- Home

- »

- Medical Devices

- »

-

Ambulance Services Market Size And Share Report, 2030GVR Report cover

![Ambulance Services Market Size, Share & Trends Report]()

Ambulance Services Market Size, Share & Trends Analysis Report By Transport Vehicle (Ground Ambulance, Air Ambulance), By Emergency Services, By Equipment, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-052-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Ambulance Services Market Size & Trends

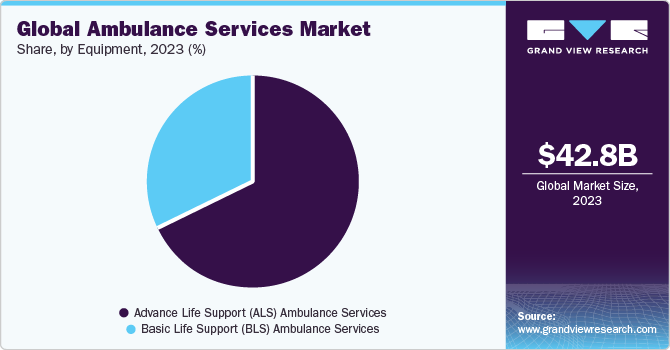

The global ambulance services market size was estimated at USD 42.78 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.90% from 2024 to 2030. The demand for ambulance services has increased due to rising incidence of traumatic accidents, an increase in a number of people suffering from various chronic diseases, and a rise in geriatric population. In addition, rise in medical tourism and availability of reimbursement policies are also expected to boost the demand for global market over the forecast period.

The presence of a large population pool over 60 years, which typically has a lower immunity level and is prone to neurological diseases, cardiac problems, cancer, and spinal injuries, is also expected to be a high impact rendering driver for the growth of the market over the forecast period. For instance, as per a report by United Nations, Department of Economic and Social Affairs, published in 2023, approximately 1 in every 6 people in the world are expected to be over 65 years of age by 2050. Moreover, as per similar source, there were 761 million people who were above 65 years of age globally in 2021. Hence, increasing geriatric population is likely to result in the market growth.

Medical tourism is also rising due to developments in healthcare infrastructure and advanced reimbursement policies. For instance, according to HealthCare, Inc., around 787,000 Americans are estimated to travel abroad for medical and dental treatment in 2022. Similarly, as per The American Journal of Medicine, the number of U.S. medical tourists & number of medical tourist in the world is expected to increase by around 25% every year. Furthermore, as per Consulate General of India, India has emerged as top 6 medical tourism site globally in recent years. Therefore, due to the growth of medical tourism, ambulance services may be required in the travel destination to transport patients to their venue of treatment. This is expected to boost market growth.

The COVID-19 pandemic has positively impacted the market due to elevated usage of ambulance services in this period. For instance, as per Quartz India, Accretion Aviation witnessed a growth of 20% during the COVID-19 pandemic. However, with decline in a number of COVID-19 patients, the need for ambulance service is anticipated to reduce, thereby the market is expected to foresee a slightly negative impact in the year 2022-2023. Even though the market declined, it is anticipated to witness a significant CAGR over the forecast period. This can be attributed to increase in number of ambulances during the COVID-19 period. For instance, according to the Mint, Ziqitza Healthcare was going to provide 200 additional ambulances to the Madhya Pradesh government during the time of COVID-19. Thus, aforementioned factors are expected to be responsible for the market growth.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The market is characterized by a moderate-to-high degree of growth. Key drivers include the global rising prevalence of chronic diseases, surge in incidence of traumatic accidents and growing geriatric population across the globe. Advancements in medical technology, communication systems, and vehicle design advance the efficacy and effectiveness of ambulance services. For example, GPS navigation systems and telemedicine capabilities enable faster response times and better patient care. These factors further shape the market dynamics.

Key strategies implemented by players in the market are new product launches, expansion, mergers & acquisitions, partnerships, and other strategies. In January 2024, LifeLine Ambulance Service announced the acquisition of Liberty Ambulance Service. The strategic acquisition of Liberty Ambulance Service marks a significant milestone for LifeLine-EMS, as it broadens its reach and improves its capabilities in providing both non-emergency and emergency medical transportation services.

The ambulance services are increasingly incorporating telemedicine capabilities, allowing emergency medical personnel to consult with healthcare professionals remotely. This enables faster diagnosis and treatment decisions, improving patient outcomes.Moreover, ambulances are being equipped with advanced medical equipment and technology to enhance patient care during transportation. This includes features such as cardiac monitors, ventilators, point-of-care testing devices, and advanced life support systems. Nonetheless, ambulance services are utilizing data analytics and performance monitoring tools to track key performance indicators, optimize resource allocation, and identify areas for improvement in service delivery. This data-driven approach helps enhance operational efficiency and patient care quality.

Regulations have a significant impact on the market, influencing various aspects of service delivery, safety standards, quality of care, and reimbursement models. Ambulance services must adhere to licensing and certification requirements mandated by regulatory agencies, such as state health departments or national regulatory bodies. Some regulatory agencies establish response time requirements for ambulance services, specifying the maximum allowable time for emergency medical personnel to reach patients after receiving a call for assistance. Ambulance services must comply with Health Insurance Portability and Accountability Act (HIPAA) regulations and patient privacy laws to protect patient confidentiality and safeguard personal health information.Overall, regulations play a critical role in shaping the market by establishing standards for safety, quality, reimbursement, and accountability.

Companies are actively acquiring development-stage firms to broaden their product portfolios, catering to a larger patient base. These collaborative efforts aim to strengthen relationships and improve the implementation of clinical programs pitched towards reducing hospitalizations for members. For instance, in September 2023, Acadian Ambulance Service announced the accomplishment of an agreement to acquire considerably all of the assets of St. Landry EMS.This acquisition allows Acadian to operate four additional units and recruit 35-40 new personnel, bolstering services in the Hub City and Central Louisiana regions.Both firms' commitments to providing great emergency medical care remain unwavering, and this deal is expected to further enhance their ability to serve communities better.

The market comprises a large number of ambulance service providersespecially in regions with diverse healthcare systems and multiple providers, which leads to a highly fragmented market scenario. Many ambulance services are provided by local or regional entities, including private ambulance companies, municipal fire departments, nonprofit organizations, and hospital-based services. These entities often operate independently, serving specific geographic areas or communities. The ambulance service market features diverse ownership structures, with a mix of public, private, and nonprofit providers. This diversity contributes to fragmentation, as different organizations may have varying service models, priorities, and operational strategies.The structure of the ambulance service market can vary significantly from one region to another based on factors such as population density, healthcare infrastructure, regulatory environment, and funding mechanisms.

Ambulance service companies may pursue regional expansion for several reasons, including capturing market share, diversifying revenue streams, and leveraging economies of scale. This involves forming partnerships, making acquisitions, and adopting localized marketing strategies to establish a stronger presence in key geographical areas. Ambulance service companies may pursue organic growth strategies by establishing new ambulance stations, deploying additional vehicles, and hiring personnel in target regions. This approach requires significant investment in infrastructure, staffing, and marketing to build brand recognition and market presence over time. Further, securing contracts with healthcare systems, hospitals, or government agencies in new regions can drive regional expansion for ambulance service companies.

Market Dynamics

The constant surge in traumatic accidents globally, is expected to impel the market growth. For instance, as per a report by the WHO, published in June 2022, around 1.3 million people die each year due to road traffic crashes. Rise in road accidents increase the demand for ambulance services, thereby impelling the market growth for ambulance services, during the forecast period.

Cardiovascular diseases such as congestive heart failure, stroke, cardiac arrest, and coronary artery diseases, require immediate emergency medical services and medical attention. According to the World Heart Federation, cardiovascular diseases accounted for 20.5 million deaths in 2021 globally. As per CDC, every year, approximately 735,000 cases of heart attack are reported in the U.S. As per British Heart Foundation, there are approximately 200,000 hospital visits every year due to heart attacks, which is, one visit every three minutes. It also reported that every year approximately 40,000 deaths are expected to take place due to stroke in the UK CVD is among the leading causes of death in the world and usually requires immediate medical attention, which increases the need for ambulance services. Therefore, rising incidence of cardiovascular diseases is expected to boost the market growth.

Transport Vehicle Insights

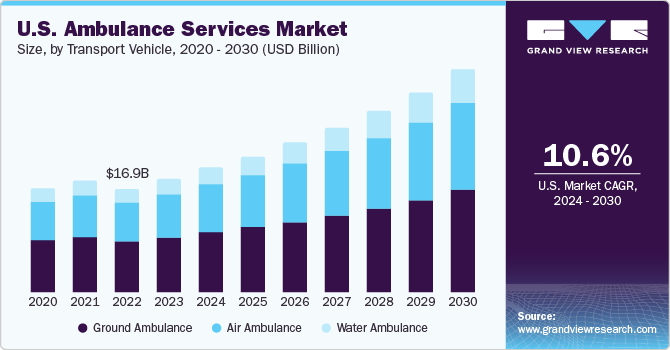

Based on transport vehicle, the ground ambulance segment led the market with the largest revenue share of 72.39% in 2023. Ground ambulance includes van or pickup trucks, car/SUV, motorcycle, bicycle, all-terrain vehicles, golf cart, and bus. Rising cases of cardiovascular disorders in this region is anticipated to impel the segment growth. For instance, as per CDC, every 30 seconds, one person dies in the U.S. due to cardiovascular disorder. Moreover, as per similar source, around 18.2 million people aged 20 and above have coronary artery disease in the U.S. Similarly, rising geriatric population in this region is expected to drive the segment growth further. For instance, according to Statistics Canada, the number of people aged 85+ increased by around 12% during the year 2016-2021. Thus, due to aforementioned factors, the ground ambulance segment is expected to dominate the market.

The air ambulance segment is anticipated to witness the fastest CAGR of 11.50% during the forecast period. Increasing cases of various accidents is expected to increase the use of air ambulance, thereby propelling the segment growth. For instance, as per Association for Safe International Road Travel, more than 46,000 people in the U.S. die every year due to road accidents, whereas, more than 4.4 million people are seriously injured. Air ambulance services are faster than ground ambulance and water ambulance services and can quickly reach remote areas where ground and water ambulance services are unable to reach. Thus, the aforementioned factors are anticipated to help the segment growth.

Emergency Services Insights

Based on emergency services, the emergency services segment led the market with the largest revenue share of 62.09% in 2023. The segment is anticipated to witness a considerable growth over the forecast period.The growth of the emergency services segment can be attributed to the prevalence of cardiovascular diseases such as cardiac arrest, stroke, and congestive heart failure and rising cases of COVID-19 across the globe.

The emergency ambulance services are provided to patients with acute injury or illness and to those who are in urgent need of medical attention. For instance, according to Heart and Strokes Organization, Canada, every year, approximately 35,000 people in Canada suffer from cardiac arrest, whereas, this number increases to around 62,000 people suffering from stroke every year. In addition, according to statistics by CDC, around 3.4 million people in the U.S. suffer from epilepsy. Similarly, as per Government of Canada, the number of injuries tallied up to about 101,572 in 2020. Moreover, as per UC Davis Health about 39,707 deaths occur in the U.S. due to firearm related accidents. Thus, people suffering from emergency healthcare situations and various traumatic accidents are expected to boost the segment growth over the forecast duration.

Nonemergency ambulance services are primarily for the transportation of pediatric and bariatric patients, transportation of patients from one healthcare facility to another, for patients requiring daycare treatments, and transportation of discharged patients from hospital to home. The segment is expected to witness the significant CAGR of 9.38% during the forecast period. Increasing number of geriatric populations in this region is expected to drive the segment growth. For instance, as per a United Health Foundation report (published in May 2023), more than 55.8 million adults aged 65 and older lived in the U.S., accounting for about 16.8% of the nation's population in 2021. Thus, due to tremendous growth in the geriatric population, coupled with rising number of discharged patients, the segment is anticipated to witness a fastest CAGR over the forecast period.

Equipment Insights

Based on equipment, the advance life support ambulance services segment held the market with the largest revenue share of 69.70% in 2023. Increase in number of people suffering from cardiac arrest is expected to boost the ALS segment over the forecast period. For instance, as per St. John Ambulance, Canada, approximately, 40,000 people in Canada suffer from cardiac arrest. Moreover, according to Sudden Cardiac Arrest Foundation, approximately 356,000 out-of-hospital cardiac arrests occur in the U.S. every year, which are around 1,000 people every day.

In addition, the rise in COVID-19 patients has helped the ALS segment propel over the past few years. For instance, according to Worldometer, the total COVID-19 cases in the U.S. have tallied up to 83,437,158 as of May 06, 2022. Patients suffering from COVID-19 are in continuous need of ventilator. Moreover, if a person suffers from additional comorbidities, continuous cardiac monitoring is required. The ALS provides patients with continuous cardiac monitoring and ventilator support along with emergency medical technician. Hence, as a result of aforementioned factors, the segment is expected to dominate the market.

The Basic Life Support (BLS) is anticipated to grow at the fastest CAGR of 8.63% during the forecast period. Rising incidence rate of acute illness such as asthma attack, bronchitis, burns, heart attacks, pneumonia is expected to drive the segment growth. For instance, as per American Thoracic Society, approximately 1.0 million adults in the U.S. are admitted in the hospital to treat pneumonia, whereas, 50,000 people from pneumonia.

Moreover, as per data by the WHO, around 3.24% people died due to influenza, pneumonia in Canada. Similarly, rising number of burn incidence is further increasing the use of BLS ambulance. For instance, according to U.S. Fire Administration, in 2021, fire death rate in the U.S. was 13.0 deaths per million populations. Similarly, according to the Joye Law Firm, on an average, about 450,000 burn injuries are registered in the U.S. alone.

Regional Insights

North America dominated the market with the revenue share of 48.31% in 2023. The growth can be attributed to factors such as presence of several key market players in this region, growing demand for high-quality healthcare services, well-established healthcare infrastructure, and favorable reimbursement policies and regulatory reforms in the healthcare sector. For instance, in February 2019, the U.S. Department of Health and Human Services (HHS), Center for Medicare and Medicaid Innovation (Innovation Center), announced a new payment model for emergency ambulance services that aims to allow Medicare Fee-For-Service (FFS) beneficiaries to obtain the most appropriate level of care at the right time and place with the potential for lower out-of-pocket costs. All of these reimbursement regulations make ambulance services accessible for the patient population, hence propelling the market growth.

The U.S. market is expected to grow the fastest CAGR over the forecast period, due to healthcare infrastructure development, technological advancements, public awareness campaigns, government support, and changes in reimbursement policies.

The Europe market was identified as a lucrative region in this industry.The European market is a rapidly growing sector within the healthcare industry. It is a crucial part of the emergency medical services (EMS) sector, which provides critical care and transportation to patients in emergencies. Various regulations on ambulance care have been implemented in most European nations to improve the quality of services. In addition, most European nations have incorporated quality indicators for regulating the quality of ambulance services. The focus of European healthcare policy on quality improvement and providing patient-centric care also drives the growth of healthcare services, such as ambulance services, in this region.

The UK market is a vital part of the healthcare sector, providing emergency medical care and transportation to patients in need. The market is highly competitive, with both public and private ambulance services operating across the country. The NHS ambulance service is the primary provider of ambulance services in the UK, with services provided by 10 NHS ambulance trusts in England, the Scottish Ambulance Service, the Welsh Ambulance Service, and the Northern Ireland Ambulance Service. Private ambulance companies also provide services in the UK, particularly for non-emergency patient transport.

In France, the ambulance services sector has seen several changes and developments in recent years. The demand for ambulance services is rising due to the increasing aging population and increasing incidents of acute and chronic illnesses. Furthermore, ambulance services in France are adopting new technologies, such as telemedicine and mobile health apps, to improve patient care and response times. In combination with these, there is a greater emphasis on training and education in the ambulance services sector in the region and more attention is being given to professional development and continuing education for ambulance staff, which is improving the quality of care provided to patients. The private sector is increasingly participating in this market, which is driving competition and leading to improvements in service quality and efficiency.

The Germany market is expected to grow at the fastest CAGR over the forecast period, due to aging population, increasing demand for emergency medical services, and the need for better integration with other parts of the healthcare system.Furthermore, High healthcare spending in Germany is expected to further boost the market growth. As per the data, in 2020, 67.9 billion euros of health expenditure was financed by government allocations and subsidies in Germany. The Federal Statistical Office addresses that it was a huge increase of 16.3 billion euros, or 31.5%, compared to 2019.

The Asia Pacific market is projected to witness the fastest CAGR of 12.46% during the forecast duration. The growth rate can be attributed to rising geriatric population in countries such as China, India, and Japan. For instance, as per Statistics Bureau of Japan, in 2020, the number of population aged 65+ was tallied up to 36.19 million which contributed around 28.8% of the total population. Similarly, according to the WHO, the geriatric population in China in expected to reach 28% of the total population by 2040, as geriatric population is more susceptible to various ailments, the Asia Pacific region is anticipated to have the fastest CAGR over the forecast period.

The China market is expected to grow at the fastest CAGR over the forecast period, due to presence of large target population and technological advancements. China has developed "smart ambulances" that are equipped with advanced medical equipment, including electrocardiogram (ECG) machines and ultrasound devices, to help paramedics diagnose and treat patients more quickly. In addition, the country has been investing heavily in 5G technology, which has the potential to greatly improve emergency care. 5G can support high-speed data transfer, allowing doctors to remotely monitor and diagnose patients in real time.

China has been increasing its use of air ambulances to transport critically ill or injured patients to hospitals. These air ambulances are equipped with advanced medical equipment and staffed by highly trained medical professionals. The regional government of China has encouraged the development of a rural Emergency Medical Systems (EMS) system and set a deadline of 2025 for the completion of a government-led EMS system plan that serves both urban and rural areas

The rising geriatric population in Japan is likely to drive the demand for ambulance services over the forecast period. According to the article published in the BBC news, in September 2023, the national data of the Japan illustrates that around 29.1% of the 125 million population is aged 65 or older- a record. Moreover, more than one in 10 people in Japan are now aged 80 or older. The elderly population is more susceptible to various diseases and disabilities, which may propel the market for ambulance services in this country.

In addition, Japan is known for its highly advanced technology, and its ambulance services are no exception. Some ambulance services in Japan are equipped with telemedicine technology, which allows doctors to communicate with patients and paramedics in real time. This can be especially helpful in remote or hard-to-reach areas, and it also uses GPS and real-time traffic information to find the quickest and most efficient route to the scene of an emergency.

The Latin America market is expected to grow at a lucrative CAGR over the forecast period. An increase in per capita healthcare spending, prevalence of cardiovascular disorders, and rise in the number of road accidents are expected to boost the market in Latin America. For instance, as per the latest statistics published in Guardian News & Media Limited, around six million injuries, and 130,000 deaths are caused due to road accidents in Latin America. Road fatalities require immediate medical attention and EMS, which in turn propels the market in the region.

Moreover, an increase in the incidence of heart failure also contributes to the market growth. The country has a varied healthcare infrastructure and emergency care centers, with some countries having more advanced systems than others. In many Latin American countries, the government is responsible for providing healthcare services. These services are often offered through a national health system or public hospitals, which provide emergency medical care. The healthcare infrastructure in Latin America varies depending on the country. While some countries have well-equipped hospitals and medical facilities, others may lack basic resources such as medical equipment and supplies.

Advancements in their healthcare system and infrastructure are expected to increase the demand for ambulance services in the region. Moreover, the high prevalence of infectious diseases in African countries makes emergency ambulance services a necessity. For instance, as per the data published by the United Nations Organization, in July 2022, Africa] is experiencing an increasing risk of zoonotic pathogen outbreaks, such as the monkeypox virus, which started in animals and subsequently switched species to infect humans. According to a World Health Organization (WHO) report, the number of zoonotic outbreaks in the region increased by 63% between 2012 and 2022 compared to 2001-2011. While these numbers have risen over the last two decades, there was a notable uptick in 2019 and 2020, when zoonotic infections accounted for roughly fifty percent of all public health occurrences. Ebola Virus Disease and other viral hemorrhagic fevers account for roughly 70% of these outbreaks, with dengue fever, anthrax, plague, monkeypox, and a variety of other diseases making up the remaining 30%.

In addition, increasing government focus on healthcare services in the region further drives the market growth. For instance, in May 2023, the Ministry of Health received two ambulances for use at the National Infectious Disease Center and one land cruiser pickup to support oxygen plant operations from the World Health Organization (WHO) and the government of the Federal Republic of Germany as part of their ongoing efforts to improve the quality of healthcare services in Liberia.

Key Ambulance Services Market Company Insights

Key players are involved in adopting strategies such as merger and acquisitions, partnership, and launching new products to strengthen their foothold in the market. Moreover, considering technological developments in this industry, several industry players are introducing new ambulances and launching new technologies to enhance ambulatory care that might positively impact the industry share in the forecast period.

Key Ambulance Services Companies:

The following are the leading companies in the ambulance services market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these ambulance services companies are analyzed to map the supply network.

- Babcock International Group PLC

- London Ambulance Service NHS Trust

- Acadian Ambulance Service

- BVG

- America Ambulance Service, Inc.

- Falck A/S

- Global Medical Response

- Air Methods Corporation

- Ziqitza Healthcare Limited

- MEDIVIC PHARMACEUTICAL PVT LTD.

Recent Developments

-

In August 2023, Huntsville Hospital merge with HEMSI ambulance service to expand their services throughout northern Alabama

-

In May 2023, Empress EMS has announced the acquisition of Mobile Life Support Services to minimize operational disruption and to ensure consistent quality service for the communities. This joint venture is expected to boost the revenue of the company

Ambulance Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.7 billion

Revenue forecast in 2030

USD 82.4 billion

Growth rate

CAGR of 9.90% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Transport vehicle, emergency services, equipment, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden, Denmark, Norway, Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Babcock International Group PLC; London Ambulance Service NHS Trust; Acadian Ambulance Service; BVG India Limited; America Ambulance Services, Inc.; Falck Global Medical Response; Air Methods Corporation; Ziqitza Healthcare Limited; MEDIVIC PHARMACEUTICAL PVT LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ambulance Services Market Report Segmentation

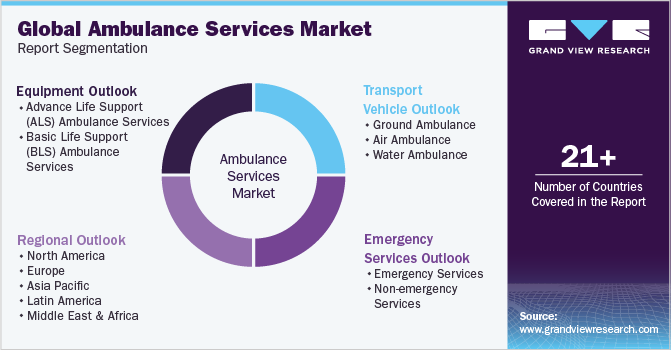

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global ambulance services market report based on the transport vehicle, emergency services, equipment, and region:

-

Transport Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ground Ambulance

-

Air Ambulance

-

Water Ambulance

-

-

Emergency Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Emergency Services

-

Non-Emergency Services

-

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advance Life Support (ALS) Ambulance Services

-

Basic Life Support (BLS) Ambulance Services

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ambulance services market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 82.4 billion by 2030.

b. The global ambulance services market size was estimated at USD 42.78 billion in 2023 and is expected to reach USD 46.7 billion in 2024.

b. The emergency services segment dominated the ambulance services market and held the largest revenue share of 62.9% in 2023. The segment is anticipated to witness a considerable growth rate over the forecast period.

b. The Advanced Life Support (ALS) ambulance services segment dominated the global market and held the largest revenue share of 68.1% in 2022. The segment is anticipated to witness the fastest growth rate over the forecast period.

b. North America dominated the ambulance services market and accounted for the largest revenue share of 48.2% in 2022. The region is expected to witness a CAGR of 10.1% over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."