- Home

- »

- Communications Infrastructure

- »

-

Air Traffic Control (ATC) Equipment Market Size Report, 2030GVR Report cover

![Air Traffic Control Equipment Market Size, Share & Trends Report]()

Air Traffic Control Equipment Market Size, Share & Trends Analysis Report By Product, By Application (Commercial Aircraft, Private Aircraft, Military Aircraft), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-286-0

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Air Traffic Control Equipment Market Trends

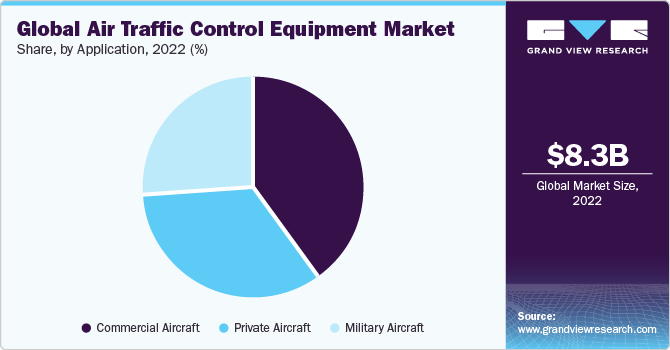

The global air traffic control equipment market size was valued at USD 8.25 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2023 to 2030. Increased aircraft movement and passenger & freight traffic have resulted in the construction of new airports and overhauling existing ones to modernize them and increase their capacity. Airport expansion and modernization require the deployment of air traffic control (ATC) equipment and its sub-systems, which is expected to boost market growth. Replacement of obsolete air traffic control systems is cumbersome as an interruption of air traffic control is not feasible.

Phasing out old air traffic control equipment is thus a gradual process wherein newly installed systems are operated in parallel with the former. High safety requirements in aircraft and technological advancements in components are expected to augment the demand for air traffic control equipment.

High procurement and maintenance costs of air traffic control equipment are expected to hamper air traffic control (ATC) equipment industry growth. Lack of expertise and efficient operations at peak hours will challenge market growth. Microelectronics development has provided expansion opportunities for the air traffic control equipment industry and is expected to be a key growth domain over the forecast period. Advancements in data-processing capabilities have ensured the alteration of data to meet several computational requirements virtually.

Application Insights

The commercial aircrafts segment dominated the market with a revenue share of 39.9% in 2022. As global economies develop and disposable incomes rise, more people opt for air travel. It has led to a higher demand for commercial flights, which puts pressure on air traffic control systems to manage increased air traffic efficiently.

The private aircrafts segment is estimated to register a significant CAGR of 8.4% over the forecast period. Private aircraft offer flexibility and convenience that commercial flights often can't match. Business executives, celebrities, and high-net-worth individuals value the ability to travel on schedule and to destinations that might not be easily accessible by commercial airlines.

Regional Insights

Asia Pacific accounted for the largest market share of 34.1% in 2022. The Asia-Pacific region has been one of the fastest-growing economic regions in the world. This economic growth has increased business and leisure travel, increasing demand for air travel services. Expanding the middle class in countries across the region has increased disposable income and a greater ability to afford air travel. This has translated into higher passenger numbers for both domestic and international flights.

Europe and North America accounted for a considerable revenue share of the air traffic control equipment industry in 2022 due to the increased government efforts to secure air traffic and aircraft. For instance, in June 2023 Federal Aviation Administration (FAA) announced the “Stand Up for Safety” campaign, which would be held on a monthly basis to provide mandatory training for its controller workforce.

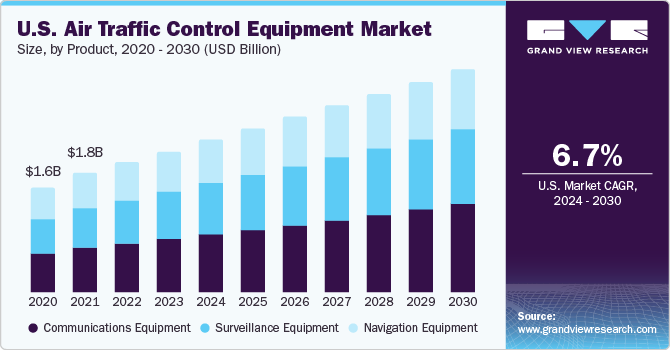

Product Insights

The communication equipment segment held the largest market share of 38.1% in 2022. The replacement rate of obsolete communications equipment has increased due to the improvement of digital data communication due to the ubiquitous use of air traffic control systems.

The surveillance equipment segment is estimated to register a significant CAGR of 8.5% over the forecast period. With the expansion of commercial aviation and the rise in global travel, the volume of air traffic is steadily increasing. Surveillance equipment helps air traffic controllers manage the growing number of aircraft more effectively and safely.

Key Companies & Market Share Insights

The global market for air traffic control equipment comprises many players divided based on product offerings. The players are undertaking forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in March 2022, The Airports Authority of India (AAI) forged a collaborative partnership with the Defense Public Sector Unit (PSU) enterprise, Bharat Electronics Limited (BEL). Their joint objective is to create domestic solutions for managing aircraft movement on airport surfaces and enhancing air traffic management within India. These strategic collaborations are anticipated to empower the involved entities further to consolidate their influence within the market.

Key Air Traffic Control Equipment Companies:

- Cobham Limited

- Advanced Navigation and Positioning Corporation

- BAE Systems

- Endeavor Business Media, LLC.

- L3Harris Technologies, Inc.

- Intelcan Technosystems Inc

- Lockheed Martin Corporation

- Indra

- Northrop Grumman

- Verdict Media Limited.

- RTX

- Thales

- Searidge Technologies

Recent Developments

-

In April 2023, Boeing, a player in aerospace, took a significant step in advancing sustainable aviation technology by expanding its ecoDemonstrator program. The company has introduced a series of specially modified aircraft, called 'Explorer' airplanes, to further its flight testing initiatives. This move underscores Boeing's commitment to developing innovative solutions that address environmental challenges in the aviation industry.

-

In February 2023,Skye Air, a player in the aviation industry, achieved a significant milestone by introducing India's inaugural Traffic Management System designed specifically for drones. This innovation marks a remarkable advancement in unmanned aerial vehicles (UAVs) and aerial mobility. The system addresses a crucial need as the utilization of drones continues to expand across various sectors, including logistics, agriculture, surveillance, and more.

Air Traffic Control Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.07 billion

Revenue forecast in 2030

USD 15.88 billion

Growth rate

CAGR of 8.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Cobham Limited; Advanced Navigation and Positioning Corporation; BAE Systems; Endeavor Business Media, LLC.; L3Harris Technologies, Inc.; Intelcan Technosystems Inc; Lockheed Martin Corporation; indra; Northrop Grumman; Verdict Media Limited.; RTX; Thales; Searidge Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Traffic Control Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global air traffic control equipment market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Communications Equipment

-

Navigation Equipment

-

Surveillance Equipment

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial Aircraft

-

Private Aircraft

-

Military Aircraft

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global air traffic control equipment market size was estimated at USD 8.25 billion in 2022 and is expected to reach USD 9.07 billion in 2023.

b. The global air traffic control equipment market is expected to grow at a compound annual growth rate of 8.3% from 2023 to 2030 to reach USD 15.88 billion by 2030.

b. Asia Pacific dominated the air traffic control equipment market with a share of 33.5% in 2022. This is attributable to increased government efforts to secure air traffic and aircraft.

b. Some key players operating in the Air Traffic Control (ATC) equipment market include Thales Group, Raytheon Company, Searidge Technologies Inc., Northrop Grumman Corp., NavAero Inc., Lockheed Martin Corp., Indra Sistemas SA, Harris Corp., Cobham Plc, and BAE Systems Plc.

b. Key factors that are driving the market growth include increased construction of new airports and overhaul of the existing ones to modernize them and increase their capacity, replacement of obsolete air traffic control systems, and high safety requirements in aircraft.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."