- Home

- »

- Automotive & Transportation

- »

-

Asia-Pacific Automotive Telematics Market Size Report, 2030GVR Report cover

![Asia-Pacific Automotive Telematics Market Size, Share & Trends Report]()

Asia-Pacific Automotive Telematics Market Size, Share & Trends Analysis Report By Technology (Embedded, Tethered, Integrated), By Solution, By Vehicle, By Sales Channel, By Application, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-119-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

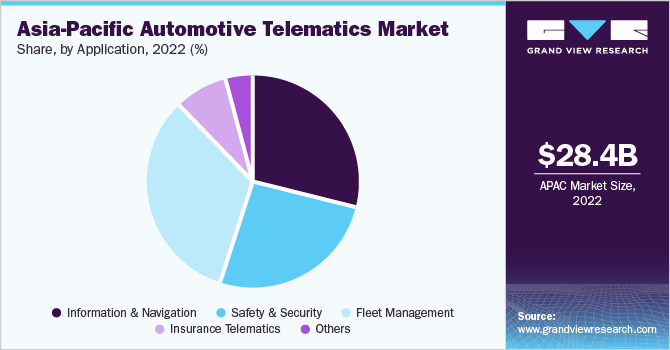

The Asia-Pacific automotive telematics market size was estimated at USD 28.37 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 15.8% from 2023 to 2030. Factors such as increasing penetration of internet services, faster adoption of smartphones, use of shared mobility fleets for commuting, and expanding e-commerce logistics, and delivery are augmenting the market growth. Moreover, government initiatives to install vehicle tracking devices and safety devices in commercial and passenger vehicles are also driving the growth. The adoption of telematics in three and two-wheeler vehicle fleets is further representing the expanding application of telematics in the Asian automotive industry. The use of telematics by the automotive insurance sector is further expected to create new growth opportunities for the Asia Pacific market.

The increasing internet penetration within the Asia Pacific region is another factor accelerating the adoption of telematics in the Asia Pacific region. According to GSMA Intelligence, in 2022, 44% of the region’s population is said to be connected through the internet. With 4G communication dominantly used in the region and accelerating the adoption of 5G networks, telematics providers are developing 4G enabled modules with enhanced connectivity capabilities.

For instance, in January 2023, TELTONIKA announced the launch of the FMC650 model, a professional category GPS tracker device having 4G LTE Cat 1 network coverage. The devices have a separate module that gathers GNSS data and dual channel L1 to L5 network support, enabling more accurate vehicle tracking the telematics model is best suited for commercial vehicles and is equipped with 16 MB of internal flash memory, capable of storing 8 times more volume of data as compared to the current models. Vehicle manufacturers operating in the region are concentrating on building standardized platforms and integrating telematics and infotainment systems solutions.

Another major factor supporting the growth of the market in the Asia Pacific countries is the government regulations to include tracking devices in public transit vehicles to build a robust intelligent transportation system. For instance, the Automotive Industry Standards Committee (AISC) under the Ministry of Road Transport and Highways. (India) has formulated a set of standards known as AIS 140. The AIS 140 mandate requires public transport vehicles operating in the country to be equipped with tracking devices, panic buttons, and video surveillance.

The AIS 140 standards motive was to establish a country-wide intelligent transportation system that aids vehicle and driver behavior monitoring, ensuring commuters’ safety and enhancing public transportation operation through route optimization and traffic management. Telematics plays a pivotal part in the development of robust public transportation systems, as telematics will enable improved and coordinated management of buses and other public transport vehicles by keeping track of their locations, fuel levels, routes, and distance travelled.

Even though telematics adoption in countries such as India, Vietnam, and Thailand are still nascent, the government regulations for vehicle insurance, electric vehicle adoption, vehicle safety norms, and the development of smart transport network is supported by telematics application across passenger and commercial vehicles. With most of the vehicles operating in Asia covered under insurance, telematics insurance is anticipated to present new growth opportunities for the telematics market, as major insurance providers in the region are providing vehicle usage-based telematics insurance. Insurance telematics delivers precise data regarding driver behavior and vehicle operations to determine the risk of insuring a particular driver.

Telematics insurance provides lower premiums, more personal coverage, and increased safety. Thus, prompting major insurance service providers to launch usage-based automotive telematics services. For instance, in July 2022, Edelweiss General Insurance announced the launch of Switch, an on-demand motor insurance under the Insurance Regulatory and Development Authority sandbox initiative. Switch is a mobile telematics insurance scheme that detects vehicle motions and automatically activates the insurance when the vehicle is driven. The usage-based model of the policy considers parameters such as the distance traveled and the driving quality to calculate the vehicles' premium.

Most Asia Pacific countries lack the adequate infrastructure required to enable features like real-time traffic for navigation systems, both in terms of telecommunication infrastructure and traffic data gathering is a major factor hindering the adoption of telematics in the Asia Pacific telematics. Furthermore, the risk of data theft and invasion of privacy is another major concern hindering market growth.

Besides software, hardware, and communications networks, vehicle telematics involves establishing service centers to ensure consistent customer assistance, which requires substantial initial investments. Therefore, due to high initial investment, the automotive telematics uptake in key Asia Pacific nations is projected to be hampered. Governments, automotive manufacturers, and telematics services providers in the region are constantly working together to address such problems by allocating resources to build the necessary infrastructure, introducing data laws, and introducing subsidies to manufacture components at lower costs.

Technology Insights

The embedded technology segment dominated the Asia Pacific automotive telematics market with the largest revenue share exceeding 70% in 2022. The increasing integration of wireless communication in commercial vehicles such as buses and trucks, government policies mandating the installation of vehicle tracking systems and safety, and the growing logistics transportation in the region are driving manufacturers to develop embedded telematics. These technologies allow users to access detailed vehicle information about trucks and buses, as well as physical proximity to other cars and vehicle locations. The gathered data can be used to improve troubleshooting during an accident or component failure, hence enhancing logistical efficiency.

The embedded segment is expected to witness the fastest growth over the forecast period. The growing traction towards connected vehicles and vehicle manufacturing installing embedded GPS telematics technology directly in the vehicles enables fleet managers to access data related to vehicles in their devices easily. With increasing internet penetration in Asia, the use of telematics in passenger and commercial vehicles is expected to witness growth opportunities, as expanding e-commerce and logistics trade in Asia and growing demand for shared mobility are increasing the demand for telematics adoption.

Solution Insights

The component segment accounted for the largest revenue share of over 57% in 2022. The increasing integration of embedded telematics systems, advancements in telematics control units, and the implementation of smart transportation systems for enhancing vehicle connectivity are driving market expansion. Furthermore, the growing incorporation of aftermarket telematics in existing buses and trucks is likely to drive industry growth. Market players are further developing telematics modules that are compatible with 5G connectivity and can operate in different weather conditions, further contributing to maintaining segmental share.

The service segment is expected to witness the fastest growth over the forecast period.Commercial vehicle manufacturers are attempting to build adaptive tracking systems that can monitor fuel usage costs and track information. Improved automotive telematics developed by telematics service providers and manufacturers will enable automation repairs and maintenance monitoring, as well as new and renewal registration and licensing of the vehicle is driving the segmental growth.The service providers are offering longer trial periods and custom subscription services, which is further driving segmental growth of the service segment.

Vehicle Insights

In 2022, the passenger vehicle segment accounted for the largest market share exceeding 76% of the APAC automotive telematics market. The growing consumer preference for luxurious, comfortable, and secure cars with wireless connectivity is driving the deployment of telematics in the passenger vehicle segment. Remote unlocking & locking, and temperature control are some of the advanced features available through the integration of advanced automotive telematics systems in vehicles; these features improve the level of comfort, thus providing an enhanced driving experience to the consumer. Moreover, through telematics, the safety of vehicles is also improved.

The commercial vehicle segment is expected to witness the fastest growth over the forecast period. Long-distance or cross-country trucks are increasingly using automobile telematics systems to track their locations, internal vehicle systems, and speed. Furthermore, collecting data regarding driver breaks, idle time, service hours, fuel economy, and tracking driver behaviour, which is frequently employed by insurance firms, contributes to segmental growth.

Sales Channel Insights

The OEM segment accounted for the largest market share in terms of revenue, exceeding 66% in 2022. The increasing emphasis of automobile manufacturers on integrating modern telematics systems in incoming vehicles to coordinate them with insurance premium businesses and increase driver and passenger safety is leading to a high segmental share.The OEM is partnering with passenger and commercial vehicle manufacturers to provide telematics modules and software services that can be integrated with the vehicle’s connected apps for seamless fleet management.

The aftersales segment is expected to witness the fastest CAGR over the forecast period. The segmental growth is attributed to the low-cost deployment of telematics through third-party sellers. Moreover, increasing retrofitting of telematics systems in older models of commercial and passenger vehicles by fleet operators is further driving segmental growth. OEMs operating in the market are expanding their footprint in the aftersales segment, by launching aftermarket product lines and services.

Application Insights

The fleet management segment accounted for the largest market share exceeding 32% in 2022.The segmental growth is attributed to factors such as the growing transport and logistics industry and the use of shared mobility as a public transport option. The development in highway infrastructure, coupled with the increasing use of private bus transportation services for intra and intercity commuting, is also driving segmental growth. Fleet management carries advantages such as enhanced driver safety, vehicle performance, fleet routing scheduling, and maintenance planning.

The safety and security segment is expected to witness the fastest growth over the forecast period. Governments in Asia Pacific countries are actively introducing regulations mandating the inclusion of ADAS to reduce road accidents. The raising concerns of drivers and pedestrian safety ADAS plays an integral role in alerting drivers and fleet managers about an imminent danger. The integration of ADAS and telematics together has the potential to reduce the risk of road fatalities and accidents owing to accurate analysis.

Country Insights

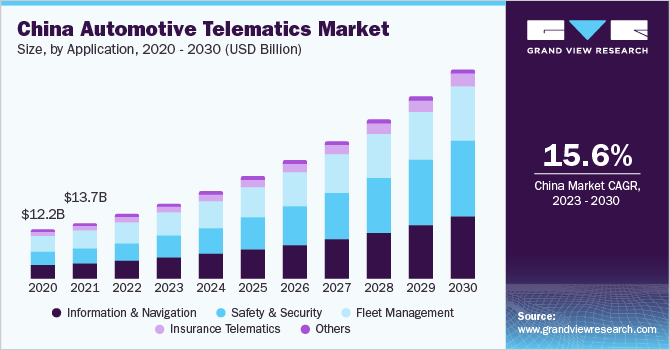

China accounted for the largest revenue share exceeding 55% in 2022. The growth is attributed to factors such as rising sales of electric vehicles in the region, including telematics devices in off-road construction equipment fleets, increasing integration of OEM embedded telematics systems in cars, and increasing internet and smartphone penetration in the region. Asia is a hub of the major automobile manufacturers in the world; moreover, the growing traction towards vehicle fleet insurance is another factor driving the growth.

China is expected to witness the fastest growth over the forecast period. The country-level growth is driven by factors such as government mandates to install telematics devices, increasing deployment of telematics in lower segment cars, development of road infrastructures, and deployment of telematics systems in two and three-wheelers. The increasing traction of e-commerce logistics delivery is also prompting logistics service providers to equip their vehicles with telematics devices.

Key Companies & Market Share Insights

The APAC automotive telematics market is highly fragmented, and the use of telematics is gaining traction in the region. Major players are initiatives such as partnerships, product launches, mergers & acquisitions, expansions, and investments. For instance, in August 2023, Shenzhen Jimi IoT Co., Ltd. announced the launch of the VL101G INS-Aided Vehicle Tracker, the 4G connectivity-based tracker is equipped with dual-frequency GPS and GNSS positioning technology designed to provide accurate and real-time location of the vehicles for efficient fleet management.

The tracker also has a TE communication with 2G fallback ensuring proper connectivity in weak network areas. The inertial navigation system transmits information regarding data related to the vehicle location, driver behavior, and fuel level. The market players focus on expanding their reach in the aftermarket by developing an aftermarket product portfolio and software services. To maintain their market dominance, the players are also differentiating themselves by providing custom subscription services, longer trial periods, and different subscription packages catering to different customer bases. Some prominent players in the Asia-Pacific automotive telematics market include:

-

Concox Information Technology Co. Ltd

-

Guangzhou Xingwei Information Technology Co. Ltd

-

HARMAN International.

-

MiX Telematics Ltd

-

Shenzhen Huabao Electronic Technology Co. Ltd

-

Suntech International

-

Tata Consultancy Services Ltd

-

Tech Mahindra Limited

-

Teletrac Navman

-

Trimble Inc.

Asia-Pacific Automotive Telematics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 32.94 billion

Revenue forecast in 2030

USD 91.76 billion

Growth rate

CAGR of 15.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, solution, vehicle, sales channel, application, country

Regional scope

Asia Pacific

Country scope

China; India; Japan; South Korea; Australia

Key companies profiled

Guangzhou Xingwei Information Technology Co. Ltd; Shenzhen Huabao Electronic Technology Co. Ltd; MiX Telematics Ltd; Concox Information Technology Co. Ltd; Trimble Inc.; Tata Consultancy Services Ltd; Tech Mahindra Limited; HARMAN International; Suntech International; Teletrac Navman

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia-Pacific Automotive Telematics Market Report Segmentation

The report forecasts revenue growth at regional and country levels and analyzes the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia-Pacific automotive telematics market report based on technology, solution, vehicle, sales channel, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Embedded

-

Tethered

-

Integrated

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Component

-

Service

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger

-

Commercial

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Information & Navigation

-

Safety & Security

-

Fleet Management

-

Insurance Telematics

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia-Pacific automotive telematics market size was estimated at USD 28.37 billion in 2022 and is expected to reach USD 32.94 billion in 2023.

b. The Asia-Pacific automotive telematics market is expected to witness a compound annual growth rate of 15.8% from 2023 to 2030 to reach USD 91.76 billion by 2030

b. China accounted for the largest revenue share exceeding 55% in 2022. The growth is attributed to factors such as rising sales of electric vehicles in the region, including telematics devices in off-road construction equipment fleets, increasing integration of OEM embedded telematics systems in cars, and increasing internet and smartphone penetration in the region.

b. Some key players operating in the Asia-Pacific automotive telematics market include Guangzhou Xingwei Information Technology Co. Ltd; Shenzhen Huabao Electronic Technology Co. Ltd; MiX Telematics Ltd; Concox Information Technology Co. Ltd; Trimble Inc.; Tata Consultancy Services Ltd; Tech Mahindra Limited; HARMAN International; Suntech International; Teletrac Navman.

b. Factors such as increasing penetration of internet services, faster adoption of smartphones, use of shared mobility fleets for commuting, and expanding e-commerce logistics, and delivery are augmenting the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."