- Home

- »

- Medical Devices

- »

-

Apheresis Equipment Market Size And Share Report, 2030GVR Report cover

![Apheresis Equipment Market Size, Share & Trends Report]()

Apheresis Equipment Market Size, Share & Trends Analysis Report By Application (Renal Diseases, Neurology), By Procedure (LDL-Apheresis, Leukapheresis), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-208-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Apheresis Equipment Market Size & Trends

The global apheresis equipment market size was estimated at USD 2.90 billion in 2023 and is expected to grow at a CAGR of 9.2% from 2024 to 2030. The rising prevalence of blood-related disorders and favorable government initiatives along with reimbursement frameworks are expected to drive the market growth. Furthermore, the rising popularity & participation in blood donation drives & camps along with the growing number of blood transfusions are anticipated to support the demand for apheresis equipment during the forecast period. Moreover, technological advancement and the development of portable apheresis devices are likely to contribute to market growth. Apheresis equipment plays a crucial role in treating leukemia, lymphoma, and myeloma, as these diseases often require blood-component therapies.

Patients with these conditions undergo apheresis for collecting specific blood components, such as platelets or white blood cells, for transfusion or therapeutic purposes. The high incidence of these diseases in the U.S., with approximately 184,720 new cases expected in 2023 alone, drives significant demand for apheresis equipment. In addition, autoimmune diseases and cancer are on the rise, further boosting the market growth. Approximately 4% of the world's population suffers from one of over 80 different autoimmune diseases, with therapeutic plasma exchange (TPE) widely used for treatment. Moreover, the increasing number of platelet donors and R&D investments by biopharmaceutical companies are expected to bode well for market growth. Apheresis, which allows selective extraction of platelets while returning other blood components to the donor, is crucial for efficient platelet collection.

In the U.S., there is a continuous demand for blood and platelets, with approximately 29,000 units of red blood cells (RBCs), 5,000 units of platelets, and 6,500 units of plasma needed daily. Sickle cell disease (CKD), affecting 90,000 to 100,000 people in the U.S., often requires lifelong blood transfusions, highlighting the critical role of apheresis equipment in providing these components. Factors, such as increased awareness of platelet donation's impact on patient care and growing reliance on platelet transfusions by healthcare facilities contribute to the rising number of platelet donors. Initiatives like the Health and Human Services' Giving = Living campaign, launched in August 2022, aim to raise awareness about the significance of blood & plasma donation and encourage Americans to establish regular donation routines.

This campaign seeks to raise awareness about the significance of blood & plasma donation and motivate Americans to establish consistent donation routines. In addition, technological advancements in apheresis are driving market growth by improving the efficiency, safety, and efficacy of procedures. Next-generation apheresis machines, such as the Fresenius APRΞD platform, feature advanced software and hardware for enhanced process control, automation, and real-time monitoring, leading to more precise & reliable blood component collection. These machines offer personalized treatments for various patient needs and are designed for convenience and efficiency. In addition, advancements have led to the development of portable and user-friendly devices, boosting the use of apheresis beyond traditional hospital settings.

Integration with Electronic Health Record (EHR) systems has facilitated seamless data management and improved patient care. For example, Terumo BCT’s Rika plasma collection system, cleared by the FDA in March 2022, enhances the donor and employee experience with safety features and faster collection times. These innovations demonstrate the industry’s commitment to enhancing efficiency, quality, and donor safety in apheresis procedures. The growing field of regenerative medicine is experiencing a surge in demand for apheresis collection, with projections indicating a tripling of the annual collections in the U.S. from 43,000 in 2021 to an estimated 132,000 by 2025.

This growth is mainly driven by the extensive use of gene therapies and Chimeric Antigen Receptor (CAR) T-cell therapies, with the FDA currently approving two gene therapies for rare diseases and six CAR T-cell therapies for treating six distinct cancer types. The research pipeline is brimming with hundreds of cells and gene therapy products, many of which are in phase 3 trials, underscoring the need for apheresis services. The increased demand for apheresis has presented challenges for treatment centers, particularly in adapting to these new modalities. One key area of growth is the rise in photopheresis treatments for Graft-Versus-Host Disease (GVHD), which has been spurred by the growth of stem cell transplant programs, leading to a significant increase in apheresis procedures and necessitating the expansion of equipment and capacity.

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating due to rising adoption of advanced apheresis equipment, prevalence of chronic diseases, & demand for blood components, and a high degree of technological innovation in the field

The degree of innovation in the market is high, with continuous advancements in technology leading to the development of more efficient, portable, and user-friendly devices. For instance, in June 2020, Fresenius Kabi AG launched the Amicus Extracorporeal Photopheresis (ECP) System at the 49th annual meeting of the European Society for Blood and Marrow Transplantation (EBMT), showcasing the industry's commitment to innovation and improving patient care

Key players are leveraging new product launches and enhancing their product portfolios to strengthen their industry positions. For instance, in May 2023 TERUMO BCT, INC. launched the first training program initiative to support cell and gene therapy manufacturers, improving cell collection processes and boosting therapeutic commercialization

Mergers and acquisitions in the apheresis equipment market are moderate, with key players occasionally acquiring smaller companies to expand product portfolios or enhance technological capabilities. For instance, in August 2023, Fresenius Kabi AG and Lupagen Inc. entered into a supply and development agreement for technologies aimed at bringing cell and gene therapies to the bedside, reflecting the industry's strategic moves to strengthen market positions and foster innovation

Regulation plays a significant role in the market, ensuring product safety, efficacy, and quality. Stringent regulatory requirements, such as FDA approvals and CE markings, are essential for market entry, influencing product development and market access strategies for manufacturers

Product substitutes for the market could include alternative blood collection methods, such as whole blood collection or direct plasma collection. However, these methods may not be as precise or targeted as apheresis, which allows for the separation of specific blood components

Key players, such as Asahi Kasei Medical Co., Ltd., Terumo BCT, Haemonetics Corp., Fresenius Kabi AG, B. Braun SE, Mallinckrodt Plc, and Nikkiso Europe GmbH (a Part of NIKKISO Group), hold substantial shares in the market. Their dominant presence is mainly due to their well-established brands, extensive distribution networks, and product portfolio

The market is experiencing robust global expansion due to the increasing prevalence of chronic diseases and improving healthcare infrastructure

Product Insights

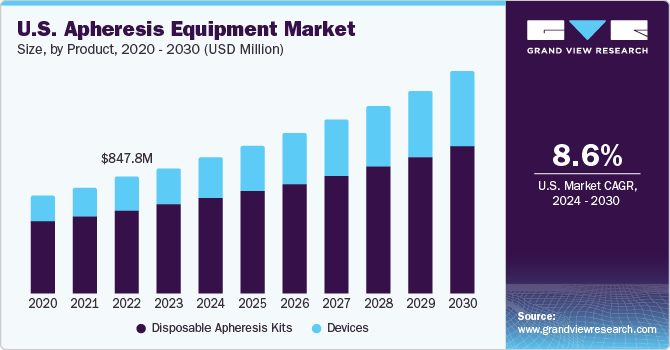

The disposable apheresis kits segment accounted for the largest market share of 72.17% in 2023 due to the high prevalence of blood-related disorders, extensive usage of disposable kits, and demand for apheresis procedures. The segment growth is also bolstered by the high incidence rates of hospital-acquired infections (HAIs), which have led to a notable increase in the use of disposable kits. Factors, such as rising participation in blood donation drives and camps, along with the growing demand for blood derivatives like platelets, plasma, and leukocytes, are expected to further drive segment growth. In addition, government support and investments in apheresis equipment development are contributing to market expansion.

For instance, Fresenius Kabi's investment in a new apheresis and transfusion disposables plant in the Dominican Republic in January 2020, totaling USD 32.15 million, has increased the company's production capacity, reflecting strategic initiatives that are expected to boost the market. The devices segment is expected to register the fastest CAGR from 2024 to 2030. This growth can be attributed to the availability of commercially advanced apheresis machines, including component collection systems, separator machines, plasmapheresis systems, and data management systems. These devices are utilized for various procedures, such as leukapheresis, plasmapheresis, plateletpheresis, erythrocytapheresis, and other apheresis procedures.

Factors driving this growth include advancements in healthcare infrastructure, increasing demand for automated blood component separators, and a rise in blood donation numbers. Modern apheresis machine is designed for short run times and prioritizes operator and patient safety. The introduction of sophisticated and automated apheresis machines, such as Fresenius Kabi's Amicus, and the growing demand for this equipment in emerging economies like Asia Pacific and Latin America, are expected to fuel market expansion in the coming years.

Application Insights

The neurology segment accounted for the largest share of 50.94% in 2023 and is expected to register the fastest CAGR from 2024 to 2030. This is due to the increasing prevalence of neurological disorders like Multiple Sclerosis (MS), myasthenia gravis, Guillain-Barre syndrome (GBS), and chronic inflammatory demyelinating polyneuropathy, which require Therapeutic Plasma Exchange (TPE) as a primary treatment. The rising prevalence of autoimmune disorders, particularly MS, with over 2.8 million global cases, is a key driver for market growth. This number is projected to rise significantly in the future. This trend is expected to boost product demand, as TPE becomes more common in autoimmune disorder treatment protocols.

Rising GBS cases, affecting about one in 100,000 adults annually, also highlight the importance of TPE in managing autoimmune disorders, as it involves removing plasma from a patient's bloodstream to eliminate specific antibodies/substances causing disease symptoms. The hematology segment is expected to register lucrative CAGR from 2024 to 2030 due to high prevalence of hematological disorders and increasing adoption of apheresis as a therapeutic approach. For instance, in the U.S., approximately 70,000 to 100,000 people are affected by SCD, which can lead to serious complications like stroke, kidney damage, heart issues, lung tissue damage, and anemia. The treatment for SCD often involves RBC transfusions to manage these health challenges, highlighting the importance of apheresis in hematology and its role in improving patient outcomes.

Procedure Insights

The plasmapheresis segment accounted for the largest share of 51.98% in 2023 due to the increasing incidence of leukemia, lymphoma, and myeloma in the U.S. According to the Leukemia & Lymphoma Society (LLS) article published in 2023, around 184,720 individuals in the U.S. were expected to be diagnosed with leukemia, lymphoma, and myeloma in 2023. Furthermore, new cases of leukemia, lymphoma, and myeloma were predicted to account for 9.4% of the total estimated number of new cancer cases in the U.S. in 2023, which is around 1,958,310. These figures underscore the significant impact of hematologic malignancies on the overall landscape of cancer diagnoses in the country. Moreover, despite being commonly used to lower plasma triglyceride levels in patients with HTG-AP, plasmapheresis did not demonstrate an association with improved outcomes in terms of organ failure incidence & duration. These findings suggest the need for further investigation into the effectiveness of plasmapheresis in improving clinical outcomes in HTG-AP.

The leukapheresis segment will have a significant CAGR from 2024 to 2030 due to the increasing prevalence of cancer, particularly breast & prostate cancer, and leukemia. The prevalence & mortality rate of Acute Myeloid Leukemia (AML) is another factor expected to drive the demand for leukapheresis procedures, facilitating segment growth. According to the American Cancer Society’s article published in 2024, the data for leukemia in the U.S. for 2024 reveals approximately 62,770 new cases of leukemia (all types) and an estimated 23,670 deaths attributed to leukemia (all types) within the year. Among these cases, around 20,800 new cases of AML are anticipated, with a corresponding projection of about 11,220 deaths specifically from AML. Furthermore, about 1% of all cancers, AML remains one of the most prevalent types of leukemia in adults, underscoring the importance of effective treatment modalities like leukapheresis, which involves the removal of abnormal WBCs from the bloodstream.

Technology Insights

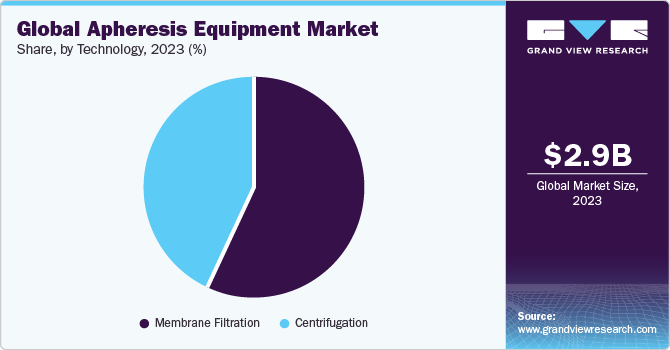

The membrane filtration technology segment accounted for the largest share of 57.03% in 2023. This is primarily due to the effectiveness in addressing key challenges faced during apheresis procedures. Membrane filtration technology plays a crucial role in reducing membrane fouling, platelet activation, and complement system activation, thereby improving the efficiency and safety of apheresis equipment. For instance, in 2022, Terumo Blood and Cell Technologies (Terumo BCT) introduced the Spectra Optia Apheresis System with new X-solve technology, which features an innovative membrane filtration system.

This system helps reduce membrane fouling and enhances the overall performance of the apheresis machine, contributing to the segment's dominance in the industry. The centrifugation technology segment is expected to register the fastest CAGR from 2024 to 2030. Centrifugation plays a crucial role in apheresis equipment, separating blood components based on density for various therapeutic procedures. Recent advancements, like high-speed and automated centrifuges, have improved efficiency, as seen with Haemonetics Corporation's 2021 launch of the NexSys PCS System.

This system offers automated control and monitoring, enhancing apheresis performance. These advancements are expected to drive demand for centrifugation-based apheresis equipment. In addition, automatic centrifugation, as highlighted in a 2021 Royal Society of Chemistry article, consistently outperforms manual methods, yielding higher recovery rates and purer blood components. Automatic centrifugation reduces processing times, improving operational efficiency without compromising separation outcomes, critical for maintaining blood product integrity and quality.

Regional Insights

North America dominated the overall apheresis equipment market with a share of 34.99%in 2023. This is due to the high prevalence of blood-related diseases and demand for blood components. The major end-users include hospitals, clinics, and blood donation centers. Key players like B. Braun Melsungen AG, Haemonetics Corp., and Fresenius Kabi AG lead the market, focusing on mergers & acquisitions. The U.S. dominates the North America regional market due to its advanced healthcare infrastructure. Future trends include technological advancements and increasing awareness, ensuring continued market growth

U.S. Apheresis Equipment Market Trends

The U.S. Apheresis Equipment Marketaccounted for the largest share of the North America marketin 2023, due to high healthcare spending, prevalence of blood-related & chronic diseases, demand for plasma-derived medicines, supportive government initiatives, and rising number of blood donation drives & camps. Key market players in the country include B. Braun Melsungen AG; Haemonetics Corp.; Fresenius Kabi AG; Asahi Kasei Medical Co., Ltd.; Terumo BCT, Inc.; and Mallinckrodt. In September 2023, BioLineRx Ltd. announced FDA approval of APHEXDA (motixafortide) with filgrastim for mobilizing hematopoietic stem cells in multiple myeloma patients. As apheresis equipment is used in stem cell collection, separates desired blood components from donors or patients, facilitating procedures like leukapheresis and HPC collection for various medical treatments.

Europe Apheresis Equipment Market Trends

The Apheresis Equipment Market in Europe was identified as lucrative due to increasing cases of chronic diseases, such as kidney, liver, and heart diseases, as well as autoimmune disorders like lupus & rheumatoid arthritis, which require blood components extracted through apheresis. This increases the demand for apheresis equipment.

The UK apheresis equipment market is expected to grow rapidly over the forecast period primarily due to the increasing prevalence of diseases requiring apheresis treatments, technological advancements in apheresis equipment, rising healthcare expenditure, and growing awareness of apheresis procedures among healthcare professionals and patients.

The apheresis equipment market in France is expected to grow significantly due to the due to increasing demand for blood components, rising prevalence of chronic diseases, and advancements in apheresis technology. However, the French government's suspension of Haemonetics' blood collection device in September 2018 may impact the market growth by decreasing sales and eroding trust in the company's products. This could lead to increased regulatory scrutiny and stricter compliance requirements. Competitors in France may use this opportunity to expand their market position by promoting the reliability and safety of their products.

The Germany apheresis equipment market is expected to record considerable growth from 2024 to 2030 owing to increasing investment in R&D of extracorporeal therapy systems, including dialysis and blood purification. For example, in June 2023, the State Government of Mecklenburg-Vorpommern allocated USD 4.81 million to support research in this area for conditions, such as sepsis, Alzheimer's, and leukemia. These developments, often involving apheresis equipment for blood purification, are crucial for treating various medical conditions.

Asia Pacific Apheresis Equipment Market Trends

The apheresis equipment market in Asia Pacific is expected to register the fastest CAGR from 2024 to 2030. This is due to the high prevalence of blood disorders requiring plasma & platelet transfusion in emerging countries, such as India and China. In addition, improving healthcare infrastructure and an increasing number of healthcare practitioners in this region are expected to present the industry with a robust growth platform during the forecast period.

The Japan apheresis equipment market led the overall Asia Pacific regional market in 2023, mainly due to increasing geriatric population and a combined shift toward the Western diet and lifestyle, which is stimulating the incidence of coronary diseases, thereby leading to a greater demand for these devices. With a huge healthcare expenditure, Japan’s healthcare system is witnessing a transition, expanding the service portfolio from preventive care to nursing care in disease management. The “21st-century type social security scheme”, a national social security programme, is expected to open more avenues for the market in this country.

The apheresis equipment market in China is expected to grow over the forecast period due to the high prevalence of thalassemia. This highlights the urgent need for comprehensive screening & genetic counseling programs and underscores the importance of well-equipped healthcare infrastructure, including apheresis equipment, to address the growing demand for blood transfusions and related therapies.

Latin America Apheresis Equipment Market Trends

The Latin America apheresis equipment marketis expected to grow over the forecast period on account of increasing prevalence of chronic diseases, rising awareness of apheresis procedures, and improving healthcare infrastructure. In addition, the region's large population base and growing healthcare expenditure are driving the product demand.

The apheresis equipment market in Brazil will witness considerable growth from 2024 to 2030 on account of high incidences of chronic diseases like CVDs and blood-related conditions, driving the demand for apheresis procedures. According to a report published by Science Direct in August 2023, Sickle Cell Disease (SCD) encompasses inherited chronic conditions significantly affecting quality of life and morbidity/mortality rates. In Brazil, it ranks among the most prevalent hereditary diseases. Between 2015 and 2019, 3,320 instances of individuals with SCD succumbing to mortality of a total of 6,553,132 deaths were recorded.

MEA Apheresis Equipment Market Trends

The MEA apheresis equipment market is expected to grow over the forecast period due to the increasing prevalence of chronic diseases, rising healthcare expenditures, and advancements in medical technology. In addition, the growing awareness about blood donations and the need for efficient blood management systems are expected to contribute to market expansion. Furthermore, the region’s demographic growth and ongoing development of healthcare infrastructure are expected to create a favorable environment for market growth.

The apheresis equipment market in Saudi Africa is expected to grow over the forecast period due to the rising prevalence of chronic disorders, such as kidney diseases, cancer, and blood-related conditions. Apheresis is an essential technique for treating these chronic disorders, as it allows for the selective removal of specific components from the blood, making it a vital component in modern healthcare.

Key Apheresis Equipment Company Insights

The competitive scenario in the apheresis equipment market is driven by both established players and new entrants, with innovation, market expansion, and niche specialization being key strategies. Companies are focusing on developing advanced products and formulations that provide superior performance and patient comfort.

Key Apheresis Equipment Companies:

The following are the leading companies in the apheresis equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Asahi Kasei Medical Co., Ltd.

- Terumo BCT, Inc. (a Part of Terumo Corporation)

- Haemonetics Corporation

- Fresenius Kabi AG

- B. Braun SE

- Mallinckrodt Plc

- Nikkiso Europe GmbH (a Part of NIKKISO Group)

Recent Developments

-

In December 2023, TERUMO BCT, INC. participated in the second Connecting the Dot series, a film series, developed for European MedTech companies

-

In August 2023, The U.S. FDA cleared a platelet device developed by TERUMO BCT, INC., which processes blood into platelets in a single centrifugation cyclex

-

In August 2023, Fresenius Kabi AG and Lupagen Inc. entered into a supply and development agreement for technologies developed to bring the delivery of cell & gene therapies to the bedside

-

In May 2023, TERUMO BCT, INC. launched the first training program initiative to support cell and gene therapy manufacturers in improving the cell collection processes and boosting therapeutic commercialization

Apheresis Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.15 billion

Revenue forecast in 2030

USD 5.35 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, procedure technology, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

B. Braun Melsungen AG; Haemonetics Corporation; Fresenius Kabi AG; Asahi Kasei Medical Co., Ltd.; Terumo BCT, Inc.; Mallinckrodt Plc; Nikkiso Europe GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Apheresis Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the apheresis equipment market report on the basis of product, application, procedure, technology, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Apheresis Kits

-

Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Renal Diseases

-

Hematology

-

Neurology

-

Others

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Plasmapheresis

-

Photopheresis

-

Leukapheresis

-

Plateletpheresis

-

LDL Apheresis

-

Erythrocytapheresis

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Membrane Filtration

-

Centrifugation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global apheresis equipment market size was estimated at USD 2.90 billion in 2023 and is expected to reach USD 3.15 billion in 2024.

b. The global apheresis equipment market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 5.35 billion by 2030.

b. Plasmapheresis accounted for the largest share of about 51.98% of the overall procedure market in 2023. Rising incidence of blood-related disorders and growing demand for plasma-derived medicines is expected to serve as a primary growth driver.

b. Some of the companies catering to the apheresis equipment industry include Haemonetics Corporation; Fresenius Kabi; Asahi Kasei Medical Co. Ltd.; Terumo BCT, Inc.; B. Braun Melsungen AG; Mallinckrodt; Nikkiso Europe GmbH.

b. The presence of favorable government initiatives and reimbursement frameworks is expected to boost demand during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."