- Home

- »

- Organic Chemicals

- »

-

Alkyl Polyglucosides Market Size And Share Report, 2030GVR Report cover

![Alkyl Polyglucosides Market Size, Share & Trends Report]()

Alkyl Polyglucosides Market Size, Share & Trends Analysis Report By End-use (Personal Care & Cosmetics, Home Care Products, Industrial Cleaners), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-063-2

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Alkyl Polyglucosides Market Size & Trends

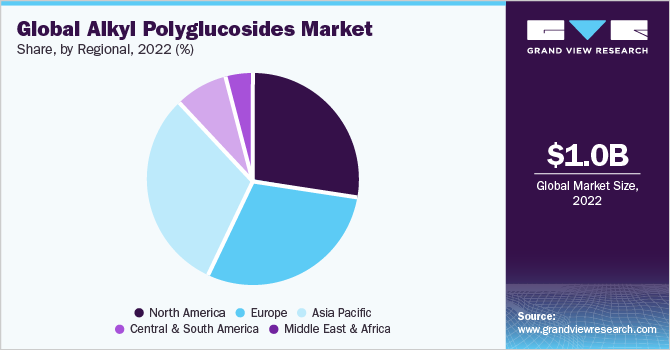

The global alkyl polyglucosides market size was valued at USD 1.0 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. The growth is attributed to the product’s adoption in laundry and personal care applications, owing to its biodegradable nature and usage as an effective alternative to petro-based surfactants. The product market is becoming increasingly popular in the personal care and cosmetic industry due to its excellent surface-active properties and low toxicity. They are used in various products such as shampoos, conditioners, body washes, shower gels, facial cleansers, hand soaps, and sunscreens. APGs are commonly used in shampoos and conditioners as mild surfactants that do not irritate the scalp and provide good foam and viscosity. They are ideal for sensitive skin, as they do not remove natural oils from the skin and provide good foaming and cleansing properties.

APGs are also used in sunscreens for their ability to stabilize active ingredients and improve the product's texture. Overall, APGs are versatile ingredients that are well-suited for a wide range of personal care and cosmetic formulations due to their mildness, excellent surface-active properties, and low toxicity. Furthermore, as the global market is witnessing significant changes in the demand for natural cosmetic brands and products, the overall demand for natural and renewable raw materials such as alkyl polyglucoside is also expected to witness exponential growth over the forecast period.

The market presents several growth opportunities due to the increasing demand for sustainable and eco-friendly products. APGs are widely used in household and industrial cleaning products due to their excellent cleaning properties and eco-friendly properties. APGs can also be used as detergents and emulsifiers in the textile industry. The growing demand for sustainable and eco-friendly textiles presents a significant growth opportunity for APGs in this industry. In addition, APGs can be used in pest control products as a surfactant and wetting agent. Furthermore, APGs can be used as emulsifiers, thickeners, and stabilizers in the food industry. The growing demand for natural and sustainable food ingredients coupled with the increasing demand from the agriculture industry presents a significant growth opportunity for APGs over the forecast period.

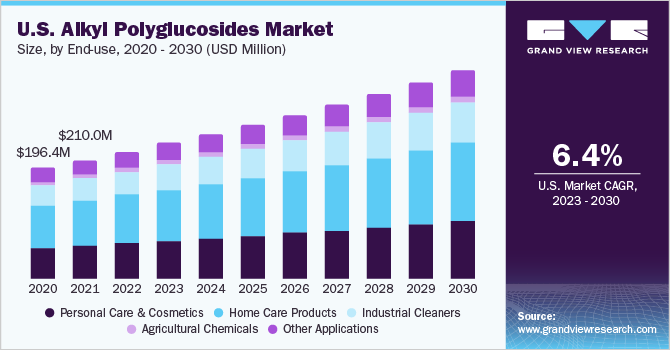

End-use Insights

Home care products dominated the market with a revenue share of more than 38.3% in 2022. The growth is attributed to increasing adoption of products in laundry detergents, dishwashing liquids, and surface cleaners due to their excellent cleaning performance, low toxicity, and biodegradability. The growing use of APGs in homecare products is seen in laundry detergents. For instance, ECOS laundry detergent by Earth Friendly Products is a popular laundry detergent that uses APGs as its primary surfactant.

In addition, APGs are used as primary or co-surfactants in many eco-friendly surface cleaners due to their excellent cleaning performance and low toxicity. For instance, Method All-Purpose Cleaner uses APGs as primary surfactants, along with other natural ingredients, to clean surfaces effectively and safely. Also, it is used in dishwashing liquids. APGs are used as a co-surfactant in many eco-friendly dishwashing liquids due to their ability to boost foam and reduce surface tension. For instance, Ecover Dishwashing Liquid uses APGs in combination with other surfactants to provide effective cleaning power while being gentle on hands and the environment.

Additionally, it is used in a range of agricultural applications, including foliar sprays, seed treatments, and soil treatments. In foliar sprays, APG improves the coverage and efficacy of herbicides and insecticides, while reducing the amount of chemicals required. In seed treatments, it enhances the absorption of nutrients and protects the seeds from fungal and bacterial infections. In soil treatments, APG improves the wetting and dispersal of chemicals, ensuring that they reach the target area and are not washed away by rain or irrigation.

Overall, the use of APG in agricultural chemicals is an effective and sustainable way to improve the performance of chemicals, while reducing their environmental impact and ensuring the safety of workers and consumers.

Regional Insights

Asia Pacific region dominated the market with a highest revenue share of 30.8% in 2022. The growth is attributed to a surge in the demand for alkyl polyglucoside from textile, food & beverages, and oil & gas industries. According to Fashionating World Magazine, Asia Pacific dominated the global textile market with a market value of USD 234.2 billion in 2021. This dominance can be attributed to increasing production of textile products from countries like India, China, Bangladesh, and Pakistan.

These countries are some of the largest exporters of textiles in the world. According to Fiber2Fashion, 72.56% of the imported apparels in the U.K. came from Asia Pacific countries in 2022, registering an increase of nearly 50% compared to 2021. Therefore, the increasing production of textiles in the region coupled with the high consumption of textile and textile-related products in both international and domestic markets is set to have a positive impact on product demand.

In 2022, North America accounted for a considerable revenue share. On account of increasing product demand from the personal care & cosmetics industry. In addition, increasing utilization of alkyl polyglucoside in soaps and detergents and other cleaning products is expected to drive the market, particularly in the U.S. According to ATAMIN KIMYA, alkyl polyglucoside is largely used in soaps due to their superior lather and mildness. Procter & Gamble, Colgate-Palmolive, and Church & Dwight are some of the leading soap manufacturing companies in the U.S.

In addition, the market in North America is driven by the growth in the cosmetics market. According to Forbes, the U.S. accounted for approximately 20% share of the total cosmetics market in 2021. Furthermore, the skincare segment accounted for more than 23% of the total U.S. beauty and cosmetics market, according to Toptal, LLC. The increasing adoption of APG in various skincare products such as sunscreen, moisturizers, and anti-ageing creams & lotions, coupled with overall growth in the U.S. beauty and cosmetic market is anticipated to have a positive impact on the market in North America.

Key Companies & Market Share Insights

The alkyl polyglucoside market is highly competitive, with a few major players dominating the industry. These manufacturers offer a wide range of APGs for various applications, including homecare products. To remain competitive, manufacturers are investing in research and development to improve the performance and sustainability of their APGs and are also expanding their production facilities to meet the growing demand for eco-friendly homecare products.

For instance, BASF SE announced in 2021 that it is expanding its production capacity for APGs in North America. The company is investing in a new production line at its site in Cincinnati, Ohio, to meet the growing demand for eco-friendly homecare products in the region. Some prominent players in the global alkyl polyglucosides market include:

-

Actylis

-

Airedale Chemical Company Limited

-

APL

-

Clariant

-

Croda International Plc

-

Kao Corporation

-

Dow

-

Shanghai Fine Chemical Co., Ltd.

-

BASF SE

-

SEPPIC

Alkyl Polyglucosides Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.07 billion

Revenue forecast in 2030

USD 1.63 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Actylis; Airedale Chemical Company Limited; APL; Clariant; Croda International Plc; Kao Corporation; Dow; Shanghai Fine Chemical Co., Ltd.; BASF SE; SEPPIC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alkyl Polyglucosides Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alkyl polyglucosides market report based on end-use and region:

-

End-use Outlook (Volume, Tons, Revenue, USD Million, 2018 - 2030)

-

Personal Care & Cosmetics

-

Home Care Products

-

Industrial Cleaners

-

Agricultural Chemicals

-

Other Applications

-

-

Regional Outlook (Volume, Tons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alkyl polyglucosides market size was estimated at USD 1.0 billion in 2022 and is expected to reach USD 1.07 billion in 2023.

b. The global alkyl polyglucosides market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 1.63 billion by 2030.

b. North America dominated the alkyl polyglucosides market with a share of 28.3% in 2022. This is attributable to increasing adoption of APG in various skincare products such as sunscreen, moisturizers, and anti-ageing creams & lotions, coupled with overall growth in the regional beauty and cosmetic market.

b. Some key players operating in the alkyl polyglucosides market include Actylis, Airedale Chemical Company Limited, APL, Clariant, Croda International Plc, Kao Corporation, Dow, Shanghai Fine Chemical Co., Ltd., BASF SE, SEPPIC.

b. Key factors that are driving the market growth include adoption of product in laundry and personal care applications, owing to its biodegradable nature and usage as an effective alternative to petro-based surfactants. The product market is becoming increasingly popular in the personal care and cosmetic industry due to their excellent surface-active properties and low toxicity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."