- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Emulsion Polymer Market, Industry Report, 2030GVR Report cover

![Asia Pacific Emulsion Polymer Market Size, Share & Trends Report]()

Asia Pacific Emulsion Polymer Market Size, Share & Trends Analysis Report By Type (Acrylics, Styrene-Butadiene Latex, Vinyl Acetate Polymers), By Application, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-248-3

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Market Size & Trends

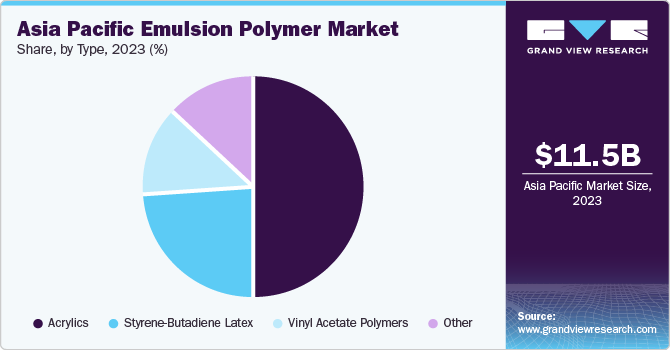

The Asia Pacific emulsion polymer market size was estimated at USD 11.52 billion in 2023 and is projected to grow at a CAGR of 7.4% from 2024 to 2030. Polymer emulsions are commonly used as binders in paints and coatings, as they possess exceptional properties including film-forming ability, adhesion, and durability. Furthermore, the construction industry utilizes polymer emulsions for a variety of purposes, including cement modification, waterproofing, and surface treatments, which has led to a rise in their demand.

The market demand is driven by its adoption in different sectors due to its environmental benefits, unique properties, and application versatility. Factors such as rising focus on environmental sustainability have driven the adoption of water-based formulations like polymer emulsions in manufacturing sectors that traditionally depend on solvent-based systems. Water-based polymer emulsions are a greener or more sustainable alternative with minimized environmental impact and reduced volatile organic compound (VOC) emissions. Therefore, industries including adhesives, textiles, and coatings have witnessed a surge in polymer emulsions demand.

The market is highly regulated to ensure the quality, safety, and environmental sustainability of these materials. China Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) is responsible for the administration of chemical substances in China. In 2020, the Inventory of Existing Chemical Substances in China (IECSC) issued mandates for the registration of chemicals intended to be used in food additives, pharmaceuticals, veterinary drugs, pesticides, cosmetics, feed, and feed supplements. Furthermore, other regulatory bodies such as the Bureau of Indian Standards (BIS), Japan’s Ministry of Economy, Trade, and Industry (METI), and the South Korea Ministry of Trade, Industry, and Energy (MOTIE) play a crucial role in shaping the landscape of emulsion polymer market in the Asia Pacific by ensuring ethical manufacturing and usage in end use industries.

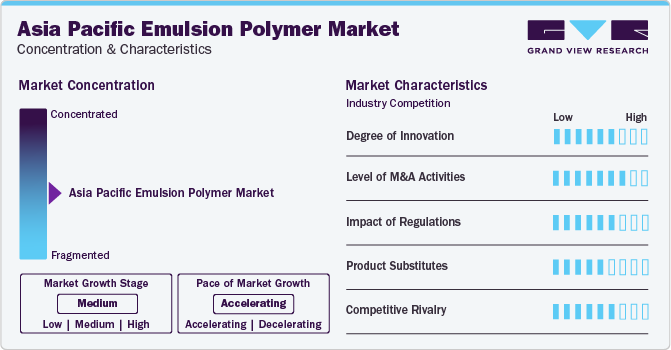

Market Concentration & Characteristics

Market growth stage is high, and the pace is accelerating owing to a moderately consolidated market. The companies provide onsite reactivation, datasheet usage, and customized production services to attract customers. Emulsion polymer manufacturers in Asia Pacific are actively implementing strategic initiatives such as new product launches, mergers & acquisitions, and production expansion, among others.

The degree of technological and product innovation is high. Polymers derived from biobased latex polymer technology are renewable and are expected to provide better performance as compared to other polymers such as Styrene butadiene and Styrene acrylic latex. The shift in trend towards the adoption of environment-friendly paints & coatings coupled with the favorable regulatory scenario is likely to support the development of low VOC content or VOC-free paints and coatings in the market. For instance, in January 2020 Asian Paints launched Nilaya Naturals, India’s first organic paint line with hero ingredients such as neem oil, castor seeds, soya bean, and pigments like natural yellow. Such innovations have led to the initiation of organic emulsion polymerization in the market.

The threat of substitutes is moderate. Ecosphere biolatex is being used as a complete replacement for petroleum-based emulsion polymers such as styrene-butadiene and styrene acrylate latex. It is obtained using naturally renewable crop resources like corn. It is used as an internal substitute for emulsion polymers in the paper coating industry.

Application Insights

The paints & coatings segment accounted for a revenue share of 45.7% in 2023. The demand for emulsion polymers in the paints & coatings segment is expected to grow at a rapid pace, especially in China and Japan, over the forecast period on account of the improved standard of living and stable economic conditions in the countries, which have led to an increase in infrastructure activities.

Adhesives form the second largest consumer segment for emulsion polymers, contributing to the rise in the global demand for these products from various end-use industries. Major product types of adhesives are acrylics, styrene blocks, polyvinyl acetate (PVA), ethylene vinyl acetate (EVA), and polyurethane. Adhesives based on vinyl are significantly contributing to the growth of the adhesives market owing to an increase in the demand for water-based adhesives. Numerous applications in the automobile and aerospace industries are anticipated to boost the demand for water-based adhesives over the next eight years.

End use Insights

The building & construction segment led the market, accounting for a revenue share of 37.7% in 2023, and is projected to emerge as the fastest-growing segment from 2024 to 2030. Housing and construction activities have been on the rise in developing countries such as China and India. Increasing disposable income in developing countries is expected to boost infrastructure activities in these regions, thereby propelling the demand for acrylic paints over the next eight years. Growth in homeownership is another factor expected to boost the demand for industrial coatings over the forecast period. Manufacturers have been adopting new technological processes and innovations, which cater to the requirements of consumers and result in improved sustainability, functionality, efficiency, and ease of application for their products. Developing products with a customer-centric view is thus expected to help boost the market growth over the forecast period.

Paper and paperboard coatings application segment accounted for a significant market share in 2023. High-performance paperboard barrier coatings are widely used to protect food and non-food applications. They offer critical properties including peelability, sealing, airtightness, humidity control, UV light protection, aroma barrier, oxygen permeability, heat resistance, and grease-proofing, thereby making them a popular choice in food packaging applications.

Type Insights

Acrylics polymer dominated the market, accounting for a share of 50.1% in 2023. It is an excellent glass substitute and is predominantly used in bullet-proof glass, windowpanes, greenhouse roofs, paints, communication devices, and machine parts. Acrylate polymers are used in dentistry, owing to their chemical, mechanical, physical, and biological properties.Acrylates are used for the production of plate denture bases, epitheses, obturator prostheses, and maxillofacial prostheses.

Styrene butadiene latex emerged as the second largest type segment in 2023. Styrene butadiene, styrene acrylics, vinyl acetate polymers, and styrene butadiene acrylonitrile have excellent physical and chemical properties including good gloss, UV resistance, and durability. These binders are widely used in paper and paperboard applications owing to the aforementioned properties.

Country Insights

Asia Pacific emulsion polymer market is driven by the growth of the construction industry in the region. Despite economic turmoil in most of the regions of the world, the economic fundamentals in Asia are expected to remain robust, as compared to the recent past. According to the International Monetary Fund’s (IMF) October 2023 report, the region's GDP growth is projected to foresee a growth in GDP of 4.2% in 2024 from 3.9% in 2022. The rise in GDP is due to rising foreign investments, which are expected to foster the development of industrial infrastructure. For instance, in November 2022 Amazon Web Services (AWS) announced an investment of USD 4.4 billion by 2030 for the construction of data centers in Hyderabad, India. Therefore, rising spending on infrastructure and construction is propelling the demand for emulsion polymers.

China Emulsion Polymer Market Trends

China emulsion polymer market accounted for the highest regional revenue share of 43.8% in 2023. The market is primarily driven by the growing initiatives taken by the government and private companies such as Sumitomo Seika (China) Co., Ltd. to promote green chemistry technologies such as water-soluble polymers, emulsion, latex and functional materials, polymer beads, and other products that offer high sustainability and functionality.

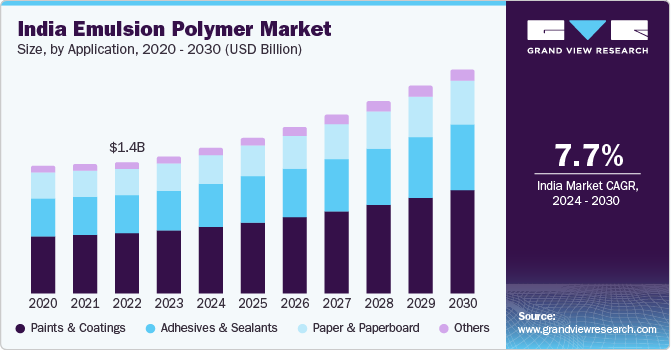

India Emulsion polymer Market Trends

Emulsion polymer market in India accounted for a significant revenue share in 2023. Future economic growth is expected to be led mostly by domestic demand given some of the concerns in India’s primary export markets, Western Europe, and North America. India is anticipated to increasingly focus on trade and investment in its domestic markets, with diminished reliance on exports. This is expected to be facilitated by relatively easy access to finance and a robust local labor market. This trend is projected to strengthen over the long term as the growing middle-class population and rising rate of real income are anticipated to further fuel domestic demand.

Key Asia Pacific Emulsion Polymer Company Insights

The market is consolidated in nature with few companies occupying a significant market share. Emerging economies such as China, India, and Japan are projected to offer growth opportunities for industry participants over the forecast period. An increase in the number of companies processing emulsion polymers, high production output, and large demand for innovative paints & coating products in the region are factors expected to lead to regional market growth over the forecast period.

Increasing use of biobased emulsion polymers is another factor anticipated to drive the Asia Pacific emulsion polymers market over the forecast period. Fluctuating prices of raw materials and the development of substitute materials are expected to be key hurdles for emulsion polymers market growth over the next eight years. Key market players such as Asahi Kasei Corporation and Nova Polychem are planning to sustain in the market, however, smaller companies are facing competitive challenges to keep a place in the regional market.

Key Asia Pacific Emulsion Polymer Companies:

- OMNOVA Solutions

- Synthomer Plc

- Trinseo

- DIC Corporation

- Arkema

- Asahi Kasei Corporation

- JSR Corporation

- Dairen Chemical Corporation

- Nova Polychem

- Kamsons Chemicals Pvt. Ltd.

- Apcotex Industries Ltd.

- Sumitomo Chemical

Recent Developments

-

In February 2023, NOVA Chemicals Corporation launched the SYNDIGO brand, a NOVA Circular Solutions that focuses on lower-emission and recycled polyethylene (rPE) solutions. The use of rPE water-oil emulsion polymers will boost market sustainability.

-

In February 2023, Sumitomo Chemical received its first ISCC PLUS certification for acrylonitrile from the International Sustainability and Carbon Certification (ISCC). Acrylonitrile is used in several products, including synthetic resins such as acrylonitrile butadiene styrene (ABS) resin, synthetic fibers such as acrylic fiber, paper strength enhancers, and polymer flocculants.

Asia Pacific Emulsion Polymer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.27 billion

Revenue forecast in 2030

USD 18.83 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, country

Region scope

Asia Pacific

Country scope

China; India; Japan; South Korea; Australia; Southeast Asia

Key companies profiled

OMNOVA Solutions; Trinseo; Synthomer Plc; DIC Corporation; JSR Corporation; Solutions; Dairen Chemical Corporation; Nova Polychem;Kamsons Chemicals Pvt. Ltd.; Arkema Group.; Asahi Kasei Corporation; Apcotex Industries Ltd.; Sumitomo Chemical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Emulsion Polymer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific emulsion polymer market report based on type, application, end use, and country:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylics

-

Styrene-Butadiene Latex

-

Vinyl Acetate Polymers

-

Other

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints and Coatings

-

Adhesives & Sealants

-

Paper & Paperboard

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive

-

Chemicals

-

Textile & Coatings

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

Frequently Asked Questions About This Report

b. The Asia Pacific emulsion polymer market was valued at USD 11.52 billion in the year 2023 and is expected to reach USD 12.27 billion in 2024.

b. The Asia Pacific emulsion polymer market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 18.83 billion by 2030.

b. Based on type, acrylic polymer segment emerged as a dominating segment in the market with a share of 50.1% in 2023 due to the growing number of construction activities in China and India.

b. The key market players in the Asia Pacific emulsion polymer market include OMNOVA Solutions; Trinseo; Synthomer Plc; DIC Corporation; JSR Corporation; Solutions; Dairen Chemical Corporation; Nova Polychem; Kamsons Chemicals Pvt. Ltd.; Arkema Group.; Asahi Kasei Corporation; Apcotex Industries Ltd.; Sumitomo Chemical.

b. The key factors that are driving the Asia Pacific emulsion polymer market include, exponential growth in the construction sector due to rising foreign investments in infrastructure development.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."