- Home

- »

- Organic Chemicals

- »

-

Acrylonitrile Market Size, Share And Trends Report, 2030GVR Report cover

![Acrylonitrile Market Size, Share & Trends Report]()

Acrylonitrile Market Size, Share & Trends Analysis Report By Application (Acrylic Fibers, Adiponitrile, Styrene Acrylonitrile, ABS, Acrylamide, Carbon Fiber, Nitrile Rubber, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-871-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Acrylonitrile Market Size & Trends

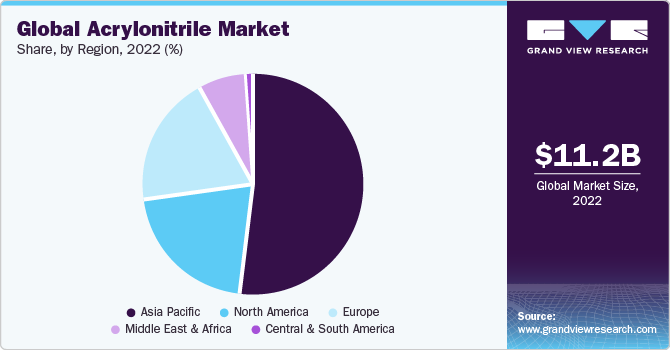

The global acrylonitrile market size was valued at USD 11.19 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.2% from 2023 to 2030. The increasing demand for acrylonitrile from end-use industries, such as automotive and construction, is expected to drive the industry. Due to the growing construction industry, the consumption of acrylonitrile is increasing, which is projected to positively influence industry growth. Acrylonitrile is used in producing derivatives, such as acrylonitrile butadiene styrene, acrylic fiber, acrylamide, carbon fiber, and nitrile rubber, which are being utilized in the construction industry. As the plastics made using the product show many properties, such as chemical resistance, durability, high strength, and thermal stability, acrylonitrile is expected to witness high demand in the near future.

The product demand is also increasing in the consumer appliances industry as it showcases properties, such as heat resistance and chemical resistance. Changing lifestyles, growing consumer preferences, and increasing per capita income are expected to drive the demand for the consumer appliances market, which, in turn, will fuel the demand for acrylonitrile in the consumer appliances industry. The growth in the automotive industry is also projected to increase the consumption of acrylonitrile. Due to its low weight and high strength & durability at low temperatures, it is widely used in the automotive industry. Acrylic fibers have high demand, especially in the automotive industry, which is further estimated to contribute to the industry's growth.

The demand for acrylonitrile is increasing due to the increasing use of acrylic fibers. Moreover, growing textile and garment industries in Asia Pacific, as a result of rapid urbanization, will also support industry development. Acrylic fibers have a strong resistance to microbiological attack, UV deterioration, and laundry bleach. These fibers are excellent choices for clothes as they are lightweight. It is the main raw material used for manufacturing acrylic fibers. Due to the lightweight and high performance of acrylic fiber, it is used in the textile & garment industry. However, the demand may be reduced due to the introduction of new, inexpensive polyester fibers. It is also anticipated that the preference for bio-based polymers, particularly in developed economies, will hamper the acrylic fibers’ demand.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 52.0% in 2022. This is attributed to the increasing demand for building materials on account of the growing construction sector. Furthermore, rising demand from the textile and home furnishing industries is expected to positively influence the segment. The developing countries of Asia Pacific, such as India and China, are focusing on the construction of commercial and new residential buildings, and this trend is expected to increase in the future. Factors, such as the high demand for efficient building materials and advances in civil construction, also drive the regional market.

The leading players have a strong presence in the Asia Pacific region and continue to invest in organic growth through joint ventures and licensing agreements. The shifting of end-use industries, such as automotive, marine, and furniture, to cost-competitive countries, is driving the ABS segment in these countries.

The North American acrylonitrile market is anticipated to grow at a CAGR of 2.3% over the forecast period. North America is expected to witness significant growth owing to the strong presence of key companies, such as Ascend Performance Material in the U.S. The prime focus of the aforementioned companies on new product developments in automobile products and construction products is expected to promote industry growth over the forecast period.

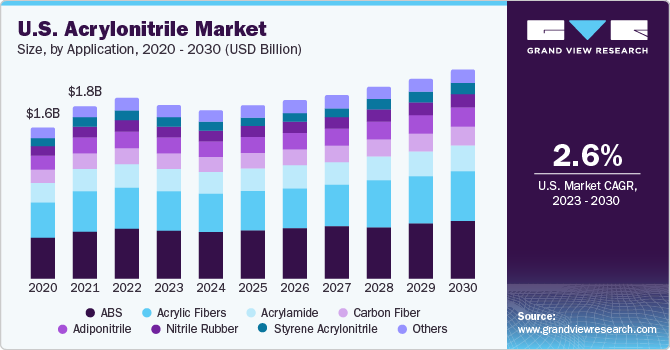

Application Insights

The acrylonitrile butadiene styrene (ABS) segment held the largest revenue share of 28.7% in 2022. This is due to the product’s increasing use in automotive, electronics, consumer goods, and the construction industry as it is easy to install and lightweight. In addition, the product has strong mechanical strength and is corrosion-resistant and more durable than PVC. The carbon fiber segment is expected to register the fastest growth rate over the forecast period as it is strong, light, and extremely stiff, which makes it useful in building materials.

The carbon fiber segment is expected to grow at the fastest CAGR of 2.6% over the forecast period. Carbon fiber is widely used in the aerospace & defense, automotive, alternative energy, and construction industries. The market for carbon fiber is likely to grow at a faster pace in Asian countries on account of the high spending on aerospace technology, especially in countries, such as China and India. However, high prices of carbon fiber are anticipated to significantly restrict its demand in the coming years. Nitrile rubber, a synthetic rubber, is obtained from the copolymerization of butadiene and acrylonitrile. It is used as a synthetic rubber due to its resistance to oil and solvents.

The increasing demand for nitrile rubber to produce non-latex gloves, auto transmission belts, adhesives, and binders is likely to augment the segment growth over the forecast period. Acrylic fiber is obtained by reacting monomers with petroleum-based chemicals. It is used in the textile industry due to its low weight, high performance, high insulin, and good moisture management qualities. Since polyester fiber is relatively inexpensive, it has largely replaced acrylic fiber in the textile industry. Acrylic fiber is expected to gain traction primarily in the textile industry.

Key Companies & Market Share Insights

The global industry is heavily concentrated among a small number of firms, including Sinopec Group, Sumitomo Chemicals, Ascend Performance Materials, and Mitsubishi Chemical Corp. Large sums of money are being spent by businesses on R&D efforts for the creation of novel goods and process advancements. To maintain their position in the worldwide industry and assure a consistent demand for the product, they are also concentrating on developing long-term relationships with their customer base. To withstand the competitive surroundings, companies are undergoing several execution programs to increase their operational efficiency, and strategic planning, and increase their presence globally.

Key Acrylonitrile Companies:

- INEOS

- China Petrochemical Development Corp.

- Asahi Kasei Advance Corp.

- Ascend Performance Material

- Chemelot

- Formosa Plastics Corp.

- Mitsubishi Chemical Corp.

- Secco

- Taekwang Industrial Co., Ltd.

- Sumitomo Chemical Co., Ltd.

Recent Developments

-

In June 2023, INEOS Nitriles introduced its inaugural bio-attributed product line for Acrylonitrile, branded as InvireoTM. The newly launched product will be manufactured at INEOS Nitriles' state-of-the-art facility in Cologne, Germany. The production of InvireoTM involves the utilization of bio-attributed propylene, enabling the replacement of conventional fossil fuel resources. This innovative product contributes to a reduction in greenhouse gas emissions and aids in the conservation of natural resources by incorporating renewable feedstock. INEOS has obtained certification from the Roundtable on Sustainable Biomaterials (RSB) and the International Sustainability & Carbon Certification (ISCC Plus).

-

In February 2023, Sumitomo Chemical received its inaugural ISCC PLUS certification for acrylonitrile production at its Ehime Works in Niihama, Ehime, Japan. The International Sustainability and Carbon Certification (ISCC) awarded this prestigious certification, validating the sustainable nature of the product.

-

In response to the growing call for businesses to transition away from fossil resources and contribute to a sustainable society, Sumitomo Chemical has been actively pursuing ISCC PLUS certification for its products derived from biomass and recycled raw materials. Notably, the acrylonitrile produced by the company has emerged as its first-ever ISCC PLUS-certified product, signifying a significant milestone in its sustainability endeavors.

-

In December 2021, Titan Solar Farm, situated in West Texas, commenced its electricity generation operations, with the primary objective of supplying power exclusively to Ascend Performance Materials' acrylonitrile plant located in Chocolate Bayou, Texas. Throughout the year, this solar farm was projected to produce approximately one-third of the electricity required to sustain the company’s production operations, thereby reducing its reliance on grid-based power sources. Ascend is actively dedicated to reducing its greenhouse gas footprint by 80% by the year 2030.

Acrylonitrile Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.84 billion

Revenue forecast in 2030

USD 13.33 billion

Growth Rate

CAGR of 2.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Malaysia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

INEOS; China Petrochemical Development Corp.; Asahi Kasei Advance Corp.; Ascend Performance Material; Chemelot; Formosa Plastics Corp.; Mitsubishi Chemical Corp.; Secco; Taekwang Industrial Co., Ltd.; Sumitomo Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acrylonitrile Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acrylonitrile market based on application, and region:

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Acrylic Fibers

-

Adiponitrile

-

Styrene Acrylonitrile

-

ABS

-

Acrylamide

-

Carbon Fiber

-

Nitrile Rubber

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global acrylonitrile market size was estimated at USD 11.19 billion in 2022 and is expected to reach USD 10.84 billion in 2022.

b. The global acrylonitrile market is expected to grow at a compound annual growth rate of 2.2% from 2022 to 2030 to reach USD 13.33 billion by 2030.

b. Asia Pacific dominated the acrylonitrile market with a share of 52.0% in 2022. This is attributable to the rising demand for acrylic fibers from the apparel and home furnishing industry.

b. Some key players operating in the global acrylonitrile market include INEOS, Sinopec Group, Sumitomo Chemicals, and Asahi Kasei, among others.

b. Key factors that are driving the market growth include increasing demand of acrylic fibers and growing utlization of production of plastics and composites.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."