- Home

- »

- Petrochemicals

- »

-

Activated Carbon Market Size, Share & Trends Report, 2030GVR Report cover

![Activated Carbon Market Size, Share & Trends Report]()

Activated Carbon Market Size, Share & Trends Analysis Report By Form (Powdered, Granular), By Type (Liquid Phase, Gas Phase), By End Use (Water Treatment, Automotive), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-073-6

- Number of Report Pages: 158

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Activated Carbon Market Size & Trends

The global activated carbon market size was estimated at USD 4.92 billion in 2023 and is projected to grow at a CAGR of 6.0% from 2024 to 2030.Activated carbon is used to purify liquids and gases in various end-use applications including municipal drinking water, food & beverage processing, and automotive among others. This is attributable to its beneficial properties such as cost effectiveness, easy removal of bad taste, color stability, and quick removal of bad odor.

Stringent regulations related to the maintenance of air quality, coupled with the rise in investments to set up municipal and industrial wastewater treatment plants worldwide, is likely to positively impact the market. They are commonly used in water treatment chemicals due to its ability to remove impurities and contaminants from water. The process of using the product in water treatment involves adsorption, which is the binding of contaminants to the surface of the carbon material.

Drivers, Opportunities & Restraints

Activated carbon finds application in water treatment processes. It is considered to be highly efficient in the process of eliminating chlorine and volatile organic compounds from drinking water. It also removes dissolved radon, lead, and various other odor-causing compounds. They are also considered for their adsorbing capacity, which marked them suitable for water treatment. Water contamination is caused due to agricultural waste, leakage from ground storage tanks, and industrial waste.

The Environmental Protection Agency (EPA) Health Advisory Level (HAL) has kept strict standards toward the exposure of chemicals owing to their toxicity, which leads to adverse effects on human health. These chemicals include benzene, chlorobenzene, vinyl chloride, carbon tetrachloride, and other hazardous substances.

The scarcity of raw materials driven by the increasing demand is expected to result in higher prices quoted by major raw material suppliers. For instance, Coconuts are found near water bodies, and due to the absence of water bodies in the region, the countries in the region are mainly import-dependent and have few domestic product manufacturers. Other factors such as low inventory levels, high operating rates, tight and high-priced supplies of foreign materials, and high-energy costs are expected to have a negative impact on the market and further contribute to higher prices.

Water treatment application of market has witnessed the highest penetration rate as well as a high growth rate. The product market shows high efficiency with organic as well as inorganic particulate removal. Government agencies have recommended using it for purification. These are some of the prime factors responsible for its growth. In addition, stringent rules and regulations on emission levels are forcing manufacturing companies to adopt the product market treatment processes for air purification. Furthermore, these are mainly used in the food industry as a colorant and odor-removal catalyst, which is also expected to create lucrative opportunities for the global market.

Industry Characteristics & Concentration

The activated carbon market is moderately consolidated as some key companies account for its significant share. Emerging economies such as India and China are expected to provide growth opportunities to manufacturers of activated carbon over the forecast period.

Some of the companies are fully integrated through the value chain. For instance, Cabot Corporation has fully integrated their processes from producing raw materials and manufacturing activated carbon to its distribution. Full integration has enabled companies to offset the volatility associated with raw material procurement along with implementing strict quality control parameters on production.

Leading market players, such as Evoqua Water Technologies LLC., Carbon Activated Corporation., Boyce Carbon, Cabot Corporation, Kuraray Co., Jacobi Carbons Group, and Osaka Gas Chemicals Co., Ltd., have a vast distribution network owing to their global presence and are integrated throughout the value chain.

Type Insights & Trends

“Powdered Activated Carbon (PAC) segment is expected to witness growth at 6.3% CAGR”

Powdered activated carbon (PAC) segment held the largest market share in 2023. This type of activated carbon possesses high adsorption capacity and thus is used for numerous applications. It is considered an economical recommended technology for effective removal of effluent organic matter (EfOM) and petroleum hydrocarbons (PhC) from wastewater.

Granular activated carbon (GAC) serves as both an adsorbent and a filter medium in the water treatment process, which involves its selection, placement, and utilization in filter adsorbers. Companies such as Carbon Corporation are significant formulators of granular activated carbon, investing in research and development activities related to it. These companies also carry out the development of high-intensity technological interfaces related to activated carbon.

Application Insights & Trends

“Gas phase segment is expected to witness growth at 6.1% CAGR”

Activated carbon, also known as activated charcoal, is a highly porous form of carbon that is used in gas-phase applications owing to its ability to adsorb gases and vapor. It is typically used in the form of small pellets, granules, or powder in gas-phase applications. Activated carbon is commonly used in gas-phase applications for air purification purposes. It is used in air filters to remove pollutants, such as volatile organic compounds (VOCs), ozone, and other gases. They adsorbs these pollutants as they pass through filters containing it, thereby cleaning the air.

The product market is commonly used in liquid-phase applications for the adsorption process to remove impurities or contaminants from liquids by attracting and retaining them on the surface of carbon material. It has a highly porous structure, which provides a large surface area to facilitate the adsorption process of liquids to take place. Some liquid-phase applications of are water treatment, beverage purification, chemical processing, etc.

End Use Insights & Trends

“Water treatment segment is expected to witness growth at 6.1% CAGR”

Water treatment segment accounted for the largest revenue share of 42.3% of the market in 2023 owing to continuous technological advancements and innovations in water treatment and recycling plants.

The automotive segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributable to the rise in use of the product in the automotive industry. They are an essential component in the automotive industry as it is used in cabin air filters, evaporative emission control canisters, and ultra-capacitors. Granular activated carbon is used in cabin air filters of vehicles to eliminate odor and purify the air inside passenger compartments.

Regional Insights

North America is characterized by the presence of stringent regulations on air and water pollution. This prompts the surged demand for activated carbon in the region as it can remove harmful contaminants from water & air. In addition, government regulatory agencies in North America have suggested the usage of activated carbon for impurity removal from water as well as air.

U.S. Activated Carbon Market Trends

The public drinking water systems in the country that are regulated by the U.S. EPA supply drinking water to 90% of Americans. According to the Centers for Disease Control and Prevention, there are over 155,000 public water systems in the U.S. with approximately 82% of the population relying on these community water systems. The stringent government regulations intended for monitoring the disposal and production of wastewater in the country are predicted to fuel the demand for activated carbon in water treatment applications in the U.S. over the coming years.

Europe Activated Carbon Market Trends

The increasing demand for activated carbon in Europe can be attributed to surged awareness among the masses about pollution hazards, stringent implementation of regulations promoting, and risen demand for the product from the manufacturing sector of the region.

The Germany activated carbon market is expected to witness substantial growth over the forecast period. Food & beverage processing is one of the leading industries in Europe. Countries such as Germany, the UK, Poland, and Spain are some of the top beer producers in the region. The rise in the consumption of beer, soft drinks, and wine in Europe is expected to fuel the demand for activated carbon used in the production of beverages.

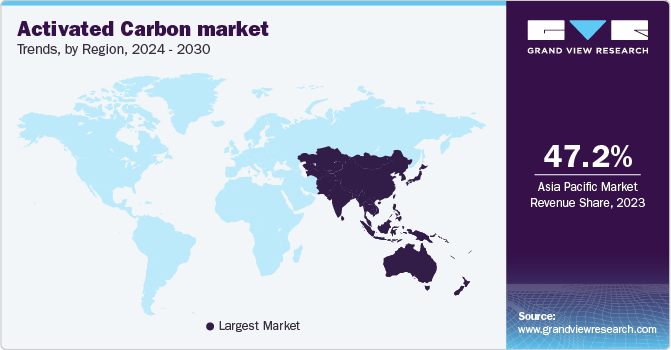

Asia Pacific Activated Carbon Market Trends

“China to witness market growth of CAGR 7.2%”

Asia Pacific is a prominent consumer of activated carbon in the world with revenue share of 49.7% in 2023. The growth of the market in this region can be attributed to the increasing consumption of coconuts and coconut-based activated carbon across key countries such as Indonesia, India, and Sri Lanka.

The China activated carbon market has been experiencing steady growth in recent years due to the increasing demand for air purification. This rising demand has resulted in a higher need for activated carbon, which is a prime component used in air purifiers.

Central & South America Activated Carbon Market Trends

Central & South America is projected to be an emerging market for activated carbon that is expected to grow continuously during the forecast period. Countries such as Brazil and Argentina are promoting the development of new air and water treatment and purification technologies and are supporting innovations in the existing technologies.

Argentina activated carbon market is expected to witness high demand for granular activated carbon and powdered activated carbon through its Integrated Urban Water Management initiative in the coming years. Argentina is known for controlling the quality of water in the region with the use of extremely advanced water management technologies.

Middle East & Africa Activated Carbon Market Trends

The Middle East is the potential market for activated carbon over the forecast period. The increase in concern regarding water sanitation and health & hygiene is resulting in the growth of activated carbon products in the region. The demand for air purification in the region is likely to grow on account of increasing demand from the industrial, residential, and commercial sectors.

Saudi Arabia activated carbon market is witnessing lucrative product demand. The scarcity of water in Saudi Arabia has led to an increase in demand for water for all purposes with limited availability of natural water resources and a rise in the hot climate. According to the National Water Company Qatrah, Saudi Arabia is the third-largest consumer of water in the world, after the U.S. This is expected to result in a rise in demand for activated carbon in water treatment applications. In addition, the demand for water reuse is anticipated to boost in both urban and rural areas of Saudi Arabia.

Key Activated Carbon Company Insights

Some of the key players operating in the market include Kuraray Co., Jacobi Carbons Group, and Osaka Gas Chemicals Co., Ltd. among others.

-

Kuraray Co., Ltd. produces and sells activated carbon, along with other products. Its products are categorized under plastics & polymers, fibers & textiles, chemicals/elastomers & rubber, new businesses, engineering, and medical & environment related categories. The company also has a research and development department, which comprises two research and development centers in Kurashiki and Tsukuba. The company has a significant global presence with offices in countries such as the U.S., Germany, Belgium, China, Korea, Hong Kong, and India.

-

Osaka Gas Chemicals Co., Ltd. is a Japan-based company, which operates through two major business segments, namely, advanced material solutions and absorption & separation solutions. The products of the company are categorized as fine chemical materials, surface processing, resin additives, wood preservatives, industrial preservatives, and activated carbon and its products. Activated carbon products of Osaka Gas Chemicals Co., Ltd. are marketed under the brand, Shirasagi. The company has a product development center and a distribution center in Osaka, Japan. In addition, it also has a technology center in Nara, Japan.

CarbPure Technologies, CarboTech AC GmbH, and Haycarb (Pvt) Ltd., among others, are some of the emerging market participants in the market.

-

CarbPure Technologies, a part of Advanced Emission Solutions, Inc., is a manufacturer and supplier of high-quality activated carbon products. Its products are majorly used in water treatment applications. The company is vertically integrated to ensure a constant and reliable supply of quality products to its customer base. CarbPure Technologies also has research and development centers to introduce new instrumentation required in unique product development techniques. The products of the company are regulated and tested under the American Society for Testing and Materials (ASTM) standards. It also has various supply agreements and partnerships to ensure a constant and quick supply of its products throughout various regions.

-

Carbotech is one of the leading manufacturers and suppliers of granulated, powdered, and extruded activated carbon products. Its products are used in the food & beverages industry, as well as in fluid treatment, hydrogen purification, air & gas purification, water & wastewater treatment, and carbon molecular sieve applications. The production facility of the company is located in the industrial Ruhr conurbation of Germany. Under its sustainability initiatives, Carbotech is shifting its focus from producing powdered activated carbon to granular activated carbon owing to the highly sustainable nature of the latter. The products of the company are Halal, Kosher, and ISO certified and fulfill the REACH requirements.

Key Activated Carbon Companies:

The following are the leading companies in the activated carbon market. These companies collectively hold the largest market share and dictate industry trends.

- CarbPure Technologies

- Boyce Carbon

- Cabot Corporation

- Kuraray Co.

- CarboTech AC GmbH

- Donau Chemie AG

- Haycarb (Pvt) Ltd.

- Jacobi Carbons Group

- Kureha Corporation

- Osaka Gas Chemicals Co., Ltd.

- Evoqua Water Technologies LLC

- Carbon Activated Corporation

- Hangzhou Nature Technology Co., Ltd.

- CarbUSA

- Sorbent JSC

Recent Developments

-

In January 2023, Ningbo Juhua Chemical & Science Co., Ltd. awarded a contract to Technip Energies for a Activated Carbon plant with an annual capacity of 72 kilo tons in Ningbo, Zhejiang, China. This is part of the company’s initiative to expand its petrochemical new material business.

-

In January 2024, Germany-based chemical manufacturer Nordmann acquired Italy-based SD Chemicals S.r.l., a distributor of raw materials catering to the cosmetics industry catering to skin care, hair care and makeup applications. This acquisition will enable Nordmann to expand its presence and enhance customer reach.

Activated Carbon Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.26 billion

Revenue forecast in 2030

USD 7.33 billion

Growth Rate

CAGR of 6.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

CarbPure Technologies; Boyce Carbon; Cabot Corporation; Kuraray Co.; CarboTech AC GmbH; Donau Chemie AG; Haycarb (Pvt) Ltd.; Jacobi Carbons Group; Kureha Corporation; Osaka Gas Chemical Co.; Ltd.; Evoqua Water Technologies LLC.; Carbon Activated Corporation; Hangzhou Nature Technology Co., Ltd.; CarbUSA; and Sorbent JSC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Activated Carbon Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global activated carbon market report based on form, application, end use, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Powdered

-

Granular

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Liquid Phase

-

Gas Phase

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Water Treatment

-

Food & Beverage Processing

-

Pharmaceutical & Medical

-

Automotive

-

Air Purification

-

Other End Use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global activated carbon market size was valued at USD 4.92 billion in 2023 and is expected to reach USD 5.26 billion in 2024.

b. The global activated carbon market is projected to expand at a CAGR of 6.0% during the forecast period to reach USD 7.33 billion by 2030.

b. Water Treatment dominated the activated carbon market with a share of 42.3%. The growth is attributable owing to continuous technological advancements and innovations in water treatment and recycling plants.

b. Key players in the activated carbon market include Cabot Corporation, Jacobi Carbons Group, Boyce Carbon, Osaka Gas Chemical Co. Ltd., and Evoqua Water Technologies LLC., among others.

b. Key factors that are driving the market growth include the increasing demand for purified air and water is also driving the market due to the rising population, higher living standards, and growing concern about environmental pollution.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Activated Carbon Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Activated Carbon Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Outlook

3.3. Price Trend Analysis, 2018 - 2030

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.4.4. Industry Opportunities

3.5. Industry Analysis Tools

3.5.1. Porter’s Five Forces Analysis

3.5.2. Macro-environmental Analysis

Chapter 4. Activated Carbon Market: Type Estimates & Trend Analysis

4.1. Type Movement Analysis & Market Share, 2023 & 2030

4.2. Activated Carbon Market Estimates & Forecast, By Type, 2018 to 2030 (Kilotons) (USD Million)

4.3. Powdered

4.3.1. Activated Carbon Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.4. Granular

4.4.1. Activated Carbon Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.5. Others Types

4.5.1. Activated Carbon Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Activated Carbon Market: Application Estimates & Trend Analysis

5.1. Application Movement Analysis & Market Share, 2023 & 2030

5.2. Activated Carbon Market Estimates & Forecast, By Application, 2018 to 2030 (Kilotons) (USD Million)

5.3. Liquid Phase

5.3.1. Liquid Phase Activated Carbon Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.4. Gas Phase

5.4.1. Gas Phase Activated Carbon Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Activated Carbon Market: End Use Estimates & Trend Analysis

6.1. End Use Movement Analysis & Market Share, 2023 & 2030

6.2. Activated Carbon Market Estimates & Forecast, By End Use, 2018 to 2030 (Kilotons) (USD Million)

6.3. Water Treatment

6.3.1. Activated Carbon Market Estimates and Forecasts, for Water Treatment, 2018 - 2030 (Kilotons) (USD Million)

6.4. Food & Beverage Processing

6.4.1. Activated Carbon Market Estimates and Forecasts, for Food & Beverage Processing, 2018 - 2030 (Kilotons) (USD Million)

6.5. Pharmaceutical & Medical

6.5.1. Activated Carbon Market Estimates and Forecasts, for Pharmaceutical & Medical, 2018 - 2030 (Kilotons) (USD Million)

6.6. Automotive

6.6.1. Activated Carbon Market Estimates and Forecasts, for Automotive, 2018 - 2030 (Kilotons) (USD Million)

6.7. Air Purification

6.7.1. Activated Carbon Market Estimates and Forecasts, for Air Purification, 2018 - 2030 (Kilotons) (USD Million)

6.8. Other End Use

6.8.1. Activated Carbon Market Estimates and Forecasts, for Other End Use, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Activated Carbon Market: Regional Estimates & Trend Analysis

7.1. Regional Movement Analysis & Market Share, 2023 & 2030

7.2. North America

7.2.1. North America Activated Carbon Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.2.2. U.S.

7.2.2.1. Key country dynamics

7.2.2.2. U.S. Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.2.3. Canada

7.2.3.1. Key country dynamics

7.2.3.2. Canada Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.2.4. Mexico

7.2.4.1. Key country dynamics

7.2.4.2. Mexico Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3. Europe

7.3.1. Europe Activated Carbon Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.2. Germany

7.3.2.1. Key country dynamics

7.3.2.2. Germany Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.3. UK

7.3.3.1. Key country dynamics

7.3.3.2. UK Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.4. France

7.3.4.1. Key country dynamics

7.3.4.2. France Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.5. Italy

7.3.5.1. Key country dynamics

7.3.5.2. Italy Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.6. Spain

7.3.6.1. Key country dynamics

7.3.6.2. Spain Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Activated Carbon Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.2. China

7.4.2.1. Key country dynamics

7.4.2.2. China Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.3. India

7.4.3.1. Key country dynamics

7.4.3.2. India Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.4. Japan

7.4.4.1. Key country dynamics

7.4.4.2. Japan Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.5. South Korea

7.4.5.1. Key country dynamics

7.4.5.2. South Korea Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.6. Australia

7.4.6.1. Key country dynamics

7.4.6.2. Australia Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5. Central & South America

7.5.1. Central & South America Activated Carbon Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.2. Brazil

7.5.2.1. Key country dynamics

7.5.2.2. Brazil Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.3. Argentina

7.5.3.1. Key country dynamics

7.5.3.2. Argentina Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6. Middle East & Africa

7.6.1. Middles East & Africa Activated Carbon Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.2. Saudi Arabia

7.6.2.1. Key country dynamics

7.6.2.2. Saudi Arabia Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.3. South Africa

7.6.3.1. Key country dynamics

7.6.3.2. South Africa Activated Carbon Market estimates & forecast, 2018 - 2030 (Kilotons) (USD Million)

Chapter 8. Activated Carbon Market - Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company Categorization

8.3. Company Market Share/Position Analysis, 2023

8.4. Company Heat Map Analysis

8.5. Strategy Mapping

8.6. Company Profiles

8.6.1. CarbPure Technologies

8.6.1.1. Participant’s overview

8.6.1.2. Financial performance

8.6.1.3. Product benchmarking

8.6.1.4. Recent developments

8.6.2. Boyce Carbon

8.6.2.1. Participant’s overview

8.6.2.2. Financial performance

8.6.2.3. Product benchmarking

8.6.2.4. Recent developments

8.6.3. Cabot Corporation

8.6.3.1. Participant’s overview

8.6.3.2. Financial performance

8.6.3.3. Product benchmarking

8.6.3.4. Recent developments

8.6.4. Kuraray Co

8.6.4.1. Participant’s overview

8.6.4.2. Financial performance

8.6.4.3. Product benchmarking

8.6.4.4. Recent developments

8.6.5. CarboTech AC GmbH

8.6.5.1. Participant’s overview

8.6.5.2. Financial performance

8.6.5.3. Product benchmarking

8.6.5.4. Recent developments

8.6.6. Donau Chemie AG

8.6.6.1. Participant’s overview

8.6.6.2. Financial performance

8.6.6.3. Product benchmarking

8.6.6.4. Recent developments

8.6.7. Haycarb (Pvt) Ltd.

8.6.7.1. Participant’s overview

8.6.7.2. Financial performance

8.6.7.3. Product benchmarking

8.6.7.4. Recent developments

8.6.8. Jacobi Carbons Group

8.6.8.1. Participant’s overview

8.6.8.2. Financial performance

8.6.8.3. Product benchmarking

8.6.8.4. Recent developments

8.6.9. Kureha Corporation

8.6.9.1. Participant’s overview

8.6.9.2. Financial performance

8.6.9.3. Product benchmarking

8.6.9.4. Recent developments

8.6.10. Osaka Gas Chemical Co., Ltd.

8.6.10.1. Participant’s overview

8.6.10.2. Financial performance

8.6.10.3. Product benchmarking

8.6.10.4. Recent developments

8.6.11. Evoqua Water Technologies LLC

8.6.11.1. Participant’s overview

8.6.11.2. Financial performance

8.6.11.3. Product benchmarking

8.6.11.4. Recent developments

8.6.12. Carbon Activated Corporation

8.6.12.1. Participant’s overview

8.6.12.2. Financial performance

8.6.12.3. Product benchmarking

8.6.12.4. Recent developments

8.6.13. Hangzhou Nature Technology Co., Ltd.

8.6.13.1. Participant’s overview

8.6.13.2. Financial performance

8.6.13.3. Product benchmarking

8.6.13.4. Recent developments

8.6.14. CarbUSA

8.6.14.1. Participant’s overview

8.6.14.2. Financial performance

8.6.14.3. Product benchmarking

8.6.14.4. Recent developments

8.6.15. Sorbent JSC

8.6.15.1. Participant’s overview

8.6.15.2. Financial performance

8.6.15.3. Product benchmarking

8.6.15.4. Recent developments

List of Tables

Table 1 List of Potential End-Users

Table 2 Regulatory Framework, by Regions

Table 3 List of Raw Material Suppliers

Table 4 U.S. Macroeconomic Outlay

Table 5 Canada Macroeconomic Outlay

Table 6 Mexico Macroeconomic Outlay

Table 7 Germany Macroeconomic Outlay

Table 8 UK Macroeconomic Outlay

Table 9 France Macroeconomic Outlay

Table 10 Italy Macroeconomic Outlay

Table 11 Spain Macroeconomic Outlay

Table 12 China Macroeconomic Outlay

Table 13 India Macroeconomic Outlay

Table 14 Japan Macroeconomic Outlay

Table 15 South Korea Macroeconomic Outlay

Table 16 Brazil Macroeconomic Outlay

Table 17 Argentina Macroeconomic Outlay

Table 18 Saudi Arabia Macroeconomic Outlay

Table 19 South Africa Macroeconomic Outlay

Table 20 Participant's Overview

Table 21 Financial Performance

Table 22 Product Benchmarking

Table 23 Company Heat Map Analysis

Table 24 Key Strategy Mapping

List of Figures

Fig. 1 Activated Carbon Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Production And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Activated Carbon Market Snapshot

Fig. 7 Activated Carbon Market Segmental Outlook, 2023 (Kilotons) (USD Million)

Fig. 8 Activated Carbon Market: Competitive Insights

Fig. 9 Global Activated Carbon Market, 2023 (Kilotons) (USD Million)

Fig. 10 Global Activated Carbon Market Value Chain Analysis

Fig. 11 Activated Carbon Market Dynamics

Fig. 12 Activated Carbon Market: Porter's Five Forces Analysis

Fig. 13 Activated Carbon Market: PESTEL Analysis

Fig. 14 Activated Carbon Market Analysis & Segment Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

Fig. 15 Activated Carbon Market Analysis & Segment Forecast, Powdered Type. 2018 - 2030 (Kilotons) (USD Million)

Fig. 16 Activated Carbon Market Analysis & Segment Forecast, Granular Type, 2018 - 2030 (Kilotons) (USD Million)

Fig. 17 Activated Carbon Market Analysis & Segment Forecast, Other Types, 2018 - 2030 (Kilotons) (USD Million)

Fig. 18 Activated Carbon Market Analysis & Segment Forecast, By Application, 2018 - 2030 (Kilotons) (USD Million)

Fig. 19 Liquid Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 20 Gas Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 21 Activated Carbon Market Analysis & Segment Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Fig. 22 Activated Carbon Market Analysis & Segment Forecast, for Water Treatment Chemicals, 2018 - 2030 (Kilotons) (USD Million)

Fig. 23 Activated Carbon Market Analysis & Segment Forecast, for Food & Beverage Processing, 2018 - 2030 (Kilotons) (USD Million)

Fig. 24 Activated Carbon Market Analysis & Segment Forecast, for Pharmaceutical & Medical, 2018 - 2030 (Kilotons) (USD Million)

Fig. 25 Activated Carbon Market Analysis & Segment Forecast, for Automotive, 2018 - 2030 (Kilotons) (USD Million)

Fig. 26 Activated Carbon Market Analysis & Segment Forecast, for Air Purification, 2018 - 2030 (Kilotons) (USD Million)

Fig. 27 Activated Carbon Market Analysis & Segment Forecast, for Other End Uses, 2018 - 2030 (Kilotons) (USD Million)

Fig. 28 Activated Carbon Market, By Region, 2023 & 2030 (%)

Fig. 29 North America Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 30 U.S. Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 31 Canada Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 32 Mexico Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 33 Europe Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 34 Germany Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 35 UK Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 36 France Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 37 Italy Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 38 Spain Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 39 Asia Pacific Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 40 China Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 41 India Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 42 Japan Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 43 South Korea Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 44 Australia Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 45 Central & South America Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 46 Brazil Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 47 Argentina Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 48 Middle East & Africa Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 49 Saudi Arabia Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 50 South Africa Activated Carbon Market Analysis & Segment Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 51 Activated Carbon Market: Company Categorization

Fig. 52 Activated Carbon Market: Company Market Share Analysis

Fig. 53 Activated Carbon Market: Company Market Positioning Analysis

Fig. 54 Activated Carbon Market: Strategy MappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Activated Carbon Type Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

- Powdered

- Granular

- Other Types

- Activated Carbon Application Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

- Liquid Phase

- Gas Phase

- Activated Carbon End Use Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Use

- Activated Carbon Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

- North America

- North America Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- North America Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- North America Activated Carbon Market, By End Use

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- U.S.

- U.S. Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- U.S. Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- U.S. Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- U.S. Activated Carbon Market, By Type

- Canada

- Canada Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Canada Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Canada Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Canada Activated Carbon Market, By Type

- Mexico

- Mexico Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Mexico Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Mexico Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Mexico Activated Carbon Market, By Type

- North America Activated Carbon Market, By Type

- Europe

- Europe Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Europe Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Europe Activated Carbon Market, By End Use

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Germany

- Germany Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Germany Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Germany Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Germany Activated Carbon Market, By Type

- UK

- UK Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- UK Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- UK Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- UK Activated Carbon Market, By Type

- France

- France Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- France Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- France Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- France Activated Carbon Market, By Type

- Italy

- Italy Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Italy Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Italy Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Italy Activated Carbon Market, By Type

- Spain

- Spain Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Spain Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Spain Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Spain Activated Carbon Market, By Type

- Europe Activated Carbon Market, By Type

- Asia Pacific

- Asia Pacific Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Asia Pacific Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Asia Pacific Activated Carbon Market, By End Use

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- China

- China Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- China Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- China Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- China Activated Carbon Market, By Type

- India

- India Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- India Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- India Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- India Activated Carbon Market, By Type

- Japan

- Japan Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Japan Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Japan Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Japan Activated Carbon Market, By Type

- South Korea

- South Korea Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- South Korea Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- South Korea Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- South Korea Activated Carbon Market, By Type

- Australia

- Australia Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Australia Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Australia Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Australia Activated Carbon Market, By Type

- Asia Pacific Activated Carbon Market, By Type

- Central & South America

- Central & South America Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Central & South America Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Central & South America Activated Carbon Market, By End Use

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Brazil

- Brazil Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Brazil Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Brazil Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Brazil Activated Carbon Market, By Type

- Argentina

- Argentina Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Argentina Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Argentina Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Argentina Activated Carbon Market, By Type

- Central & South America Activated Carbon Market, By Type

- Middle East & Africa

- Middle East & Africa Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Middle East & Africa Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Middle East & Africa Activated Carbon Market, By End Use

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Saudi Arabia

- Saudi Arabia Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- Saudi Arabia Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- Saudi Arabia Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- Saudi Arabia Activated Carbon Market, By Type

- South Africa

- South Africa Activated Carbon Market, By Type

- Powdered

- Granular

- Other Types

- South Africa Activated Carbon Market, By Application

- Liquid Phase

- Gas Phase

- South Africa Activated Carbon Market, By Function

- Water Treatment

- Food & Beverage Processing

- Pharmaceutical & Medical

- Automotive

- Air Purification

- Other End Uses

- South Africa Activated Carbon Market, By Type

- Middle East & Africa Activated Carbon Market, By Type

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

Grand View Research employs a comprehensive and iterative research methodology focused on minimizing deviance to provide the most accurate estimates and forecasts possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation which looks market from three different perspectives. Critical elements of the methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For a comprehensive understanding of the market, it is essential to understand the complete value chain, and to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia, and trade journals. Technical data is also gathered from an intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, and pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression, and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, industry experience, and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of the technology landscape, regulatory frameworks, economic outlook, and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restraints, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts, and buyers to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation but also provide critical insights into the market, current business scenario, and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market-leading companies

• Raw material suppliers

• Product distributors

• BuyersThe key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight into the current market and future expectationsData Collection Matrix

Perspective

Primary research

Secondary research

Supply-side

- Manufacturers

- Technology distributors and wholesalers

- Company reports and publications

- Government publications

- Independent investigations

- Economic and demographic data

Demand-side

- End-user surveys

- Consumer surveys

- Mystery shopping

- Case studies

- Reference customers

Industry Analysis MatrixQualitative analysis

Quantitative analysis

- Industry landscape and trends

- Market dynamics and key issues

- Technology landscape

- Market opportunities

- Porter’s analysis and PESTEL analysis

- Competitive landscape and component benchmarking

- Policy and regulatory scenario

- Market revenue estimates and forecast up to 2030

- Market revenue estimates and forecasts up to 2030, by technology

- Market revenue estimates and forecasts up to 2030, by application

- Market revenue estimates and forecasts up to 2030, by type

- Market revenue estimates and forecasts up to 2030, by component

- Regional market revenue forecasts, by technology

- Regional market revenue forecasts, by application

- Regional market revenue forecasts, by type

- Regional market revenue forecasts, by component

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."