand for EV adhesives is expected to increase. It is anticipated to provide significant growth opportunities for automotive adhesive manufacturers.

Technology Insights

Reactive & others technology segment held the largest volume share of 67.9% in 2018. The products based on this technology have witnessed a high growth rate in the recent years owing to their excellent durability under adverse environmental conditions as well as high bond strength. In addition, these offer performance advantage over solvent-based or hot-melt products by curing to a material that resists melting.

Water-based technology is anticipated to witness the fastest growth rate of 5.6%, in terms of revenue, from 2019 to 2025, owing to the environment-friendly factor associated with the technology. Water-based adhesives emit low emissions during their manufacturing process, which is anticipated to boost their consumption over other technologies.

Hot melt is among the fastest-growing technology segments, in terms of revenue, in the industry. Hot melts based on reactive polyurethane are gaining popularity in automotive industry due to their ability to provide a superior bond and strong resistance against heat, moisture, and chemicals. Also, the use of hot melts in automotive industry speeds up the production process in comparison to water-based and solvent-based products.

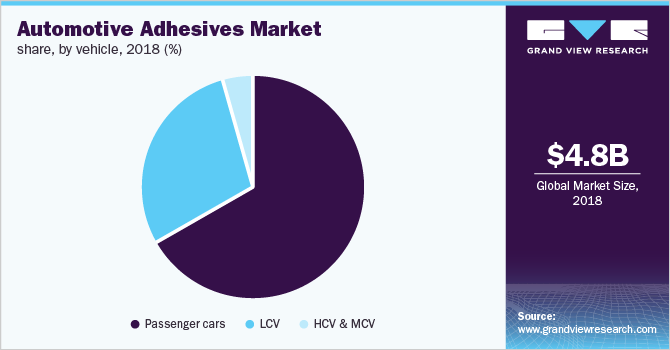

Vehicle Insights

The passenger cars segment held the largest share in 2018, holding 66.7% of the total market volume share. Increasing production of electric vehicles is expected to boost the growth of the global market. In addition, along with structural bonding, adhesives act as buffer and crash-resistant material in the event of accident.

Commercial vehicles are anticipated to register the fastest growth rate over the forecast period due to their increasing production. According to the OICA, the production of heavy trucks increased by 17.3% in NAFTA and 27.1% in South America from 2017 to 2018. Similarly, the production of heavy buses increased by 5.8% in Europe, 38.2% in South America, and 4.2% in Africa. The global production of light commercial vehicles increased by 5.9% during the same period.

In heavy & medium commercial vehicles segment, the utilization of adhesives has significantly increased over the past years due to the rising awareness regarding their benefits over rivets. Hence, growth in the production of heavy commercial vehicles is a positive sign for the industry. According to The Adhesive and Sealant Council, the amount of adhesives consumed in North American medium/heavy truck and bus was 2.4 gallons per unit in 2015.

Function Insights

The bonding segment constituted the largest revenue share of 47.4% in 2018. Adhesives are being increasingly used as bonding agents in lightweight vehicles. Structural adhesives are quickly replacing mechanical fasteners as they deliver several benefits such as weight reduction, bonding of dissimilar substrates such as metal to plastic, improved aesthetics, and flexibility in design of the final assembly.

NVH is anticipated to be the fastest-growing segment, in terms of volume, over the forecast period. Growing consumer preference for comfortable and quiet driving experience is propelling OEMs to abide by NVH standards. Adhesives help in meeting the NVH levels and providing a better driving experience. For example, 3M, one of the key market players, offers sound deadening pads that are efficient in reducing noise, rattles, and sound system vibrations in a vehicle.

Sealing is another important function, as the safety and reliability of automotive applications largely depend on strong sealing between various components. Sealing aids in preventing the vehicle from a possible damage by protecting it against unfavorable environmental conditions such as leakage of hazardous gases or materials and corrosion.

Application Insights

Automotive adhesives cater to various applications such as exterior, interior, powertrain, electronics, body in white, and chassis. Body in white segment constituted the largest volume share of 33.1% in 2018. Adhesives are increasingly replacing spot welding for the bonding of raw vehicle framework. Their application leads to weight reduction, increased crash durability, and reduced metal fatigue. Epoxy and polyurethane are the majorly used products in body in white application.

Interior segment is anticipated to be the fastest-growing application segment over the forecast period. Adhesives are used in various interior applications such as dashboards, seating, headliners, door panels, and trunk trim. They play a significant role in sound elimination to offer a comfortable ride to passengers.

Exterior segment was one of the major shareholding segments in 2018. Adhesives are used in headlamps, hand-on-parts, windscreen, hood, roof, and various other exterior components of a vehicle. Their use helps in uniform distribution of the load as compared to rivets, helping HCVs, such as buses, to offer better performance in rollover and impact tests.

Polyurethane adhesives have excellent heat resistance and fast curing process. These properties allow them to be extensively used in headlamps, tailgates, fascia, roof modules, hang-on parts, and spoiler. Acrylics find application in exterior, interior, powertrain, electronics, and body in white. They are majorly preferred owing to their strong structural properties and are ideal for cross bonding metals to composites.

Regional Insights

North America and Europe are expected to witness slow growth rate as compared to other regions. The production of passenger cars in North America declined consecutively in the past four years (2015 to 2018). Also, Europe’s overall vehicle production declined by 0.3% in 2017 and 1.4% in 2018 compared to the previous years. This has affected the utilization of adhesives in these regions; however, growing emphasis on electric and lightweight vehicles is expected to boost the consumption of adhesives over the coming years.

Asia Pacific constituted the largest volume share of 53.0% in 2018. The share is a result of growing opportunities in developing countries in terms of vehicle manufacturing and technology innovation. Presence of growth opportunities has pushed manufacturers to expand their production capacities and amplify their market reach.

For instance, in November 2018, DuPont invested over USD 80 million for building a compounded high-end engineering plastics and adhesives manufacturing plant in China and the plant is expected to be operational by 2020. The products offered will cater to various industries including transportation.

The Central & South America and Middle East & Africa regions are anticipated to register the fastest growth rates over the forecast period. Increasing growth opportunities are propelling adhesive manufacturers to expand their capacities and regional footprint in these regions. For instance, in June 2019, H.B. Fuller announced the opening of its new adhesives center in Brazil after recognizing the potential of the Latin America market.

Key Companies & Market Share Insights

The global market is fragmented in nature with the presence of various key players such as Henkel, H.B. Fuller, Sika AG, Dow, Arkema Group, and 3M along with medium and small-scale regional players operating in different parts of the world. Major companies in the market compete in terms of application development capability, product launches, and development of new technologies for product formulation.

For instance, in March 2018, Sika launched a new range of expandable cavity sealers -SikaBaffle 400 series, for moisture sealing and acoustic dampening. The launch of this series was an attempt by the company to be in line with its strategy of delivering technologies with the latest automotive trends.

Recent Developments

-

In May 2023, Henkel Adhesive Technologies, a global leader in automotive adhesives, launched Loctite TLB 9300 APSi, a thermally conductive adhesive for EV battery systems. The new automobile adhesive provides both thermal conductivity and structural bonding in the EV battery system.

-

In December 2022, Dow launched the SILASTIC™ SA 994X Liquid Silicone Rubber (LSR) series to create sustainable technology for the transportation industry. This rubber series is used in various automotive solutions such as connector seals, radiator gasket seals, and battery vent gasket seals for hybrid and electric vehicles.

-

In April 2022, 3M and Innovative Automation Inc. collaborated to provide industrial manufacturers with an automated adhesive solution for tape applications. The RoboTape™ System for 3M™ Tape helps in the assembly processes by reducing or retasking manual labor and maximizing production throughput.

-

In February 2022, Arkema finalized the acquisition of Ashland’s Performance Adhesives business to strengthen adhesive solution segments. Ashland Performance Adhesives will offer Arkema a wide range of pressure-sensitive adhesives, particularly in protection and signage films for buildings and automotive.

Automotive Adhesives Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 6.5 billion

Growth rate

CAGR of 4.4 from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, function, vehicle, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Germany, U.K., China, India, Japan, and Brazil

Key companies profiled

Henkel, H.B. Fuller, Sika AG, Dow, Arkema Group, 3M

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Adhesives Market Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global automotive adhesives market report on the basis of technology, function, vehicle, application, and region.

-

Technology Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

-

Water-based

-

Solvent-based

-

Hot melt

-

Reactive & others

-

-

Function Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

-

Bonding

-

NVH

-

Sealing/Protection

-

-

Vehicle Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

-

Passenger cars

-

Light commercial vehicles

-

Heavy & Medium commercial vehicles

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

-

Exterior

-

Acrylic

-

Polyurethane

-

Rubber

-

Epoxy

-

EVA

-

PVA

-

Others

-

-

Interior

-

Acrylic

-

Polyurethane

-

Rubber

-

Epoxy

-

EVA

-

PVA

-

Others

-

-

Powertrain

-

Acrylic

-

Polyurethane

-

Rubber

-

Epoxy

-

EVA

-

PVA

-

Others

-

-

Electronics

-

Acrylic

-

Polyurethane

-

Epoxy

-

Others

-

-

Body in white

-

Acrylic

-

Polyurethane

-

Rubber

-

Epoxy

-

Others

-

-

Others

-

Acrylic

-

Polyurethane

-

Epoxy

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."